You have /5 articles left.

Sign up for a free account or log in.

Last year was a mostly terrible one for the world, but it was a terrific year for college endowments.

A recent study found that the average endowment size in a sample of 271 public and 442 private institutions increased by a median of 30.1 percent, with one in five of these schools now enjoying an endowment over $1 billion.

What might the future of endowments look like?

If we were to go back 30 years, when I was an undergraduate student at Washington University (1990 endowment about $3 billion in today’s dollars), was anyone projecting the three decades of endowment growth that lay ahead? (In 2021, Wash U’s endowment stood at over $13.5 billion.)

One way to get a sense of what endowments might look like three decades in the future is to ask what would happen if the story of the past 30 years was repeated. If, in the next three decades, endowments grow at the same average or median rate as they did between 1990 and 2021, where does that put us in 2050?

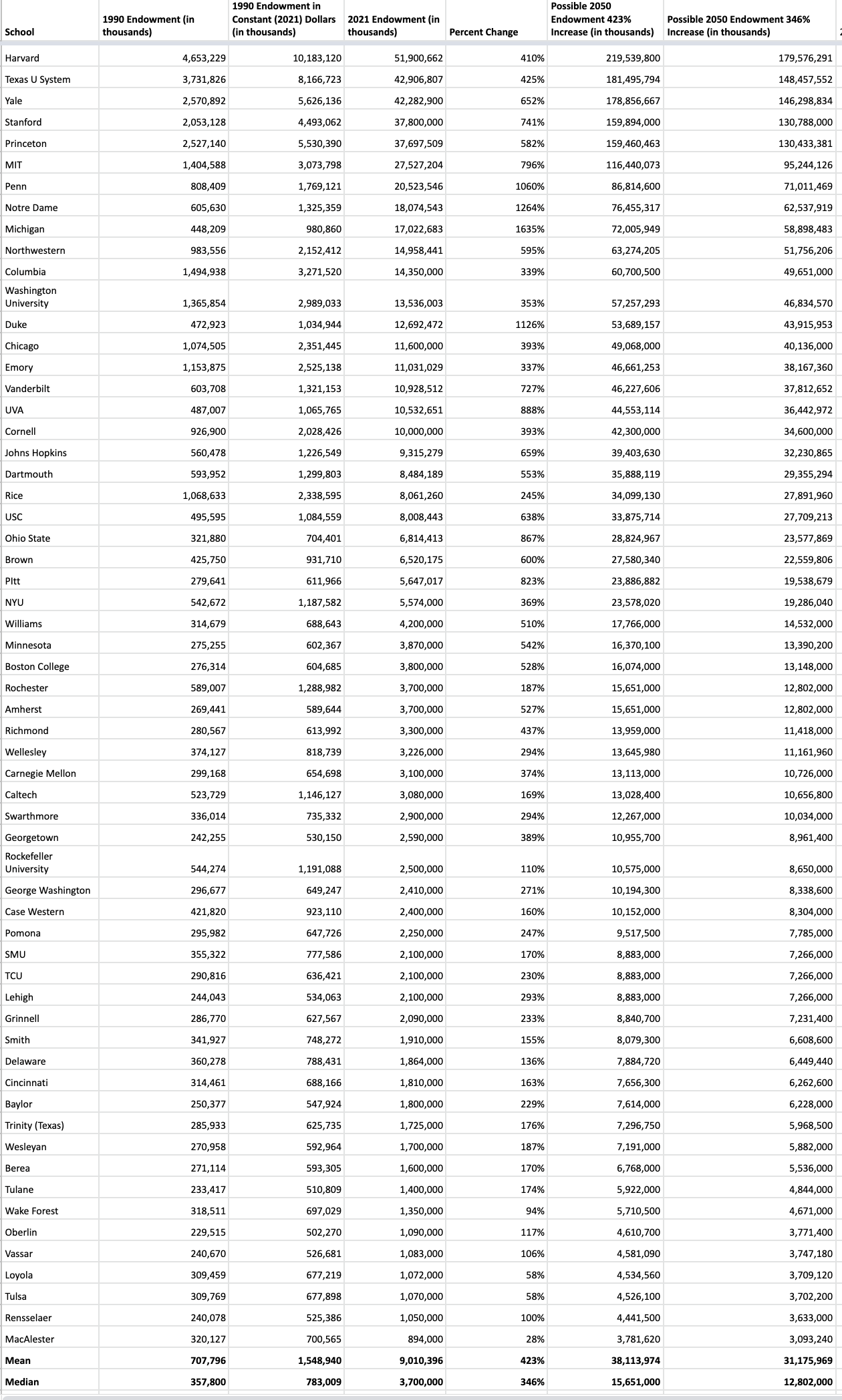

To answer that question, I found a table in a 1990 NACUBO publication that provides the market value of the top 60 university endowments of that year. In the table below, I have recreated those figures.

To gauge the change between 1990 and 2021, I used the Bureau of Labor Statistics CPI inflation calculator to determine the 2021 buying power of the 1990 endowments. This adjustment allows us to compare the percent change in endowments between 1990 and 2021 in constant dollars.

Using this method, we find that the average endowment increase from 1990 to 2021 of the 60 schools for which we have data comes in at 423 percent, while the median growth is 346 percent. (The average is pulled up by a handful of schools that have experienced tremendous endowment percentage gains.)

Cutting the list off at 60 schools is arbitrary, as many more colleges and universities than listed have substantial endowments. The sample does not account for schools that have significantly grown their endowments since 1990.

Nor does the list of endowments account for other perhaps-superior measures of institutional wealth, such as endowment per student.

The 2050 projections below also are likely to be thrown off by the fact that I used 2021 endowments, which, as we know, saw extraordinary gains from the previous year. It can be argued that it makes more sense to derive future projections from the 1990-to-2020 period. And of course, 2021 to 2050 is not a full 30 years of growth.

That is a fair critique, and one that I think underscores that these projections are only meant to be indicative of one possible scenario of continued institutional wealth accumulation. My guess is that most institutional investment offices are operating under more conservative forecasts for growth and more aggressive predictions for inflation.

More importantly, the 2050 projections below should be taken only as broadly directional for the sector of schools with considerable starting from 1990. The likelihood that the endowment projections for 2050 for any single school are low, as 30 years is way too long into the future to make projections with any confidence. We cannot know if the value of endowments for the wealthiest schools will increase by the same percentage in the next three decades as it increased in the prior 30 years.

While acknowledging that the 2050 endowments for individual institutions cannot be predicted with accuracy, we can still make some overall projections about the financial future of today’s wealthy institutions.

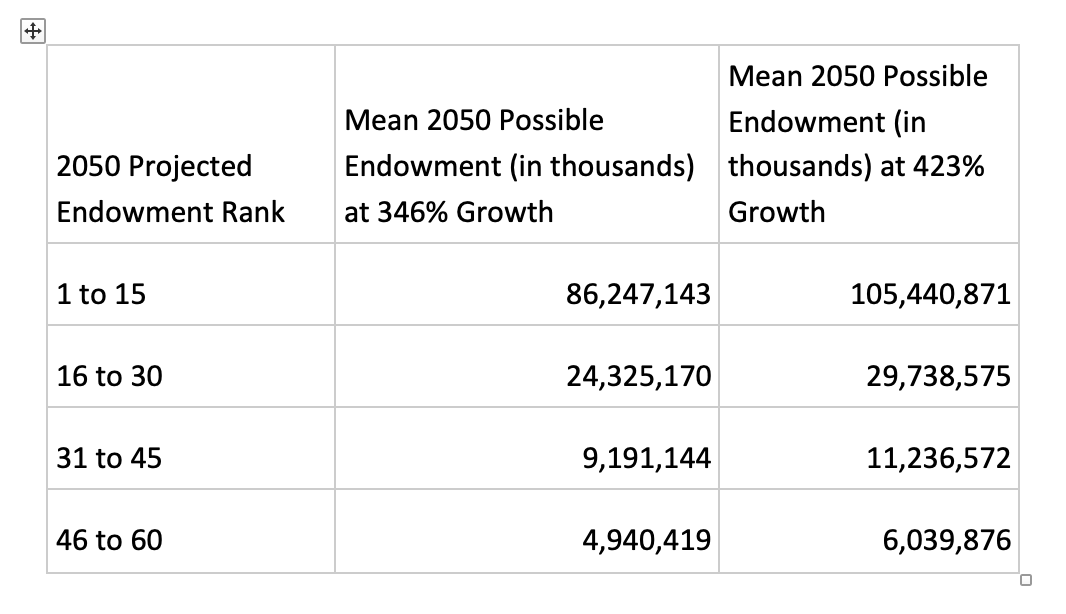

As a whole, it is most likely that today’s wealthiest universities will get much wealthier over the next three decades. Applying both of these rates of growth to the 2021 endowments to project endowments of 2050 gives the following means by quartile:

If the next 30 years turn out to be like the prior 30 years, then the universities in the bottom quartile of wealthy schools will have endowments between roughly $5 and $6 billion. At the top end of the distribution, we could see the 15 wealthiest universities having endowments of anywhere from $86 billion to well over $100 billion.

A $100 billion (or $200 billion) endowment may seem fantastical and unlikely from today’s perspective. But perhaps not. How many observers of the future of elite universities in 1990 anticipated the astounding individual and average endowment gains that would accrue in the 30 years to come?

How much thought was given to the possibility in 1990 that by 2021, the average endowment for the 60 wealthiest schools would climb from an (inflation-adjusted) average of $1.5 billion to the $9 billion average of today?

Again, these projections are only directional—and should not be used to predict the future wealth of any individual institution. Universities may decide to spend a higher proportion of their endowments to meet institutional expenses in the next 30 years compared to the prior three decades.

Average endowment returns for wealthy schools may be significantly lower in the coming decades than in the past. And inflation could be substantially higher, reducing the purchasing power of each endowment.

Even with all these unknowns and potential reasons why the next 30 years of endowment returns for wealthy schools might not look like the past 30 years, the magnitude of the likely endowments for the most affluent schools in 2050 is truly astounding.

We seem to be on safe ground in projecting that future generations of academic leaders of wealthy institutions will have more financial flexibility to meet their missions.

It also appears to be highly likely that inequality across U.S. institutions, as measured by endowments, will grow even more pronounced. Over the past 30 years, university wealth gains have mirrored broader distributional patterns, with the largest gains concentrated at the top.

If these projections are directly accurate and in the ballpark of what might come to be, what might that mean for the future of elite higher education?

Do the endowments of wealthy schools matter when thinking about the broader higher education sector?