You have /5 articles left.

Sign up for a free account or log in.

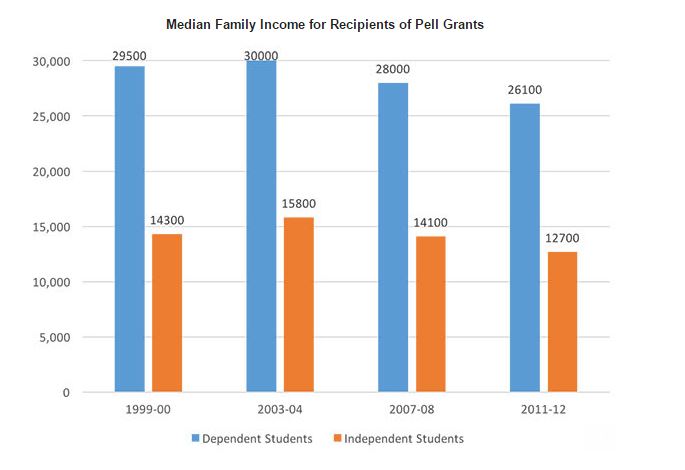

The percentage of students receiving federal Pell Grants has grown as incomes have fallen.

A new report from the U.S. Department of Education's National Center for Education Statistics found that the percentage of both independent and dependent students who received Pell Grants increased from 1999 to 2011. In 1999, 19 percent of dependent students -- or those who relied on their parents' income -- received the grants. That figure increased to 35 percent by 2011. Among independent students, the percentage of recipients increased from 25 percent in 1999 to 48 percent in 2011.

.jpg)

Those numbers correspond with decreasing median family incomes. In 1999, the median family income for dependent Pell Grant recipients was $29,500, after adjusting for inflation. That number decreased to $26,100 by 2011. For independent students, the median income declined from $14,300 to $12,700.

"This really reinforces the growing need for the Pell Grant," said Bill DeBaun, director of data and evaluation at the National College Access Network, a nonprofit organization that advocates for low-income students. "We know that the Pell is a great policy instrument promoting postsecondary access and opportunity to student groups that need it the most and who have the least access to opportunity. The decreasing median income from the report is there. It's very well targeted even as the demand grew."

After the recession, there were some concerns that the expansion of the Pell program would lead to less targeting or focus on low-income students. In 2008, for instance, the maximum Pell award was $4,350. That number has increased to $5,815 this year. But to address worries about rising costs of the program, the Obama administration in 2011 cut year-round access to the grants.

"The independent student income, it's about the level of federal poverty level for one person," said Lauren Walizer, senior policy analyst at the Center for Postsecondary and Economic Success. "With the maximum Pell, they're getting a boost of income by almost 50 percent. By extending to year-round Pell, if they get another semester's worth of Pell, that would boost their ability to engage in college."

Pell Grants are structured on family income and how much money families are expected to contribute toward students' college educations. Raising the maximum amount of money is one way of boosting the flow to the neediest students, but it can also increase the number of people who qualify for some Pell Grant funds. In 2008, there were 6.1 million Pell Grant recipients. That number grew to about 8.2 million recipients in 2014, according to federal data.

Sandy Baum, a senior fellow at the Urban Institute and an expert on financial aid, said higher-income families are receiving Pell Grants, especially if they have more than two or three kids in college at the same time. But besides exceptions like those, she said, the federal grant is going to people who have significant financial constraints.

Congress has been working to restore year-round Pell. This past summer the U.S. Senate attempted to restore the year-round measure, which would let students receive two of the need-based grants in one year to help pay for summer courses. But the U.S. House of Representatives rejected the proposal.

"You should be able to take your credits whenever you need them," Baum said.