You have /5 articles left.

Sign up for a free account or log in.

NACUBO

Private colleges and universities continue to raise their tuition discount rates, even as many institutions struggle with decreasing enrollment and declining revenue despite the practice.

A report from the National Association of College and University Business Officers released today reveals that tuition discount rates are at an all-time high and many institutions are using the strategy to a point that, according a top analyst at NACUBO, is "not sustainable."

Private institutions commonly discount their tuition -- using institutional aid (often derived from tuition revenue) to offer students a discount from the sticker price -- in an effort to entice students to enroll.

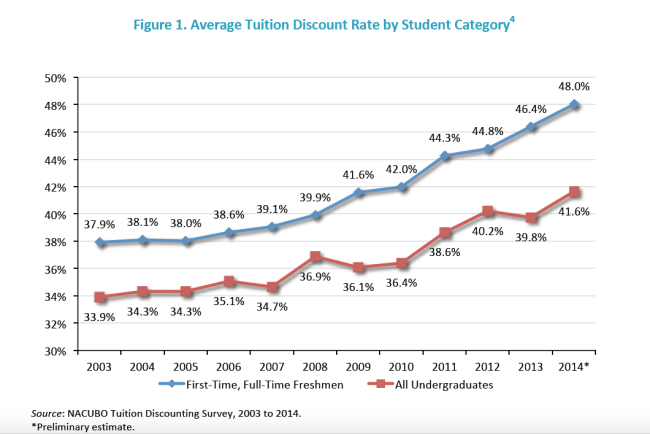

On average, private colleges’ discount rate -- institutional grant dollars as a percentage of gross tuition and fee revenue -- reached 48 percent for freshmen in 2014, up from 46.4 percent the year before, according to the 2014 Tuition Discounting Study, which surveyed 411 private colleges and universities (public institutions were not included in the survey because their funding formulas and pricing structure are different than those at private institutions).

Put another way, institutions awarded about 48 cents in institutional grants to freshmen for every dollar collected for first-year tuition and fees.

The average freshman in 2014 received an institutional grant that covered 54.3 percent of his or her college’s sticker price, up from 53.1 percent last year.

Much of the aid is going to needy students. NACUBO found that in 2013, about three-fourths of institutional aid was awarded to students with financial need.

Colleges feel pressure to increase the tuition discount in part because student demands are changing. Ever since the financial crisis of 2008, students have a heightened awareness of the price of college and are looking for as much aid as they can get.

“While the economy has improved, many families are still struggling. In a lot of communities you’re still seeing, if not job losses, jobs that don’t pay nearly as much as they did,” said Ken Redd, director of research and policy analysis at NACUBO. “There’s an increased inability [for needy students to go to college] and an unwillingness to pay even if you did have the money.”

He continued: “The level of price sensitivity … is very real.”

And colleges are trying to figure out how best to respond to that sensitivity, along with other challenges like demographic shifts in many U.S. regions that will negatively affect enrollment.

Yet increasing one’s tuition discount rate year after year isn’t necessarily the answer, Redd said.

Eighty-nine percent of first-time, full-time freshmen received some level of tuition discount, up from 88 percent the year before. That rate drops to 77 percent when all undergraduates are considered. Undergraduates as a whole received grants that cover, on average, 48.9 percent of tuition and fees.

Despite the prevalence and growing size of tuition discounts, nearly half of the institutions surveyed by NACUBO reported declining enrollment from 2013 and 2014. Sixty-three percent of business officers at institutions experiencing enrollment struggles cite price sensitivity as a contributor.

And the steep discounts are cutting into revenue: gross tuition price increases largely have been offset by increased grant aid to students. The majority of grant aid is funded from tuition and fee revenue. NACUBO found that, on average, 10.8 percent of institutional grants were funded by endowments.

Net revenue of surveyed institutions is expected to grow just 0.4 percent per student next year, the report states. This is not a new trend. After adjusting for inflation, tuition revenue has been flat for the last 13 years.

“The real decline in net tuition revenue suggests to us that tuition discounting, at the levels they are currently at, is just not sustainable,” Redd said.

Redd added that some colleges -- realizing that overdiscounting tuition may fail to improve, or even hurt, their financial health -- are trying to leverage other strategies to recruit students, like freezing tuition, expanding marketing efforts or increasing selectivity. Many are looking for recurring savings to try to make up for slowing revenue gains.

Yet Redd says change takes time, especially given existing market challenges. Tuition discounting levels will likely continue to grow in the near future.

“The financial need is still going to be very high, and the competition among schools for students is still going to be very high, so it wouldn’t surprise me, at least for the next couple of years, if we would see this trend continue,” he said.

Though the majority of institutions raised their discount rate, some held the line: 31 percent reduced or maintained their tuition discount rate from 2013 to 2014. Yet that number is lower than the previous year, when 34.6 percent lowered or held steady their discount rates.