You have /5 articles left.

Sign up for a free account or log in.

Getty Images

Federal data released last year revealed a student-loan default crisis among borrowers who are black or who attended for-profit colleges, with roughly half of both groups defaulting within 12 years after first enrolling in college.

Borrowers often default on modest loan balances, according to the data. And researchers subsequently showed that, as aggregate default rates continue to rise between 12 and 20 years after borrowers begin repaying their loans, up to 40 percent of students who took out loans in 2004 may default by 2023.

A newly released study digs deeper into the numbers and attempts to identify factors that could explain the crisis-level default rates among black borrowers and for-profit students.

After controlling for student and family background characteristics, including measures of income and parental wealth and support, the new research from the Brookings Institution still found big gaps between the default rates of black and white borrowers, and between those who attended for-profits versus other types of colleges.

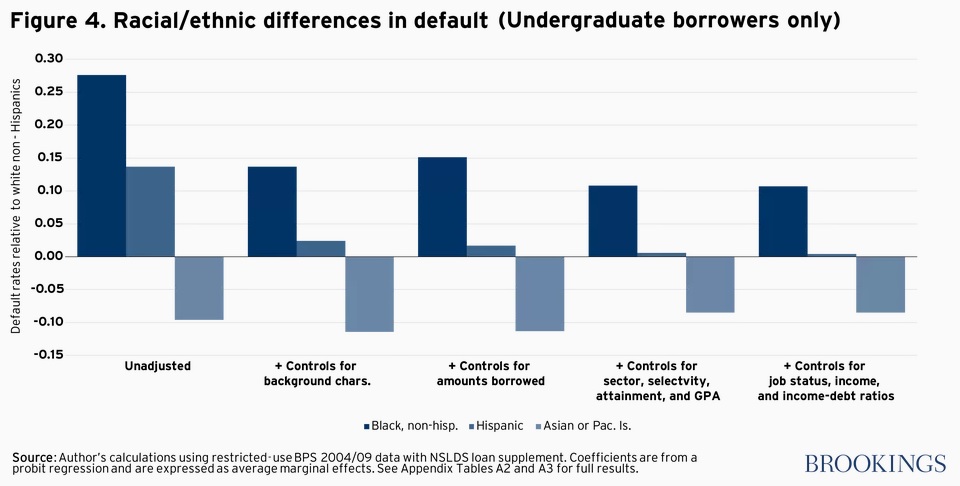

The federal data show that 17 percent of all students who entered college in 2004, and 28 percent of those who took on student loans, defaulted by 2016, according to the study. Among black borrowers, 48.7 percent defaulted, compared to 21.4 percent of white, non-Hispanic borrowers. Roughly 35 percent of Hispanic borrowers defaulted.

Half of the gap between black and white borrowers disappears (from 28 to 14 percentage points) when controlling for borrower characteristics, such as parental educational levels and home ownership.

Even after controlling for measures such as loan amounts, grade point average, whether the student earned a credential, job status, income and income-to-debt ratios, the black-white gap remained a “large and statistically significant” 11 percentage points, according to the study, which was conducted by Judith Scott-Clayton, a senior fellow with Brookings and associate professor of economics and education at Columbia University’s Teachers College.

The family background controls reduced the default gap between Hispanic and white borrowers by 80 percent, the study found.

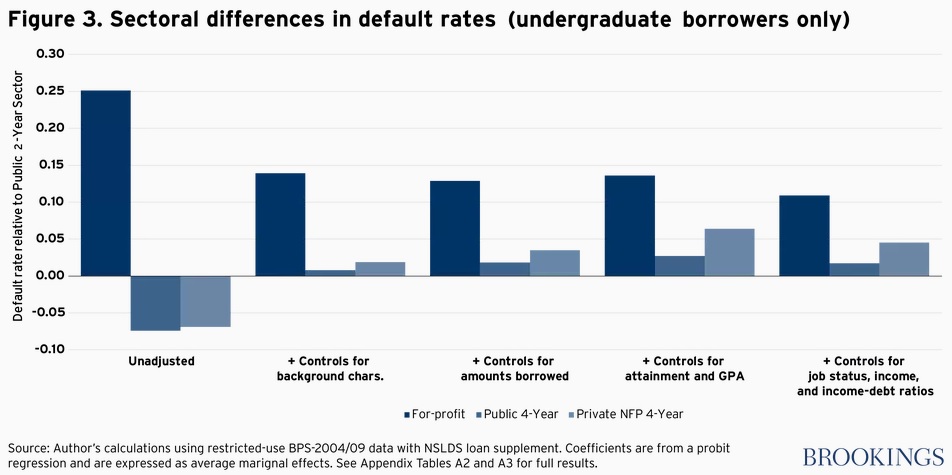

Students who attended for-profits were almost four times as likely to default as were their peers who attended community college (47 percent compared to 13 percent), according to the federal data. Among borrowers, that gap was 52 percent versus 26 percent.

As with the racial gap, the new study found that the high for-profit default rate was not fully explained by measures of employment and earnings, or other borrower characteristics.

“Entering a for-profit is associated with a 10-point higher rate of default even after accounting for everything else in the model,” the study said.

Scott-Clayton said in an interview that she was surprised by the study’s findings, particularly the persistent gap between borrowers who attended for-profits versus other institutions.

“I would’ve expected that what happens after college would explain more of the defaults,” she said.

The earnings and employment data used in the study were self-reported, incomplete and has other limitations, said Scott-Clayton.

“Better data on earnings, employment and other post-college circumstances might explain more of the gap,” the study said.

Scott-Clayton mentioned several other measures that could be used to learn more about default gaps, including the timing and trajectory of students’ college enrollment, data on other types of debt borrowers held and the health of borrowers or their single-parent status.

She and other researchers have stressed that many factors related to wealth no doubt play a role in the high default rates among black borrowers.

“We see racial gaps in a lot of areas of life,” said Scott-Clayton.

One way to further study the racial default gap, she said, might be to look at borrowers’ relative access to support systems. For example, differences in loan counseling or loan servicing could play a role.

“Even if the black-white gap in default could be fully explained by family income and wealth, this would not make it any less problematic for black borrowers who cannot change their family background,” the study said.

When a student loan enters default, the full balance becomes due, the study said, and borrowers lose access to deferment and forbearance options. Fees of up to one-quarter of the balance can be tacked on as well. And it can be harder to access credit or rent an apartment after a student loan default.

Yet the study found that most borrowers who defaulted were able to resolve at least one default (54 percent) within 12 years. In addition, 14 percent of borrowers who defaulted later returned to college.

To attempt to understand the racial and sectoral loan default gaps, the study suggested further research with higher-quality measures of income and other postcollege financial factors.

“The better we can understand what drives these stark gaps, the better policy makers can target their efforts to reduce defaults,” the study concluded.