You have /5 articles left.

Sign up for a free account or log in.

iStock

Higher education institutions are pulling in record dollars in charitable donations even though the number of individual donations are on the decline, indicating large donations are coming in from high-income individuals.

According to this year’s Giving USA report, which studied institutions for the 2018 calendar year, overall giving to educational institutions, including K-12 and higher education, declined for the first time after four years of growth by 1.3 percent and 3.7 percent, respectively, adjusted for inflation. However, the report also indicates good news for higher education.

Citing the Council for Advancement and Support of Education (CASE) Voluntary Support for Education (VSE) survey, which collects data from institutions all around higher education, Giving USA reports total contributions to higher education reached $46.73 billion in 2018, a 7.2 percent increase from the previous year.

Charitable contributions specifically to colleges and universities in 2018 reached the highest levels ever recorded by the VSE. Seven different institutions each received at least one gift over $100 million, the largest number of institutions to reach that number since 2015. The specific case study took place during during fiscal year 2018, meaning Michael Bloomberg’s historic $1.8 billion gift to Johns Hopkins University was not included in the data. (This sentence was updated to correct the timeframe of the VSE study.)

As larger capital campaign donations continue to rise, individual alumni donations continue to fall, according to a study from the Blackbaud Institute, cited by Giving USA. This study found that while there was more money raised, it came from fewer individuals. Individual alumni giving rates have declined, and the decline is expected to continue, according to the report.

Brian Flahaven, senior director for advocacy at CASE, said there are a number of reasons that could contribute to the rise in overall donations and the decline in number of individual donors. One such reason is the passage of the 2017 Tax Cuts and Jobs Act, which eliminated the need for many middle-class people to itemize their deductions. Many have worried that, absent those itemized deductions, donations would drop.

“The tax law, for high-income donors, didn’t really increase the cost of giving, so they’re still likely itemizers,” Flahaven said. “It’s really the charitable sector of organizations that depend disproportionately on smaller donations from middle-income donors who will feel more of the brunt from the tax law changes, because that’s really the group that will transition from itemizers to nonitemizers and will no longer to be able to deduct charitable gifts. So they’ll still give, they just won’t give as much.”

Multiyear fund-raising campaigns, focused on large goals, appear to be part of a rising trend within higher education. A survey cited in the report said of 600 fund-raising professionals in higher education surveyed, 81 percent were involved in or about to start a capital campaign. Forty-nine institutions are engaged in billion-dollar fund-raising campaigns. Despite this, a Marts and Lundy report cited by Giving USA said both smaller and midrange ($10-$29 million gifts) were “healthy” but still represented a slight decline from 2017-18. Inside Higher Ed has compiled a database that tracks such capital campaigns.

“While the number of donors has declined, they’re giving more,” Flahaven said. “That’s why you still see these record numbers even though individual donations have gone down.”

Flahaven said there were some concerns with this trend, including that many institutions put smaller donations (the kind coming from middle-income donors) into annual funds for current operations, while larger donations go toward endowments.

Flahaven is concerned about any decrease in giving rates by younger alumni, as patterns they set while young may stick with them for life.

“What I think, and this is a hypothesis, is there’s going to be some softness in that annual fund and operations giving,” Flahaven said. “If younger donors aren’t being incentivized to give, and they don’t make that connection with their institution while they’re young … there’s a chance that connection won’t be as strong and when they became major givers way down the line, they may not have that same connectivity.”

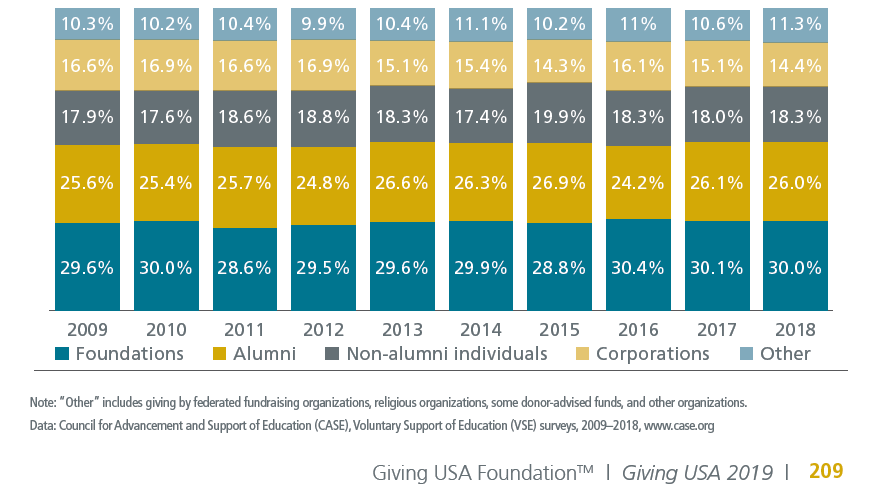

Different donor groups identified in the CASE VSE saw increases in the amount given in 2018. Giving from nonalumni individuals went up 9 percent. The largest increase is in the category of “other” groups, where giving increased 13.5 percent. The CASE VSE defines these other groups as federated fund-raising organizations, religious organizations, some donor-advised funds and other organizations.

One of the biggest winners on the fund-raising front in 2018 was community colleges. Public two-year colleges saw an average of $1.7 million in private gifts, an 8 percent increase.

2018 also saw the largest individual gift to a community college -- Tyler Junior College in Tyler, Tex., received a $19 million gift from the estate of Virginia and Jim Gatewood, though this data was not included in the CASE VSE study as it took place outside the timeframe of the study. Another study cited in the report showed community colleges benefited from planned gift programs specifically, but found only 34 percent of community colleges surveyed had such programs active.

Flahaven said CASE has seen many community colleges start to recognize the strength of charitable giving, and they have begun to turn to it at higher rates.

“Those programs really are maturing,” Flahaven said. “They’re also doing a great job at attracting the major donors, which shows there’s been an increased level of investment and sophistication happening.”

As CASE has concerns with the decline in the number of donors, Flahaven said the group has made it a priority to address the situation with lawmakers by lobbying for a universal charitable deduction, which would essentially expand the deduction to all taxpayers regardless of whether or not they itemize.

“If Congress was to expand the deduction to all taxpayers, that would certainly provide an incentive for all taxpayers to give despite their income but also help address this overall decline in voters we’ve seen across the sector.”

CASE VSE Survey: Sources of Private Funds for Colleges