You have /5 articles left.

Sign up for a free account or log in.

Webster University is seeking to reclassify $34.4 million in restricted endowment funds.

Photo illustration by Justin Morrison/Inside Higher Ed | Photo: Matthew Black/Wikimedia Commons | Documents: St. Louis County Circuit Court

Reeling from financial challenges and leadership turnover, Webster University is seeking to lift restrictions on $34.4 million in endowment funds to fulfill the conditions of a loan agreement. But it will first need a court’s permission.

Webster’s financial woes have led to a lawsuit over unpaid rent for its downtown St. Louis campus and the collapse of its bond rating over more than $125 million in debt—as well as a “double-digit operating deficit” for four consecutive years and “very thin liquidity,” according to Moody’s Investors Service.

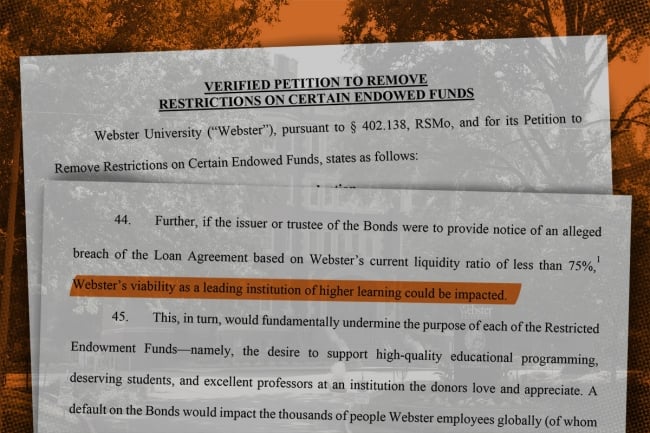

Now Webster officials are seeking to reclassify the endowment funds in an effort to satisfy liquidity requirements for an existing $30 million loan. According to court documents, Webster is required to “maintain 75% unrestricted assets to outstanding long-term indebtedness.” But in fiscal year 2023, that liquidity ratio fell to 19 percent. Officials argued in court filings that unless the endowment becomes accessible through reclassification, “Webster will be challenged to meet its financial obligations.”

Webster’s Financial Woes

The move comes amid years of financial challenges at Webster.

With more than 30 locations spread across the U.S. and other countries as well as online programs, Webster has a sprawling presence. But that presence has shrunk over the last two decades as the university has closed dozens of satellite campuses—some of which were underperforming, officials said.

Publicly available financial documents also show that the university has lost significant sums in recent years, operating at a deficit since fiscal year 2017 while also selling off millions in assets. Additionally, $2 million in university “property” was reportedly misappropriated by a former employee during the 2022–23 school year, a spokesperson said via email; officials declined to comment further due to an ongoing investigation. Webster’s endowment was reportedly valued at $98.5 million late last year, down from $101.5 million in May 2021, according to the latest available audit.

But even as Webster has struggled, executive pay has soared. Top executives Beth Stroble—who served as president from 2009 to 2019 and then as chancellor before stepping down late last year—and Julian Schuster, the former provost who became president in 2019, have seen their compensation double over the last decade, according to The St. Louis Post-Dispatch. Their leadership was called into question last fall, when the faculty issued a vote of no confidence. (The university’s chief financial officer also retired recently, among other departures.)

Last week Webster formally filed a petition with the St. Louis County court to lift restrictions on $34.4 million in endowment funds to meet liquidity requirements. Officials said in the court filing that the university has struggled financially due to “circumstances and events out of Webster’s control,” including the effects of the COVID-19 pandemic, “rapid increases in inflation and interest rates in recent years, and population trends” that have shrunk the college-aged cohort in the U.S.

The petition also argued that if the loan agreement is breached because the university can’t meet the liquidity ratio, “Webster’s viability as a leading institution of higher learning could be impacted.” Though the term “closure” is not used, it seems to be what university officials are alluding to.

“Due to Webster’s reduced operating funds, there is a strong possibility that the specific purpose of each of the Restricted Endowment Funds would not be achieved unless Webster is permitted to use the funds for more general scholarship and professorship purposes,” the filing read.

The reclassification of endowment funds is a measure the Board of Trustees approved last month, maintaining that it’s necessary in order to move the university forward.

“As a long-time donor and supporter of Webster University, I support this effort to fully leverage the strength of the University’s endowment. This removal of restrictions will allow the University to address current challenges while enabling future growth,” John Nickel, a member of the Webster University Board of Trustees, said in a statement provided to Inside Higher Ed.

In both court filings and an emailed statement, Webster officials noted that the liquidity issues are a short-term challenge and the university is on an upswing, with positive enrollment trends.

“Alongside its effort to reclassify endowment funds, Webster University remains focused on achieving greater efficiency,” said spokesperson Stephanie Dane. “In the past year, the university has seen double-digit growth in enrollment, an increase in revenue and appropriate cost savings in many areas while ensuring the student experience at Webster is not impacted.”

Enrollment at Webster’s campuses spiked by 28 percent from fall 2022 to fall 2023, rising to nearly 13,500 students. That’s the highest head count since 2007, according to court documents, which also noted that the university expects to double tuition revenue on international campuses by fiscal year 2026.

Dane added that the endowment funds will be used in a way that remains true to their intended purpose.

“Based on our financial projections, we do not intend to spend any of the funds that we are seeking to reclassify as unrestricted for any purpose other than those that the donors expressed,” she noted. Restricted scholarship funds will continue to be used for that purpose; any attempt to spend newly freed funds must be approved by trustees, she added.

Donor Relations

Webster’s argument that its “viability” could be affected may persuade the court given another recent example in Missouri. Avila University—a Roman Catholic institution in Kansas City—filed a petition last fall seeking access to restricted endowment funds as it struggled financially. Without those restrictions being lifted, Avila officials argued, the university could not afford to offer financial aid and scholarships due to its “limited resources.” Ultimately, a judge freed up $6.4 million for the institution.

Under Missouri statute, donor restrictions may be lifted for various reasons, including “if the restriction has become impracticable or wasteful” or “if it impairs the management or investment of the fund.” Institutions seeking to lift or modify donor stipulations must notify the state attorney general, who then has the chance to weigh in. In Webster’s case, the attorney general’s office told the university it “did not anticipate becoming involved in any proceedings involving the determination of or changes of purpose to donor gifts,” including removing restrictions on endowed funds.

Donors were informed of the reclassification effort in a recent letter from the Board of Trustees. Dane said that many “agreed to the reclassification because they understand the positive impact Webster University has.”

Others have raised concerns about the decision.

One donor, who established an annual scholarship at Webster to honor his late wife, told The St. Louis Post-Dispatch that he did not want the university to use his donation for anything other than a student scholarship, and he hoped the court would deny Webster’s petition to reclassify restricted endowment funds.

But the decision to lift endowment restrictions ultimately lies with the court.

Doug White, a philanthropy adviser who has written about donor relations, said Webster’s request is fairly rare and that the move is likely to pose challenges for fundraising in the future, given the likely loss of trust among donors who gave money to the university for specific purposes.

“From a public relations perspective, this doesn’t feel like it’s very well thought out,” White said, adding that Webster’s highly publicized struggles make for a difficult fundraising platform.

He noted that gifts may come with emotional attachments. Suddenly redirecting scholarship funds intended, say, to honor a graduate’s late spouse can harm donor relations, he said—especially at a time when the struggling institution needs to cultivate benefactors more than ever. The fight over repurposing Webster’s endowment funds also comes amid an ongoing capital campaign launched in 2019 that has raised only $17 million of its $35 million goal—progress that White suggests reflects broad fundraising challenges.

A hearing on Webster’s petition is scheduled for Feb. 16.