You have /5 articles left.

Sign up for a free account or log in.

Financial sustainability is a marathon, not a sprint; a college that wants to endure has to worry about much more than getting through the next year. So it would be a mistake to read too much into reports like the ones Moody's Investors Service issued on Tuesday, which show a "stabilizing" financial picture for most colleges and universities in the 2014 fiscal year.

But given the tumultuous turn of recent events involving closures of some small private institutions and major proposed cutbacks for some public university systems, the news from the ratings agency is probably modestly heartening for most campus leaders and, perhaps, modestly caution-inducing for those predicting that widespread catastrophe is about to befall traditional higher education.

The twin reports from Moody's separately examine the financial "medians" (which strive to analyze performance based on a set of factors) for public and private nonprofit colleges and universities for the 2014 fiscal year, which for most institutions ended a year ago.

Taken together, the reports show "much of the higher education sector stabilizing into balanced operations, increased liquidity and slowly strengthening balance sheets," Moody's says. But about one in five institutions continue to struggle to produce enough revenue, with particular pressure on public and private institutions that do not have a national reach. The reports also suggest a growing gap between haves and have-nots.

"If you look across the sector, there are some signs of moderating stress, with stabilizing revenue growth, though at lower levels than in the past. The broad swath is stabilizing," said Susan I. Fitzgerald, associate managing director at Moody's. "But there is a material portion of each sector that really continues to feel very significant stress, with declining revenues and enrollment and declining viability."

Public Institutions

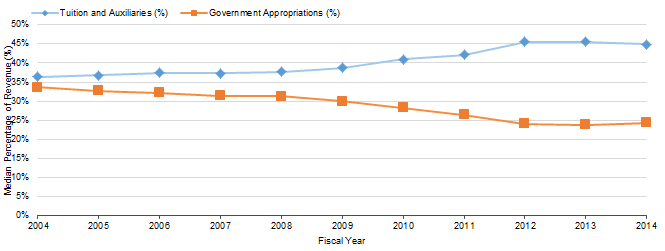

Moody's offers a decidedly mixed assessment of the state of public four-year colleges and universities. The ratings agency notes that state funding began to solidify in 2014, as "many states … traded tuition increases for increases in state funding." For the first time in more than a decade, Moody's says, "the gap between state appropriations and student charges as a portion of operating revenue narrowed marginally," with the proportion of institutional budgets funded by state funds edging up to 24.3 percent in the 2014 fiscal year, from 23.9 percent in 2013. That trend can be seen in the graphic below.

It takes two changes to shrink a gap like that, of course -- and the flip side of the slight uptick in state support for higher education for public colleges is that their net tuition isn't growing much, if at all. Nearly a quarter of public universities actually saw their net tuition revenue decrease in 2014, with regional universities (those without a global/national reach) particularly affected -- almost half of those institutions saw their net tuition revenue grow less than the 3 percent that inflation rose. Moody's officials said they expected the public policy goal of improving affordability to continue to put pressure on public college finances moving forward.

The differences in net tuition revenue between regionally focused and other public universities is linked, naturally enough, to student demand, Moody's finds. Since 2010, enrollment at the institutions the ratings agency defines as "global/national" (typically flagships and land-grant institutions) has grown by 5.4 percent, while it has fallen by 1.7 percent at regional publics. The Midwest is struggling the most, with enrollment there up by 4.3 percent since 2009, compared to 8.4 percent, 10.6 percent and 11.6 percent in the Northeast, West and South, respectively, according to Moody's.

Over all, Moody's finds, public institutions are managing to make their finances work, as their financial reserves are growing thanks to "strong stock market returns, lower debt issuance and expense management."

Private Institutions

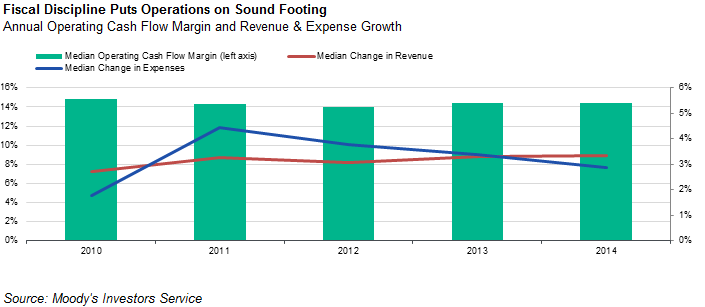

Fiscal 2014 was the first year since 2011 when median growth in revenues (3.4 percent) outpaced expense growth (2.9 percent) for private nonprofit institutions. Other positive developments for private institutions in general: median net tuition revenue surpassed inflation and seemed to be stabilize, although the 3.2 percent level was far lower than the pre-recession range of 7 percent.

But 19 percent of private nonprofit colleges rated by Moody's had their revenues decline, and 18 percent saw their aggregate net tuition revenues fall, with most of those colleges (as seen in the chart below) belonging to the lower-ranked ratings categories filled mostly with less-wealthy and less-selective institutions.

The divergence in financial outcomes among private colleges was evident in assets, as well, with median total assets growing between 36 and 48 percent for the top two ratings categories and 26 to 28 percent for lower-rated institutions.