You have /5 articles left.

Sign up for a free account or log in.

WASHINGTON -- The Obama administration plans to send email directly to about 3.5 million borrowers of federal student loans over the next month in an effort to boost enrollment in the government’s income-based repayment programs.

The department will send messages, starting this month and continuing until mid-December, to a range of borrowers who officials think may benefit from income-based repayment.

"The campaign will target borrowers whose grace periods will end soon, borrowers who have fallen behind on their student loan payments, borrowers with higher-than-average debts, and borrowers in deferment or forbearance because of financial hardship or unemployment,” Brenda Wensil, the chief customer experience officer for federal student aid, wrote in a notice posted online Friday.

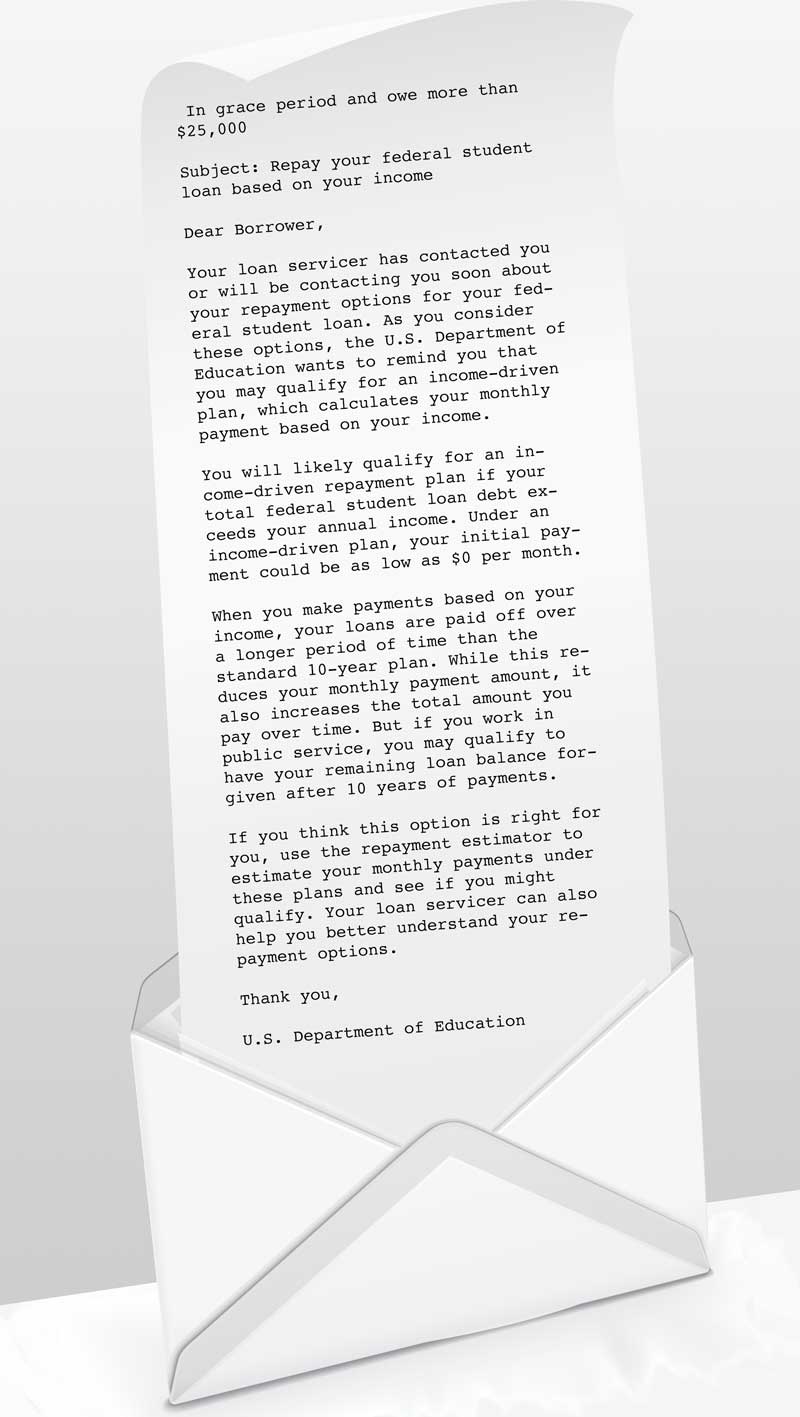

One category of borrowers to be targeted appears to be those who are in a grace period and owe more than $25,000, according to the sample email text. A department spokesman on Friday declined to provide additional details about precisely which other borrowers would be receiving emails. The spokesman, Stephen Spector, said more details would be announced later this week.

The campaign is one part of an ambitious higher education reform plan President Obama unveiled in August, which more controversially included a plan to issue ratings of colleges and universities based on affordability and student outcomes.

Despite previous attempts by the administration to promote the income-based programs and ease the application process, enrollment remains low. Fewer than 7 percent of federal direct loan borrowers whose loans were in repayment had enrolled in an income-based repayment plan by June 30 of this year, according to the department’s data.

Consumer and borrower advocates praised the new outreach campaign, but said the administration still has more work to do to increase enrollment in income-based repayment programs.

“This is a hugely positive step towards making sure that people who need to know and might benefit from these income-based programs are getting the information they need,” said Lauren Asher, the president of the Institute for College Access and Success. “We’re happy to see this is moving forward.”

Deanne Loonin, a lawyer at the National Consumer Law Center who leads its Student Loan Borrower Assistance Project, said she thinks the campaign will be helpful in educating some borrowers about the availability of income-based repayment but that other obstacles remain for borrowers who want to avail themselves of the program. “Once somebody knows about it, we need to do a better job of helping people get into the program and stay in the program,” she said.

But, she added, the Education Department has been insufficiently transparent in how the program is administered and overseen.

“The department has not been forthcoming about who’s been able to get on IBR, and of those who are on it, what the attrition rate is,” she said. ““We need more information about what’s going on, so we can do more educated interventions.”

Although the Education Department is promoting income-based repayment on government-held loans, the companies that service those loans are actually tasked with administering the program for an individual borrower.

Some consumer advocates have questioned whether loan servicers — which are contracted by the Education Department — are doing enough to tell borrowers about their income-based repayment options and enroll them in the plans. They have also questioned the of quality student loan servicing loan servicing industry more broadly.