NACUBO-Commonfund Study of Endowments for Fiscal Year 2012

Data gathered from 831 U.S. colleges and universities

Scroll down

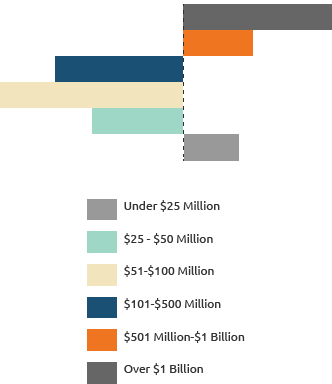

College and university endowments returned an average of -0.3 percent for the 2012 fiscal year (July 1, 2011 – June 30, 2012)

A steep decline from the FY2011 average return of 19.2 percent.

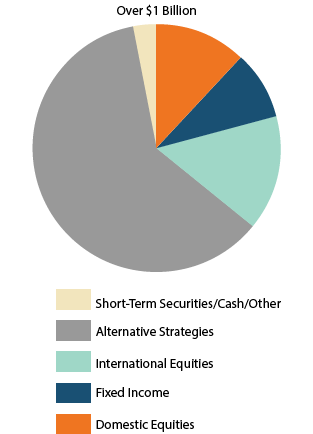

Institutions with the largest endowments saw the largest returns.

Endowments between $501 million and $1 billion grew 0.4 percent

Endowments over $1 billion grew at 0.8 percent

Endowments between $25 million and $500 averaged negative returns between 0.5 percent and 1 percent

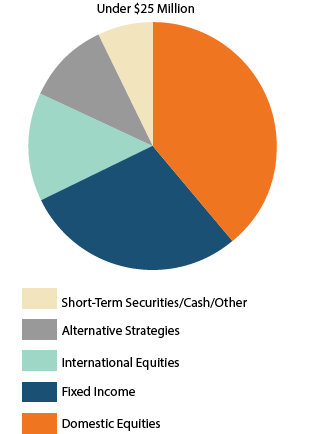

Endowments under $25 million saw a modest 0.3 percent growth

Fixed-income investment and so-called "alternative strategies" including private equity and venture capital saw the largest returns. International equities, commodities and hedge funds all had bad years.

Average 10-year returns for all institutions was 6.2 percent.

Up 0.6 percent from last year, but still below what institutions expect.

Wealthier institutions continue to invest more heavily than less-wealthy institutions in "alternative strategies" such as private equity, hedge funds, venture capital and real estate. Less-wealthy institutions still tend to invest the majority of their endowments in domestic equities and fixed-income.