You have /5 articles left.

Sign up for a free account or log in.

Even though colleges have slowed the rate at which they raise tuition, the total grant aid available to students has not been able to keep pace with tuition growth, according to two reports released Wednesday by the College Board.

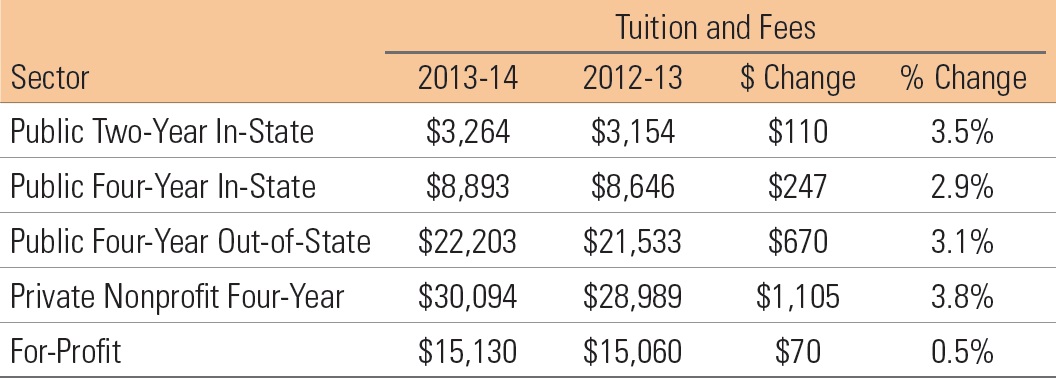

Public four-year institutions, after years of sharp increases, raised in-state tuition by only 2.9 percent this year, the smallest one-year increase in more than 30 years. Private, nonprofit four-year colleges increased their sticker price tag by 3.8 percent, which is slightly lower than recent tuition hikes.

In spite of these more modest rates of growth in published tuition prices, the net price of higher education -- what families actually end up paying after grants and other aid -- is ticking up in all sectors.

At public universities, the College Board estimates, students will pay net tuition and fees this year of $3,120 (up from $3,050 this year). In inflation-adjusted dollars, that’s nearly two-thirds higher than it was a decade ago. Similarly, the net price at private, nonprofit colleges is expected to jump by 4.4 percent this year to $12,460.

The average published price for community college tuition this year is $3,264, a $110 increase (3.5 percent) from last year. As has long been the case, federal grant aid and tax benefits, on average, cover the entire cost of tuition and fees at two-year, public institutions and also provide an excess of funding -- $1,550 this year -- to cover other educational expenses. Net tuition and fees at community colleges last year ranged from $0 for the lowest half of the income distribution to $2,280 for the highest-income group, the report says.

For the past several years, a combination of more modest increases in tuition and an influx of grant aid, particularly from the federal government, held down and even decreased the net price that families actually end up paying for college.

For instance, starting in 2007-8, the net tuition students paid (in inflation-adjusted dollars) at private, nonprofit four-year colleges declined for four straight years -- even as the “sticker price” at those institutions rose by 17.7 percent during the same period. That effect at four-year public institutions, which saw drastic cuts to their state funding, was not as pronounced, but the boost in federal spending did lower the net cost at those institutions for one year (2009-10).

But this year’s report confirms that such relief was temporary. After a 125-percent increase in federal grant aid between 2007-8 and 2010-11, that funding declined by 9 percent in 2011-12 and by another 1 percent last year, according to the report, which measured the spending in inflation-adjusted dollars.

"The federal government is not going to continue to cushion the growth in tuition,” said Sandy Baum, a senior fellow at the Urban Institute and research professor at George Washington University's Graduate School of Human Development, who co-authored of the paper. “We have no reason to believe that the federal government is going to stop helping students, but everyone would be surprised if they decided next year to increase aid dramatically again.”

Meanwhile, other sources of grant aid, namely from states and institutions, increased over all this year. Grant aid from colleges and universities grew by nearly 5 percent last year and is expected to grow by about 4 percent to $44 billion this academic year.

State grant aid, which has increased modestly in recent years, jumped 2.2 percent last year, in line with modest increases over the past several years. However, there was a wide range in how generous states were in doling out aid. In 2011-12, the report says, state grants per each full-time undergraduate ranged from under $200 in 12 states to over $1,000 in 10 states.

Beyond aggregate increases in grant aid from institutions and states, direct subsidies to students made up the largest share of students' financial aid packages -- at 49 percent -- in more than a decade.

At the same time, total education borrowing fell by 6 percent last year after a 2 percent decrease the year before. Both of those slides in borrowing come after a drastic 55 percent increase from 2002-3 to 2007-8 in the amount of money students took out in loans for college.

“You don’t want to say that nobody has to worry anymore because borrowing has moderated, but it’s important that it doesn’t just keep going up,” Baum said.