You have /5 articles left.

Sign up for a free account or log in.

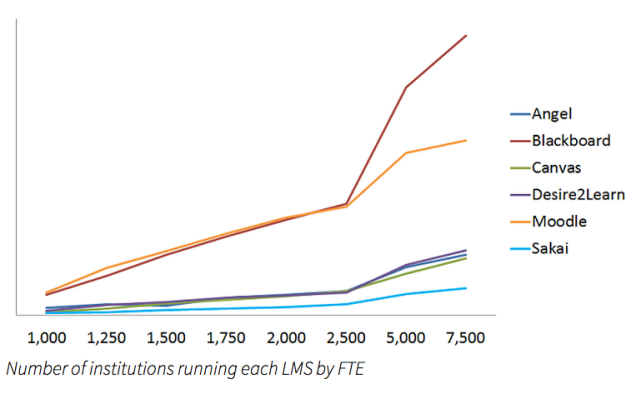

Moodle edges out competitors such as Blackboard among smaller colleges, a new analysis of the learning management systems shows, lending some evidence to the anecdotal popularity of open-source solutions among those institutions.

The analysis, published by the former Blackboard engineer George Kroner on his Edutechnica blog, shows familiar players such as Blackboard, Desire2Learn and Instructure are major forces in the market among institutions with 1,000 to 2,000 full-time students. Despite their strength, the open-source Moodle platform beats out all of them.

“I don’t think I've ever seen hard numbers of exactly how strong Moodle was in that space,” Kroner, an enterprise solutions engineer at University of Maryland University College, said. “In particular, seeing it surpass Blackboard below the 2,500 FTE mark -- I was actually kind of shocked to see that."

As opposed to other studies, which make estimations about the state of the LMS market based on survey results, Kroner's analysis bases its findings on open data sets combined with search engine interfaces that scan university websites to identify which system institutions use. Still, surveys such as the one produced by the Campus Computing Project has previously shown a decline Blackboard's market share.

Kroner said about 76 percent of institutions recognized by the U.S. Department of Education fit into that category. Moodle’s success in this space, he said, suggests these institutions are using the open-source software to suit their needs.

“A lot of people tend to write off Moodle or tend to think it’s a joke, but it’s used by hundreds and hundreds and hundreds of institutions, and those institutions are having success with it,” Kroner said. “For a lot of institutions, it does makes sense, and it probably is a good choice for them.”

Kroner said the vast majority of Moodle institutions host their own systems, even though Blackboard bought a stake in the platform when it acquired Moodlerooms and NetSpot, two companies that provide support for Moodle, in 2012. Since then, Jay Bhatt has taken over as CEO, and in a recent appearance on Bloomberg TV, he questioned the integrity of open-source software.

“The reason you go with Blackboard is because we’re spending a tremendous amount of money on R&D,” Bhatt said. “The companies that can invest in delivery of education and curriculum and content with dollars as opposed to through community development are the ones that are going to win in this space.”

Mark Strassman, Blackboard's senior vice president of industry and product management, said via email: “We are not surprised. This trend was part of the rationale for our investment in MoodleRooms and NetSpot in 2012. It’s clear that for some smaller FTE institutions, Moodle has been a good fit and we’re supporting a lot of them now with Moodlerooms. Every institution has different needs and different goals, so this gave us a way to support the use of Moodle with an offering that simplifies and enhances the basic Moodle LMS."

Smaller providers constituted about one-fifth of all the learning management systems in this slice of higher education. “Jenzabar had a strong showing as did eCollege, LearningStudio, OpenClass, WebStudy, ed2go, Epsilen, CampusCruiser, Edvance360, BrainHoney, and several other small-scale and homegrown LMS-like solutions,” the analysis reads.

Kroner did not identify a single reason that explains that diversity. On one hand, he said, larger software providers may target larger institutions to maximize their profits, but on the other hand, smaller institutions may also have an easier time experimenting with different systems.

“Competition is a healthy thing,” Kroner said. “It’s interesting that there’s a tremendous number of smaller LMSes out there that meet all sorts of needs. Smaller schools potentially should investigate those.”

The new data is an addition to a snapshot of the LMS landscape that Kroner published last October, which excluded data from hundreds of smaller institutions -- for example community colleges and small private institutions. Combined, the data now includes about 2,900 colleges and universities.

Kroner said he may analyze learning management system use at even smaller institutions, international universities or in the K-12 space next.