You have /5 articles left.

Sign up for a free account or log in.

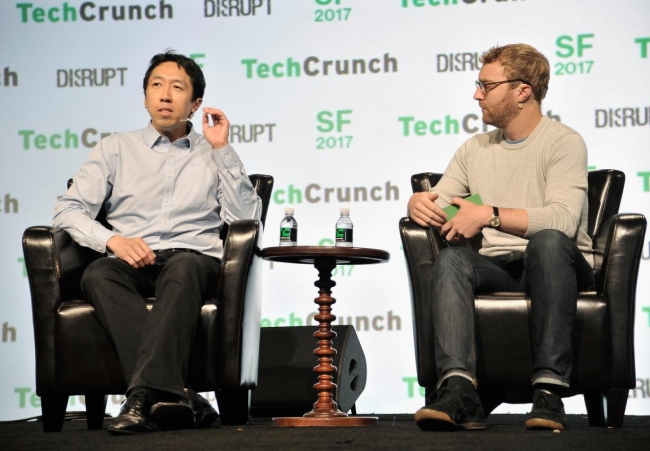

Andrew Ng, left, co-founder and chairman of the board of Coursera, leads the board of the company as it navigates its initial public offering.

Steve Jennings/Stringer/Getty Images

Online learning platform Coursera filed an application last week to become a publicly traded company and sell shares on the New York Stock Exchange under the ticker symbol COUR.

The initial public offering was long anticipated by industry analysts but is notable because few education-technology companies have taken the plunge. Most fail to reach the scale of companies such as Chegg and 2U, two publicly traded companies that announced their IPOs eight and seven years ago, respectively.

"The Coursera IPO has been the most anticipated capital event of the last few years among ed-tech prognosticators," said Daniel Pianko, managing director of University Ventures, an investment firm focused on global higher education. "There is no logical buyer of Coursera, so an IPO is the natural way for investors to achieve a return on their investment."

Due to healthy valuations and a network of around 77 million learners worldwide, leaders at Coursera are taking the company through this next step, although the number of shares to be offered -- and their price point -- is yet to be determined.

Coursera was founded almost a decade ago by Stanford University professors Andrew Ng and Daphne Koller with the proclaimed mission of bringing quality online education to the masses. In this moment of economic uncertainty, online providers such as Coursera are more important than ever before, said Ng, who chairs the company's board, in a letter filed with the SEC along with Coursera's IPO disclosures.

"We've seen billions struggle during the pandemic. At school, many learners and instructors were ill-prepared to move learning online. At work, digital acceleration is threatening many jobs as skills rapidly become obsolete," Ng said. "The staggering scale of disruption has underscored the need to modernize the global education system. Leaders tasked with creating a level playing field now recognize that learning online will be a powerful means of providing individuals with the skills they need and promoting social equity."

Although it is still possible to audit many Coursera courses for free, the company has evolved significantly since its early days as a provider of massive open online courses, or MOOCS. The platform’s combination of paid nondegree certificates, stackable degrees and professional credentials has forged a company with an estimated value of between $2.4 billion and $5 billion.

"Wall Street is desperately seeking high-growth, consumer-based businesses like what Coursera has become," Pianko said. "Massive eyeballs with a repeatable, freemium model drives the types of lofty valuations that the Coursera IPO achieves."

Documents filed with the SEC show Coursera posted revenue of $293.5 million in 2020 -- a growth rate of 59 percent over 2019. But the company did not turn a profit, reporting a net loss of $67 million in 2020. Coursera lost more money in 2020 than it did in 2019, when it lost $46.7 million. The company's accumulated deficit since inception stood at $343.6 million at the end of 2020. Its IPO filing indicated it expects to incur losses for the foreseeable future.

Many online learning platforms and providers saw usage surge during the pandemic, said Trace Urdan, managing director at investment bank and higher education consulting firm Tyton Partners. Whether those high levels of engagement can be sustained will be a key question for investors considering Coursera shares, he said.

The company's growth over the past decade has been impressive but was not without several pivots in business strategy, Urdan said.

In recent years, Coursera has branched into online program management services for universities, helping institutions to launch and manage online degrees for a share of tuition revenue. That revenue stream was thought by some analysts to be an important part of Coursera's financial future, but the IPO documents reveal that this share of the business is quite a bit smaller than some observers imagined.

Coursera splits its revenue into three different categories, IPO documents show. A consumer segment covers payments and subscriptions made directly by learners to Coursera. An enterprise segment covers businesses and government customers training their employees, as well as university customers providing online courses to students. A degrees segment works with universities to provide fully online bachelor's and master's degrees.

The consumer segment's revenue stream is by far the most significant, although revenues through business partnerships and shares of degree tuition are growing year over year. In 2020, consumer revenues were $192.9 million, enterprise revenues were $70.8 million and degree revenues were $29.8 million.

“I thought they were going to end up being an online program management company. I thought that was where the real business was,” said Urdan. “I was surprised to see how strong their consumer business is and how well they’ve grown their corporate business, especially in a pandemic.”

The company's OPM business is special because Coursera has a "gigantic database" of users, Urdan said.

"They know not only who is interested in degree programs, but also some information about their competence," he said.

Coursera spends the equivalent of 36.5 percent of its revenue on sales and marketing -- $107.2 million in 2020, according to the new IPO documents. That surprised some industry experts, because the company has not been shy about touting how cheaply it is able to market degrees to its pool of learners. Coursera's marketing spend nearly doubled between 2019 and 2020.

"One key driver of Coursera’s value proposition is that they have 77 million learners who they can convert into paying subscribers or degree seekers," Pianko said. "However, the 37 percent of revenue spent on marketing indicates that Coursera may not have the capacity to acquire students at significantly lower price points than traditional education marketers despite all those MOOC students."

The $107 million marketing spend by Coursera in 2020 is not unprecedented when you consider the company's scale and growth, said Sean Gallagher, founder and executive director of Northeastern University’s Center for the Future of Higher Education and Talent Strategy and executive professor of educational policy.

“Many companies including those in online education spend 50 percent or more of their revenue on sales and marketing when they’re scaling up and generating losses, and the share declines over time,” Gallagher said.

Like any consumer-facing business, Coursera needs to spend on marketing in order to build a brand and attract customers, Gallagher said.

"Based on the financial details in the filing, it looks like there are some real efficiencies in their ability to acquire customers,” he said.

Coursera reported that its average acquisition cost per student for online degree programs was under $2,000 for the two years ending in December. That figure is impressively low, said Gallagher. Most universities spend many thousands of dollars enrolling online degree students, he said.

"It is clear that their reach and platform is efficient at creating a pipeline of certificate and degree students," Gallagher said.

The relatively small size of Coursera’s OPM business was not surprising to Gallagher.

“Beyond a few pilot partners like the University of Illinois, it was really just 2018 and 2019 when they started to scale that business up -- so it’s impressive that it's been doubling each year,” he said.

Though users can sample many courses on Coursera without paying, the sheer volume of students paying relatively small fees for certifications has played a huge role in the financial success of the company. A two-hour guided project on how to build a website, for example, costs just $9.99.

“It’s clear that monetizing credentials -- certificates and degrees -- are what have made the MOOC platform business model sustainable,” Gallagher said.

Some industry experts, including Gallagher, feel the MOOC business model has simply evolved over time to a model that includes paid options. Others feel the model has been replaced by something quite different.

Coursera's CEO, Jeff Maggioncalda, spent the last several years moving the company away from its MOOC heritage, Pianko said. The company was moving toward a model where consumers pay for stackable credentials.

“The headline is that the MOOC failed, but the short course won,” Pianko said.