Filter & Sort

Communication on Growth Mindset Can Benefit Student Achievement

New research from Washington State University finds first-generation students perform better after receiving encouraging messages from their instructor on strategies for improvement.

Advising on Classes, Life and Anything Else

The University of Central Florida streamlined student supports by merging the roles of academic adviser and student success coach roles into one.

Academic Success Tip: Teaching Introverts Confidence and Community

A course at Worcester Polytechnic Institute helps students feel comfortable in their personality type and learn professional skills.

Professor Creates Digital Marketing Simulation to Teach Practical Skills

Students at Hult International Business School in Massachusetts play a simulated game that teaches the principles of digital marketing and allows them to refine their skills.

Creating a Data Culture Through Professional Development Training

The University of California, Irvine, created a certificate program to teach digital literacy skills to campus community members with the hope of improving student outcomes.

Degrees Earned Fall Again, Certificates Rise

Fewer people are earning degrees for the second year in a row, but certificates are having a moment, according to a new report.

Data-Based Decisions Tip: Convene Regular Data Meetings

Student success advocates at the University of Kentucky have built a culture of evidence through weekly data meetings. Here’s how they do it, plus pointers for organizing data meetings on your campus.

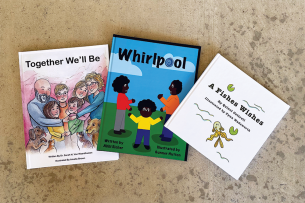

Academic Success Tip: Interdisciplinary Art Collaboration Creates Diverse Course Materials

Music education students at Central College partnered with their visual arts peers to create story and song books for elementary-aged students.

Pagination

Pagination

- 1

- /

- 30