You have /5 articles left.

Sign up for a free account or log in.

There’s good news and bad news when it comes to how much of a financial burden students and families are shouldering for a college education.

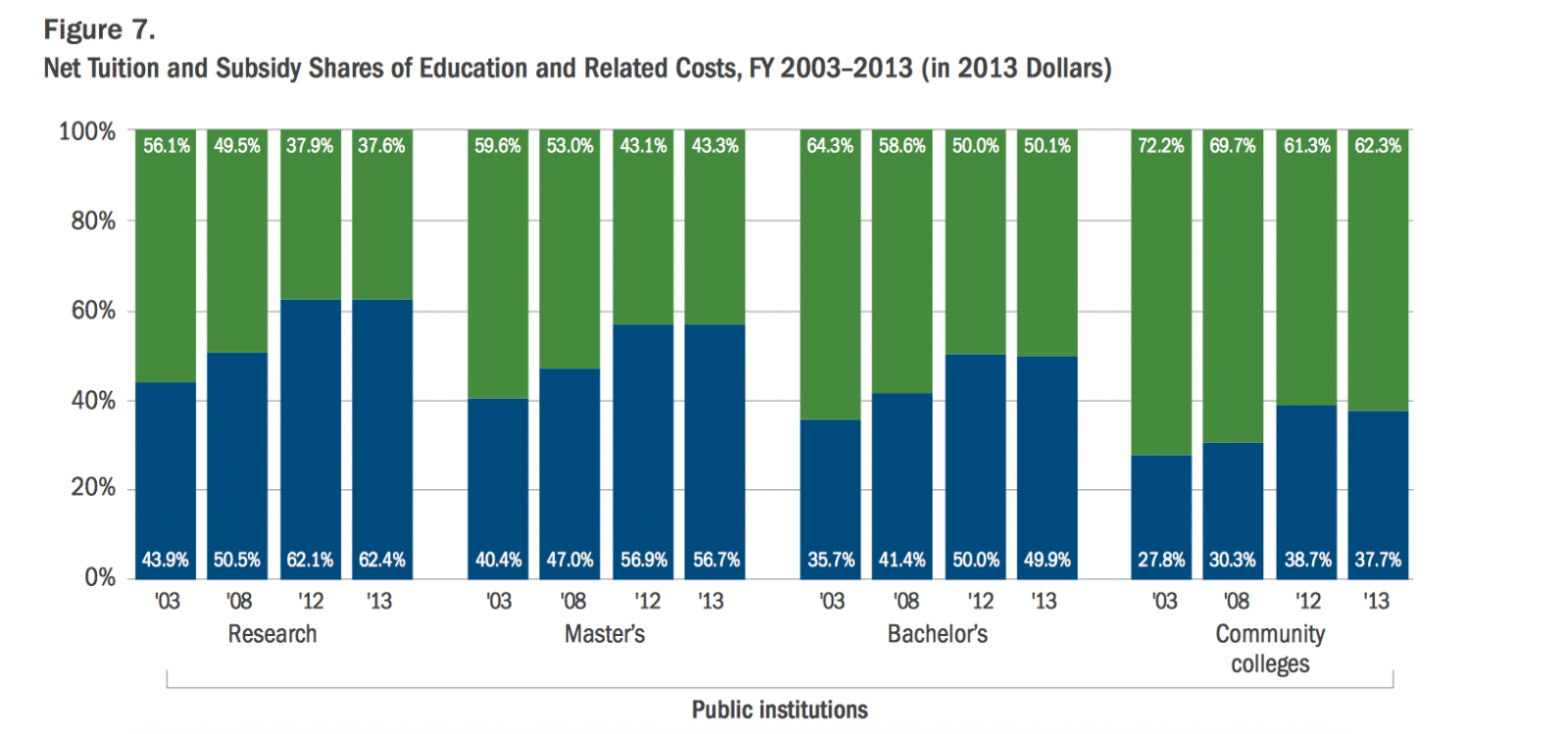

The good news? The share of tuition that covers educational costs at institutions didn’t go up much in 2013, the most recent year studied by the Delta Cost Project in its new report “Trends in College Spending: 2003-2013,” released Tuesday. The bad news? Students and families, through tuition, have been shouldering a much larger portion of educational costs ever since the recession hit in 2008. The increase is, on average, 10 percentage points.

“For the first time in a while for all public four-year institutions, the share did not go up from 2012. Community colleges actually dipped down a percentage point,” explained Steven Hurlburt, a senior researcher at American Institutes for Research and co-author of the report.

“They're not taking on any more of the costs right now,” he said of families. Yet Hurlburt added a big caveat to the good news: not that long ago, things were much better. “Of course, we are in a period of an economic upturn. If you look at it from the beginning of the recession, they are still taking on the majority of costs.”

In 2008, net tuition at public research universities covered 50.5 percent of educational costs, on average. That figure has since ballooned to 62.4 percent in 2013, up just slightly (0.3 percent) from 2012. At public master’s institutions it was 56.7 percent (up from 47 percent in 2008) and at public bachelor’s institutions, it was 49.4 percent (up from 41.4 percent in 2008).

And at community colleges, tuition covered 37.3 percent of educational costs in 2013, up from 30.3 percent in 2008 (but down slightly from 38.3 percent in 2012).

The change in the share families pay, while slowing, is significant, Hurlburt says.

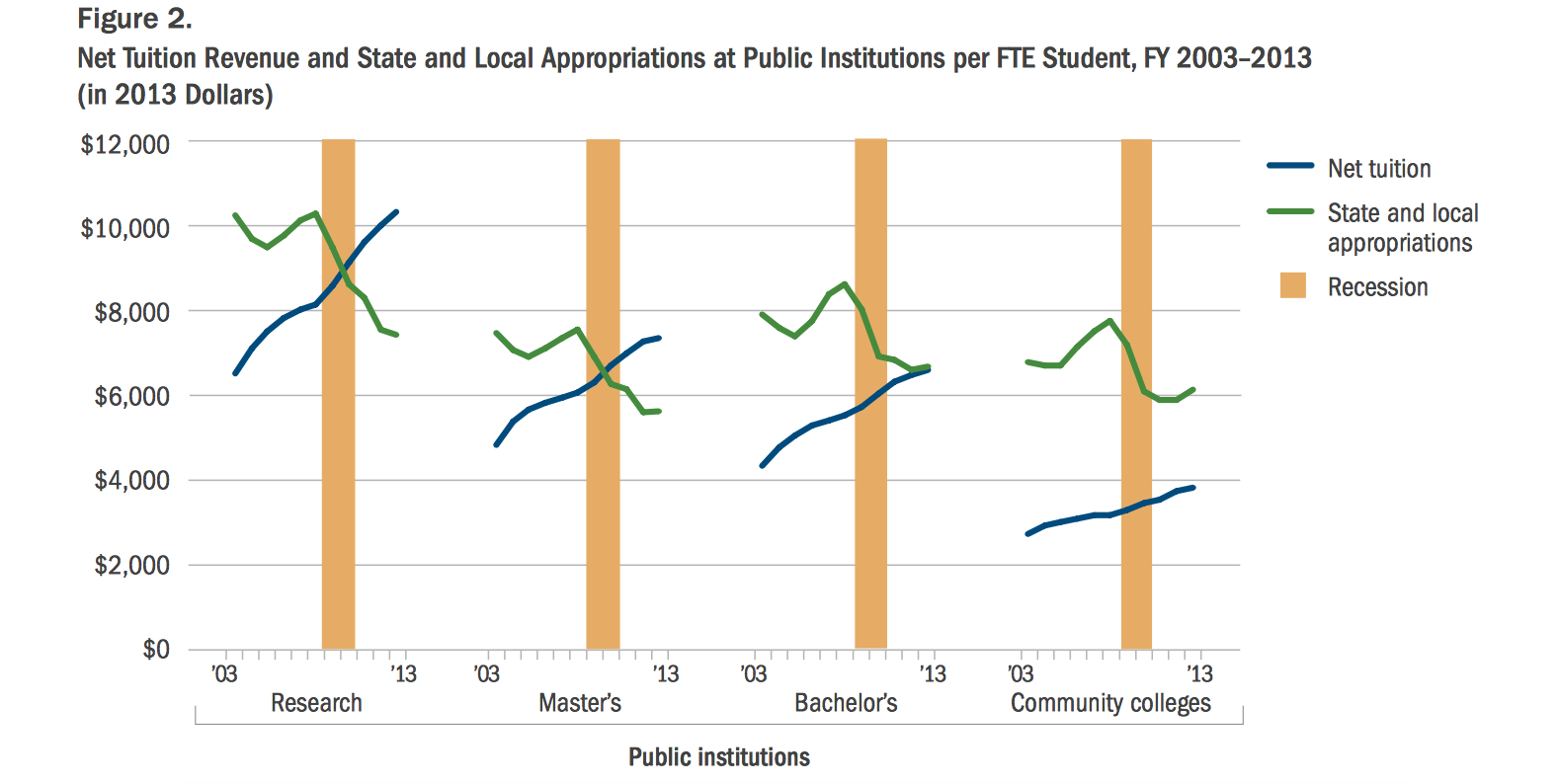

Despite the revenue constraints that colleges faced during the recession, such as lowered state and local appropriations, institutions did not drastically cut spending. Rather, they shifted more of the cost burden onto families through tuition increases. Explained the report: "Instead, they turned to students to increasingly finance their operations, further reinforcing the notion of education as a private, rather than a public, good." And Hurlburt warns that another recession could tip the scales and make the financial burden too heavy for many students.

“What happens in the next economic downturn? Unless colleges are really going to buckle down and restructure their costs … you have this downward slide,” he said. “Our next recession we might see students and families taking on even more.”

AIR runs the Delta Cost Project, which studies spending in higher education. Its most recent report relies on the latest year of fully verified federal data, which is why it lags behind the present year.

The report also found that 2013 was the year when states began reinvesting in higher education funding after the recession, albeit slowly.

Following four years of sharp declines, state and local funding increased 5 percent for community colleges and 1 percent for public bachelor’s-granting institutions between 2012 and 2013 (although public research universities declined 2 percent, which is an improvement over annual declines since 2008). Yet funding remained well below pre-recession levels. In fact, since the recession, funding at public research universities has dipped 28 percent -- or about $2,800 per student, on average -- at public research universities.

Over all, 2013 was a good year for community colleges.

Not only did they see their public funding increase from 2012 to 2013, but they also increased their per-student spending by 5 percent -- the second consecutive year of a significant spending increase (public four-year colleges saw per-student spending increases that averaged between 2 and 3 percent). And community colleges, for the first time since the recession, saw an uptick in revenue in 2013. The 3 percent increase in per-student revenue is likely correlated to enrollment decreases.

During the recession students flooded community colleges. Enrollment increased 25 percent between 2007 and 2011, resulting in institutions that were stretched very thin. In 2013 community college enrollment declined (4 percent) for the second consecutive year.

“Community colleges definitely were hit the hardest and they've seen a really good rebound,” Hurlburt said.

“They saw a large influx in the number of students enrolled [during the recession, and] because you had so many students, there are less resources to go around,” he continued. “Now there are less students. You've still got the same amount of resources but you don't have to spread it around so thinly.”

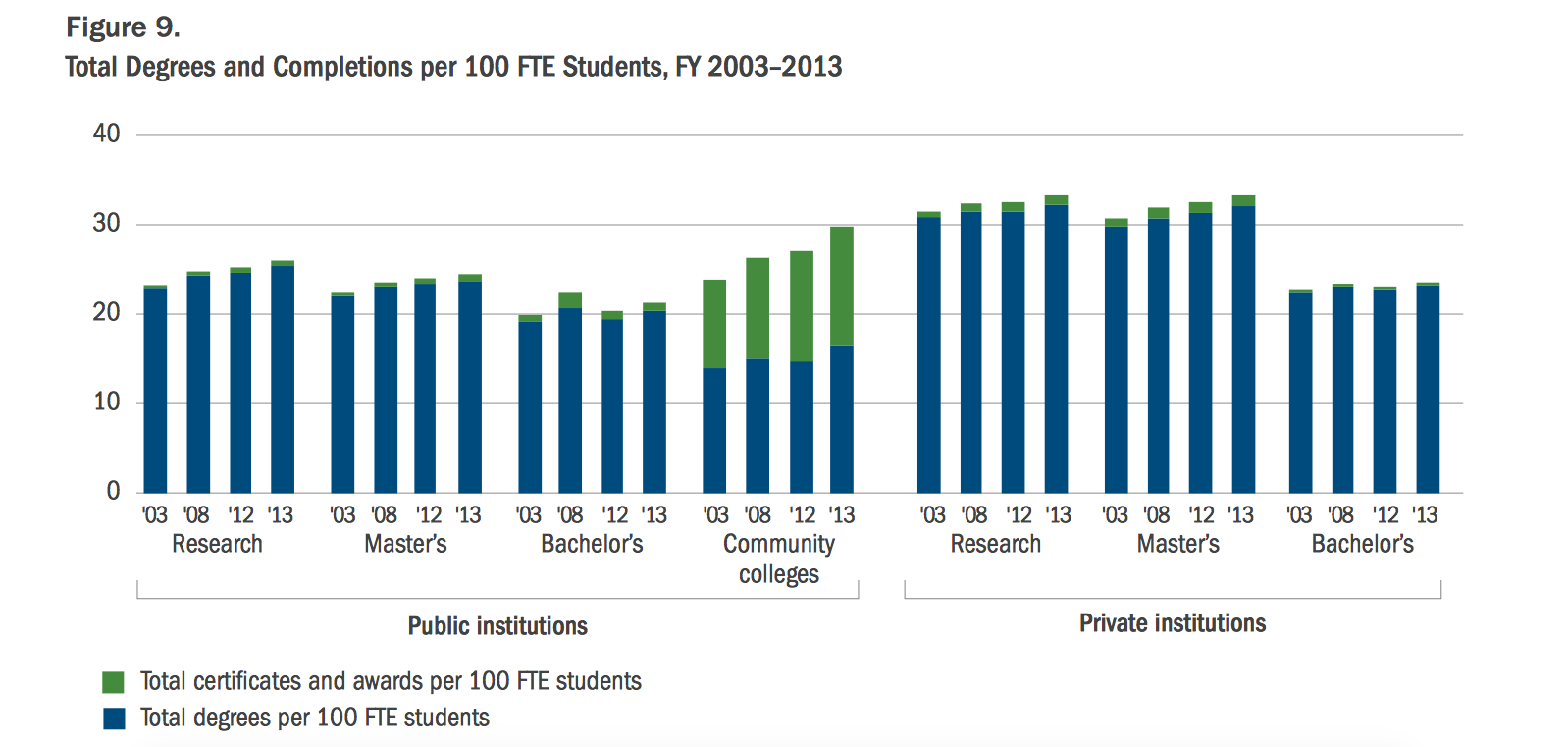

On the flip side, the increased enrollment led to a heightened degree of productivity. Community colleges, for example, awarded seven more degrees or certificates per 100 students in 2013 than they did in 2003.

Other data of note from the report:

- From 2003 to 2013, spending on instruction and research increased 9.4 percent and 9.5 percent, respectively, at public research universities. Meanwhile, at those same institutions, spending on student services and academic support saw a much steeper increase: 22.3 percent and 25.5 percent, respectively.

- Hurlburt surmised that increased student services spending could be the result of a heightened emphasis on career readiness or due to increased support for Pell Grant recipients since the recession.

- Community colleges weren't the only institutions to significantly increase the number of degrees they awarded over the decade that ended in 2013. Public institutions over all produced three more credentials per 100 students in 2013 than in 2003. Private research and master’s institutions produced two more credentials per 100 students in 2013 than in 2003.