You have /5 articles left.

Sign up for a free account or log in.

The average debt that borrowers of student loans had at graduation continued to rise last year, climbing to $29,400 for the class of 2012, according to a new report released Wednesday by the Institute for College Access and Success (TICAS).

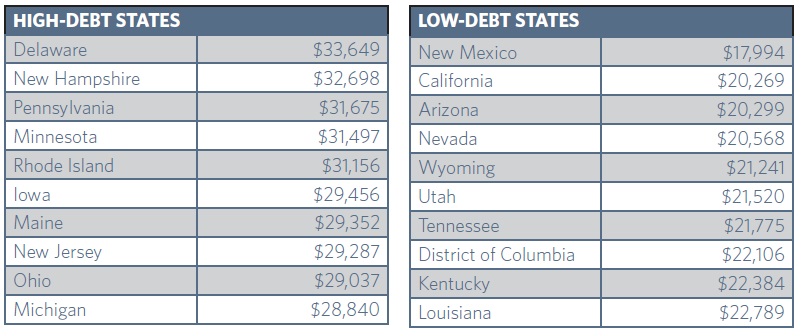

As in previous years, the report shows a wide variation in average student debt loads across different states and institutions. Delaware and New Hampshire lead the list of the highest-debt states, with average debt levels of $33,649 and $32,698, respectively. Meanwhile, New Mexico’s average student debt of $17,994 gives the state the distinction of the lowest-debt state. California was the second-lowest-debt state with $20,269.

The high-debt states remain concentrated in the Northeast and Midwest while lower-debt states were mostly in the West and South, the report says.

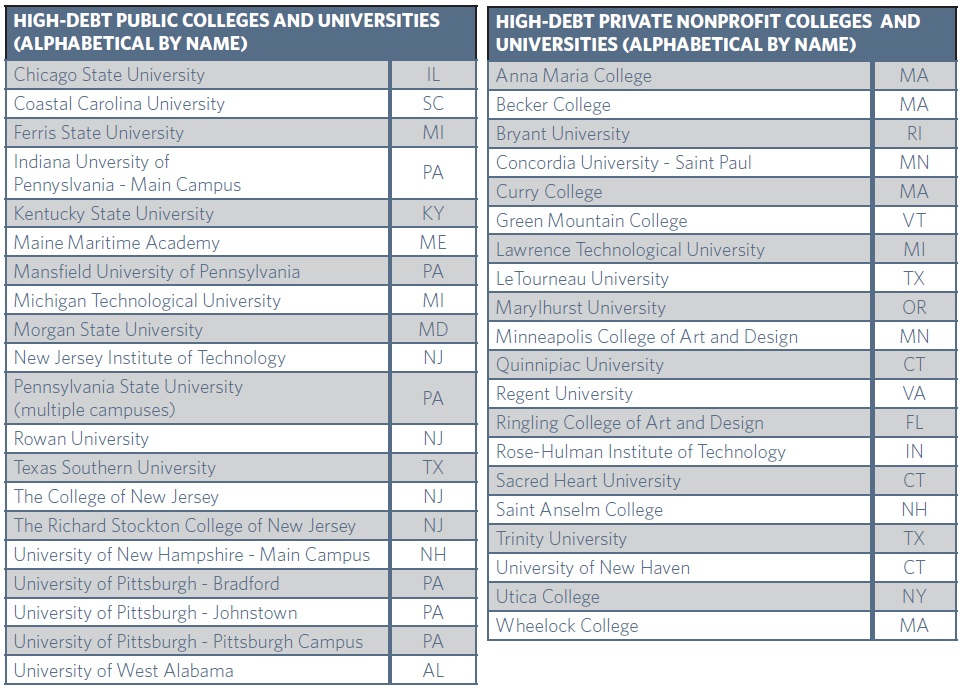

Among individual colleges, the average debt also varies significantly, and it ranged from $4,450 to $49,450. Anna Maria College and Becker College, both in Massachusetts, were ranked in the report as the highest-debt private nonprofit colleges, while Chicago State University and Coastal Carolina University had that distinction among public colleges.

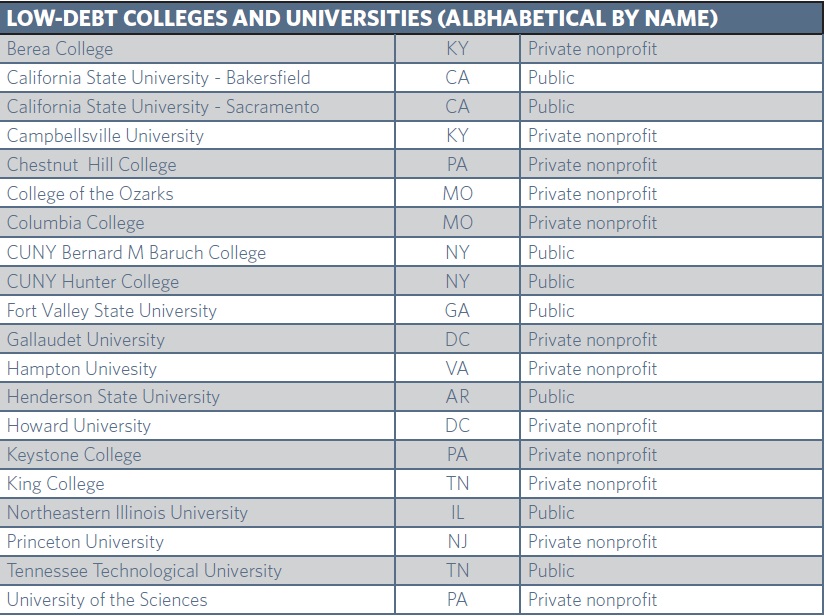

At the other end of the list, Berea College in Kentucky, a private nonprofit, and California State University’s Bakersfield campus, a public institution, were deemed the lowest-debt colleges.

These average debt statistics are not necessarily an indication of how costly an institution might be for any one student, since they can be skewed by extremes in either direction and don't take into account the actual price a family might pay. They also don't take into account the wealth of an institution's student body.

The state averages and lists of high- and low-debt colleges in the report are also limited to those institutions that voluntarily report their data. TICAS said that it was not able to include for-profit colleges because so few of those institutions report debt data in the survey.

Because much of the annual student loan data in the TICAS annual report is collected on a voluntary basis each year, it is difficult to compare institutions from year to year and within the same year.

“Right now, some colleges escape accountability by opting not to report their graduates’ debt, while those who do report are stuck on an unequal playing field,” Matthew Reed, the report’s primary author, said in a statement.

In fact, some institutions stopped voluntarily reporting their debt data after appearing in the report last year. Twenty percent of colleges on the high-debt public college list in last year's report, and 30 percent of all colleges on the low-debt colleges lists did not provide data this year.

"While we cannot say why colleges that voluntarily reported debt data in the past chose to stop reporting, it underscores the limitations of voluntarily reported data and the need for the Education Department to collect this data for all colleges,” the report says.

TICAS, along with other groups, has been pushing the administration to collect better data on student debt. Its report calls on the Education Department to collect college-level information about students’ cumulative debt loads and private student loan borrowing.

Rising student debt has grabbed headlines and the attention of policy makers for some time now, but the average student debt figure has been a widely cited statistic this year on virtually all sides of the national debate over how to make college more affordable.

The Obama administration is in the process of developing a ratings system to judge colleges on yet-to-be-determined metrics aimed at measuring accessibility, affordability and student outcomes.

Part of his plan is convincing Congress to eventually condition colleges’ receipt of federal student aid on their performance in the ratings system with the idea that such a system will put drive down costs, and in turn, student borrowing.