Free Download

The world looked pretty bleak last spring and summer, as the COVID-19 pandemic upended most aspects of society and no clear end was in sight. College and university business officers were not immune, as respondents to Inside Higher Ed's annual survey of chief business officers last summer expressed far less confidence about their colleges' five-year financial outlook than they had in previous years. They cited sharp drops in revenue and unexpected spending on health, safety and learning technology as a painful combination.

A year later, with COVID-19 loosening its grip on campuses, the economy and American psyches, and many institutions' budgets boosted by a major infusion of federal funds, it's not surprising to find campus financial managers in a better place. Three-quarters of respondents to Inside Higher Ed's 2021 Survey of College and University Business Officers, conducted this month with Hanover Research, express confidence in their institution's financial stability over the next decade. The same proportion says their college or university is in better financial shape than it was a year ago, and two-thirds say it is stronger than it was in 2019.

Large majorities also believe that their institution's response to the pandemic and the resulting recession positioned them well for the future, causing them to implement "positive, long-lasting" changes" (78 percent agree) and pushing them to "think outside of the box" in ways that will benefit the institution in the long run (96 percent agree).

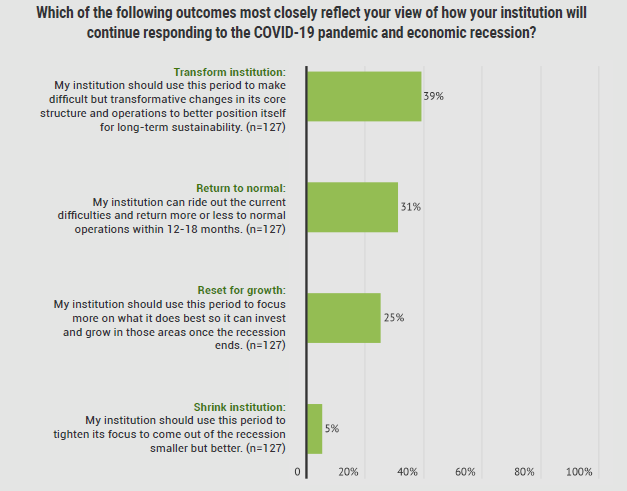

Experts on college finances who reviewed the survey's results said they were taken aback -- and in some cases troubled -- by the business officers' optimism, which seems to be softening their views on whether their underlying business models are broken. In last year's survey, 47 percent of chief business officers said they thought their institution should use the pandemic period to transform the institution, and a quarter believed they could return to normal; this year 39 percent said they should try to make transformative changes, and 31 percent aim to return to normal.

More on the Survey

Inside Higher Ed’s 2021 Survey of College and University Business Officers was conducted by Hanover Research for the first time this year. The survey included 133 chief business officers from public, private nonprofit and for-profit institutions. A copy of the report can be downloaded here.

Inside Higher Ed regularly surveys key higher ed professionals on a range of topics.

On Wednesday, Aug. 25, Inside Higher Ed will present a free webcast to discuss the results of the survey. Please register here.

The Inside Higher Ed Survey of College and University Business Officers was made possible in part with support from Amazon Web Services, EY-Parthenon and Syntellis Performance Solutions.

And few CBOs expect their colleges and universities to embrace the sorts of changes that might reflect a shift in how higher education operates: more than eight in 10 say their institution had no plans this year to share administrative operations or academic programs with another college, to abandon existing plans to build new facilities, or to revise tenure policies.

"If this small sample set really is representative of the thoughts of CBOs across higher education, then we already have the answer to whether the pandemic will boost higher education out of the complacency and resistance to change which has been one of its greatest weaknesses," said Kathleen M. Byington, senior vice president for administration at Stony Brook University, part of the State University of New York system.

Among other highlights of the survey of 133 business officers:

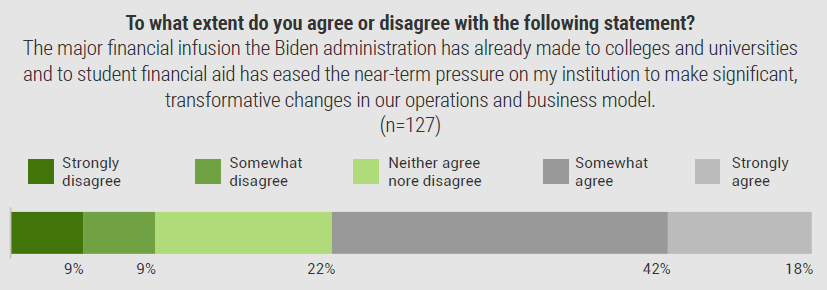

- Business officers overwhelmingly credit the Biden administration's economic recovery package with helping their institutions stabilize their financial situations -- but about three-quarters say the relief will be only temporary.

- About 60 percent of business officers expect their college or university to reverse decisions made last year to restructure classrooms and dining halls; about 40 percent say they'll do the same regarding student housing.

- Fewer than two-thirds of CBOs agree that they have the data they need to make informed decisions about a range of matters related to performance within their institutions, including the performance of administrative and academic technology and the performance of administrative units.

Business Officers' Confidence in Their Institutions

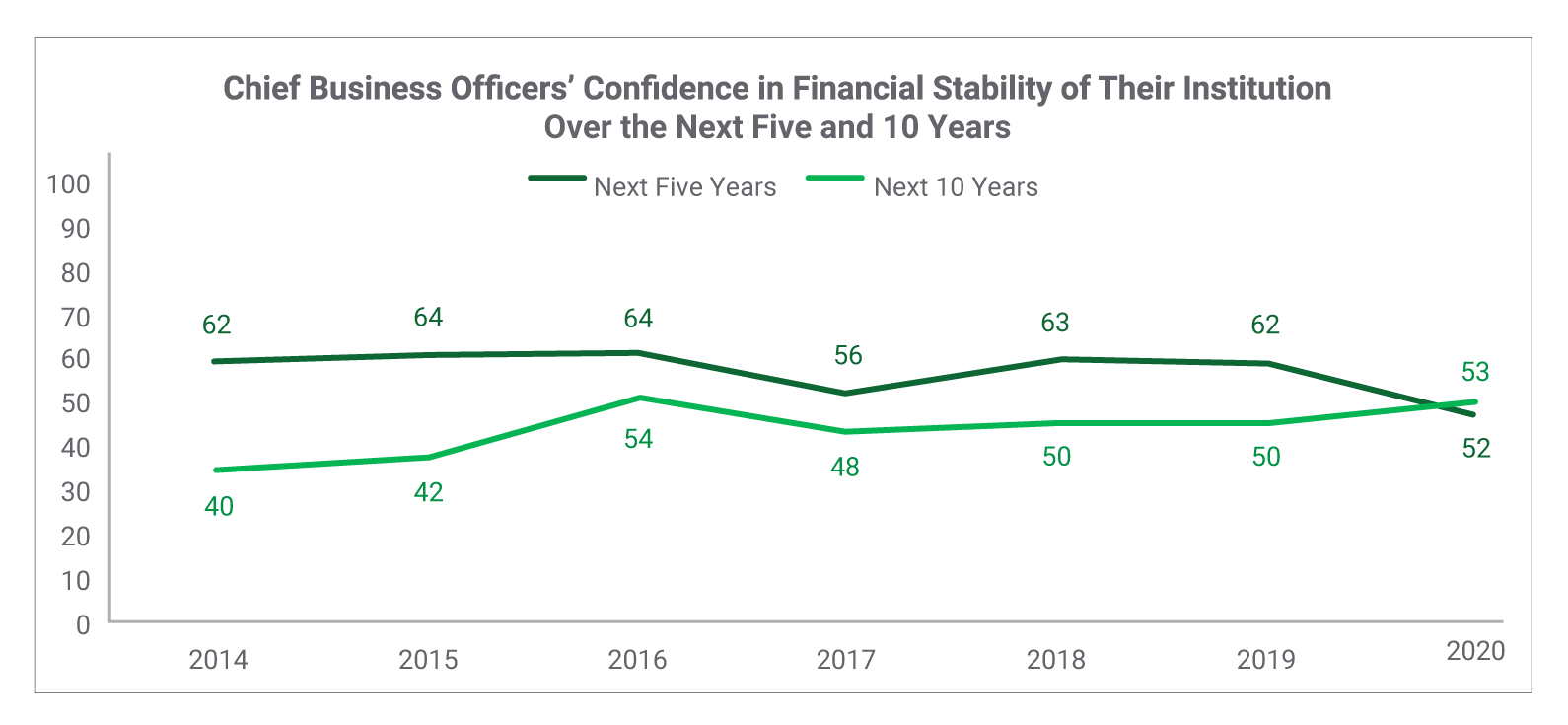

One hallmark of Inside Higher Ed's surveys of business officers and college presidents is a question designed to gauge the overall confidence of the institutions' leaders in their near- and midterm financial stability. Over the last half decade, CBOs' confidence has risen and fallen with national economic conditions and other factors. Last year, in the teeth of the pandemic, the short-term "confidence survey" suffered a sharp drop, as seen in the graph below.

Because this year's survey was conducted by our new survey partner, Hanover Research, the survey data between years is not directly comparable. But while Hanover has not calculated "statistically significant differences" between this year's results and previous iterations conducted by Gallup, "a top-level review of the findings [suggests] some generalizable trends."

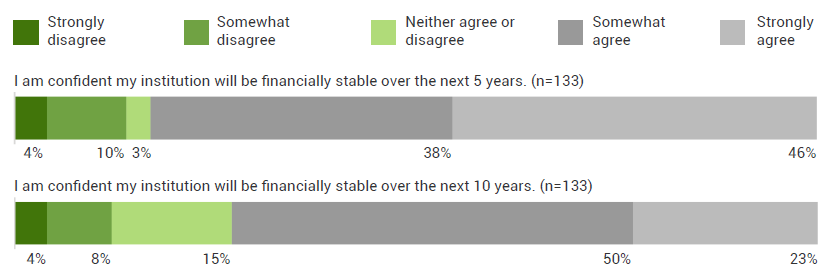

The extent of business officers' renewed confidence this year isn't subtle. More than eight in 10 business officers express confidence (46 percent strongly) in their institution's five-year financial outlook, and 73 percent agree (23 percent strongly) that they are confident in their 10-year financial stability.

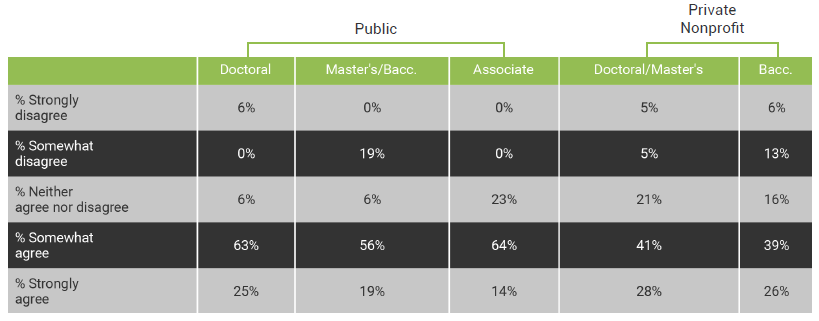

While business officers in every sector express more confidence, it isn't evenly felt. CBOs from public higher education sectors are more optimistic than their private college counterparts, and business officers from public and private nonprofit teaching institutions (as opposed to research-oriented ones) are more likely than their peers in other sectors to actively say they are not confident (about one in five do that).

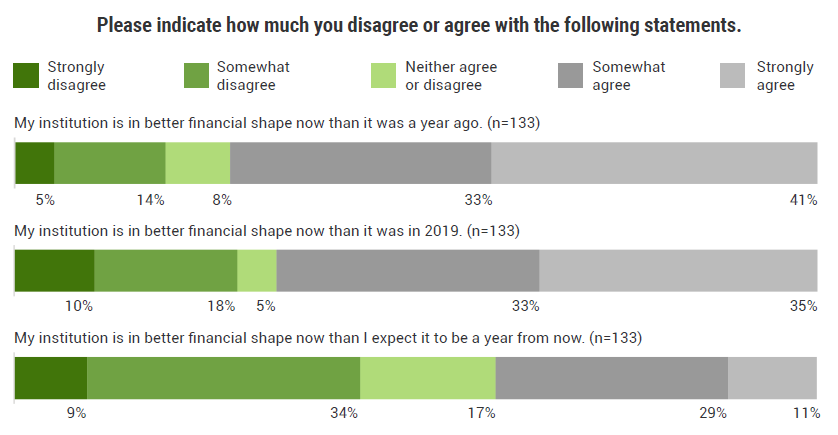

To try to put those numbers in more context, given the unprecedented nature of the last 18 months, the survey also asked business officers to compare their current financial situation to recent years. Across the board, business officers say their institution is in better shape now than it was both last year (during the heart of the pandemic) and in 2019, when many state budgets were ailing and enrollments had been slumping at many colleges and universities.

What explains the business officers' renewed confidence? Of the roughly three-quarters of business officers who said their institution was in better shape this year than last year, a full 84 percent attributed the difference to the American Rescue Plan (and presumably the other federal recovery funds that Congress has allocated since last summer). Majorities also credited the fact that they quickly cut their budgets (66 percent), used existing infrastructure to support the switch to remote learning during the pandemic (55 percent) and maintained steady enrollment (53 percent).

The minority of business officers who said they were in worse shape now than a year ago also cited one main reason: not maintaining steady enrollment. Ninety-two percent of them cited declining enrollment as a reason their institution was struggling now, 60 points more than cited any other reason (next was insufficient funds from the federal rescue plan).

Higher education finance analysts said the business officers were understandably buoyed by the unprecedented flow of federal dollars to their institutions and their students this year. But beyond the tangible reasons cited in their survey responses, the external analysts striving to make sense of the CBOs' heightened confidence often turned to psychological reasons for that bullishness. That's because most of them struggled to find sound reasons for the upbeat view.

"They seem overconfident for the wrong reasons," said Paul N. Friga, clinical associate professor of strategy at the University of North Carolina at Chapel Hill's Kenan-Flagler Business School. Human beings are "overconfident by nature," and they may be especially inclined to look on the bright side having just come through such a difficult period, said Friga, who leads the public higher education transformation project for the Association of Governing Boards of Universities and Colleges.

Byington recalled that pre-pandemic, many colleges and universities were struggling with flat or declining enrollments, growing public doubts about higher education affordability and the value of degrees, and declines in state support. Now, "we are riding the sugar high of federal relief funds but that has done nothing to change the underlying dynamics," she said via email. "I would agree given the tremendous uncertainty we were all facing in the spring and summer of 2020 and the timing of the arrival of the federal funds in the spring of 2021 that many of our institutions' financial statements looked better for 2021 than we expected and better than they did the year before. But I am surprised at the percentage of respondents who see their financial condition as being better than in 2019."

Some business officers seem to recognize the relative good fortune they're experiencing at the moment. When asked to look ahead to next year, and the shape they might be in then compared to now, college financial officials are almost evenly divided: 40 percent agree (11 percent strongly) that they're in better financial shape now than they will be a year from now, while 43 percent disagree (9 percent strongly).

The Impact of and Response to COVID-19

Answers to other questions in the Inside Higher Ed survey only complicate one's view of how campus business leaders assess their institutions as they are beginning to emerge -- Delta variant and regional vaccination rates permitting -- from the grip of the pandemic.

Business officers are far likelier (46 percent) to say that the pandemic's financial impact on their institution was better than they expected than that it was worse (21 percent). A third said it was about as expected. Two-thirds estimated that they had incurred less than $5 million in unanticipated budget expenses because of COVID-19, while 17 percent said the impact was $10 million or more.

Many see the pandemic and ensuing recession as having significantly influenced how leaders view the institution, though. When given a range of choices about how their college or university would continue responding to the upheaval wrought by the last year and a half, a plurality, 39 percent, said they would seek to "transform" the institution, using the period to make "difficult but transformative changes in its core structure and operations to better position itself for long-term sustainability."

Nearly a third, 31 percent, said they envisioned "rid[ing] out the current difficulties and return[ing] more or less to normal operations within 12-18 months." Smaller proportions said they would "reset for growth" (25 percent) and "shrink the institution" (5 percent).

In last year's survey of business officers, conducted in June 2020, 47 percent said they would strive to transform the institution (eight percentage points higher than say that now), and 26 percent envisioned a return to normal (fewer than say that now). And when Inside Higher Ed and Hanover surveyed college presidents a few months ago, in March, 44 percent of them selected the transformation option, and just 20 percent sought to return to normal. (For what it's worth, the presidents were even more optimistic about their institutions' financial health, with 79 percent agreeing that their institution was financially sustainable over a decade.)

Answers to a set of other questions about institutional change suggest that most business officers recognize that the pandemic has altered their institutions' agendas.

Seventy percent agree that the pandemic-driven shifts to remote learning and remote work "created an opportunity for my institution to make other institutional changes we have been wanting to make anyway."

And overwhelming majorities agreed that the pandemic forced their colleges and universities to think "out of the box" (96 percent, 57 percent strongly), that they'd been "able to implement some positive, long-lasting institutional changes" (78 percent, 35 percent strongly), and that their institution would "keep some of the COVID-19-related changes" after the pandemic ends (93 percent, 43 percent strongly).

Business leaders also believe the pandemic has improved their institutions' ability to pivot.

Two years ago, 38 percent of CBOs in Inside Higher Ed's 2019 survey said they believed their institution had the "right mindset to respond quickly to needed changes," and 35 percent said their college had the right "tools and processes" to move with agility.

Those percentages rose to 56 and 48 percent last year, during the heart of the pandemic, and in this year's survey 68 percent of respondents said they had the right mind-set and 62 percent the right tools and processes to respond quickly.

What Experts Make of Those Results

Those numbers were something of a Rorschach test for analysts looking at them.

Susan Whealler Johnston, president and CEO of the National Association of College and University Business Officers, said she believed they showed that "many chief business officers have a new imperative." For the 39 percent of respondents aiming for “transformative change,” she said, "collaboration and innovation will have to be the name of the game."

But Johnston expressed concern that nearly a third of CBOs envisioned a "return to normal" in the coming year-plus. "If that’s financially possible, is it a good idea?" she said. "What was learned during the pandemic that we can carry forward?"

Rick Staisloff, founder and senior partner of rpk Group, which consults with colleges on finance and strategy, was also heartened by the plurality of business officers recognizing the need for transformation but said he saw a "mismatch" in the actions that business officers had taken and planned to take.

He was addressing the respondents' answers to questions about what they had done -- and envisioned doing this year -- to deal with the impact of the pandemic.

Presented with a 27-item list of possible budgetary or operational actions that many colleges had taken (or might take this year) in response to the pandemic, at least half of business officers said they had slowed or stopped capital projects (58 percent), eliminated administrative positions (53 percent), or eliminated adjunct faculty positions (51 percent).

Between 40 and 50 percent said they had increased or would increase the number of employees who work remotely (49 percent), revamped their academic calendars to provide more flexibility (46 percent) and eliminated underperforming academic programs (43 percent).

Protecting employees, fewer than a quarter said they had reduced or would reduce health-care benefits (7 percent), the pay of faculty and staff (20 percent), or retirement benefits (24 percent). And fewer than one in five said they would abandon existing plans to build new campus facilities (17 percent), share administrative functions with another institution (12 percent) or combine academic programs with another college or university (9 percent).

"Though they indicate the need for transformation," Staisloff said, "they aren’t supporting the actions that would be needed to achieve transformation, like streamlining academic portfolios and supporting flexible learning and work models."

Friga of North Carolina said it appeared to him that "too many institutions seem to be weathering the storm with short-term changes" rather than using the bridge provided by the influx of federal emergency funds to make longer-term changes that might prepare them for the continuing enrollment declines likely due to demographic shifts.

"Inertia just keeps creeping back in," he said.

It's not that the business officers don't recognize that the federal money is fleeting: 73 percent said the funds from the American Rescue Plan had "significantly, but only temporarily, alleviated my institution's financial difficulties," while the rest said the relief had been more permanent (13 percent) or that the money had provided no significant relief at all (14 percent).

But a majority (60 percent) agreed that the federal recovery funds had "eased the near-term pressure on my institution to make significant, transformative changes in our operations and business model." Business officers from private nonprofit bachelor's-granting colleges were far less likely to agree with that statement than were CBOs from other sectors: just 39 percent of them agreed, while community college respondents were the next lowest at 57 percent.

Is Collaboration in the Cards?

For those, like NACUBO's Johnston, who believe cross-institutional cooperation will be key going forward, the results of the business officers' survey may prove disheartening. As noted above, barely one in 10 campus financial leaders said they would share administrative functions or academic programs with another institution by the end of 2021.

That's despite the fact that more than half of respondents said they believed their institution should share administrative functions (54 percent) or combine academic programs (51 percent) with another institution in the next five years.

Going further -- to merging with another institution -- seems off the table for many chief business officers and colleges. Just 7 percent of respondents report that senior administrators at their institutions had had "serious internal discussions in the last year" about merging with another institution. CBOs at private baccalaureate colleges were twice as likely (14 percent) to say they'd had such discussions.

Only 8 percent of business officers said their institution was either very or somewhat (6 percent) likely to merge into or be acquired by another college or university within five years, again with private four-year colleges being likelier than others to say so (21 percent). Ten percent of CBOs said their institution was likely to acquire another college or university in the next five years -- with private doctoral/master's institutions (15 percent) and public doctoral universities (13 percent) most likely.

Fifteen percent of business officers -- about one in five among public doctoral and all private nonprofit institutions -- said their college or university should merge within the next five years. About the same proportion said they believed the pandemic and recession had made their institution more likely to merge than it was before, while 11 percent said it had made them less so.

Friga and Staisloff both said they were unsurprised that business officers were so disinclined to seek a merger. "Mergers, while they may make a lot of sense in some cases, are incredibly hard to pull off, because nobody wants to relinquish local control," said Friga. But institutions should be looking for ways to share services or programs with others, either through existing systems or new or expanded cross-institutional structures.

Data to Drive Decision Making

As recently as a few years ago, the proportion of business officers who said they had sufficient data to inform decisions around the performance of campus departments and services hovered in the 40s.

Those proportions have risen in the last few years, and in this year's survey, nearly two-thirds of CBOs agreed they have the information they need to make informed decisions about the performance of administrative technology (66 percent), individual faculty members (64 percent), academic technology (64 percent) and which academic programs to eliminate or enhance (63 percent). But in no case did even a quarter of finance officials strongly agree.

Chief business officers are divided, though, on whether a "lack of adequate data and analytic capacity is a significant obstacle to a sustainable financial future for my institution": 44 percent agreed, and 40 percent disagreed.

Staisloff called those answers "a bit scary," adding, "High percentages of senior leaders indicate that they do not have the data they need to inform their decision making. The move to a data-informed culture will be essential if higher education is going to achieve a sustainable future."

Other Findings

The Inside Higher Ed survey explored several other issues; highlights are below.

The Biden administration. Public colleges and universities are much more upbeat than their private nonprofit counterparts about the impact the new leadership in Washington is likely to have on their institutions. More than two-thirds of public college business officers predict that the new administration will have a significantly (20 percent) or somewhat (49 percent) positive effect on their institution, compared to well under half (6 percent and 39 percent, respectively) for private nonprofit institutions.

Community college CBOs are especially enthusiastic, with 81 percent anticipating a positive impact.

Those numbers reflect both the policy proposals (free community college, doubling the Pell Grant) and the very strong rhetoric from President Biden (and First Lady Jill Biden, a community college instructor and champion). Private colleges also tend to oppose the tuition-free college plans that Biden and some of his Democratic congressional allies favor, which they believe will unfairly put a thumb on the scale for public institutions in the competition for students.

Faculty understanding of finances. Inside Higher Ed asks business officers each year whether different campus constituents "are aware of and understand the financial challenges confronting my institution." Each year, large majorities of CBOs say that senior administrators (most of all) and trustees do -- and that faculty members don't. In 2019, for instance, 90 percent of CBOs agreed (57 percent strongly) that their senior administrative peers grasped the financial context, and 78 percent said the same (35 percent strongly) about trustees. The faculty? Not so much, with only 32 percent agreeing, 5 percent strongly.

What a difference a pandemic makes. Sure, business officials still credit administrators and trustees with much more understanding, at 90 and 84 percent, respectively (more than 50 percent strongly for each).

But a full half of CBOs now say faculty members on their campuses "get it," with 36 percent disagreeing (only 8 percent strongly).

That suggests both that the pandemic and the recession have forced college financial officers to put more focus on communicating about their institutions' financial situations, and that faculty members are paying more attention and, as they do, gaining appreciation for the difficult decisions their colleges face.

Using campus spaces. As noted above, minorities of colleges appear to be seriously considering reducing their physical footprints. Only 17 percent say they have abandoned or expect to abandon plans to build new campus facilities, and about half say they are increasing the number of employees who work remotely.

Almost three in five CBOs say they will reverse decisions they made during the pandemic to restructure their classroom and dining spaces to allow for physical distancing. That suggests that some, at least, will return to large lecture halls to deliver in-person courses, which some learning experts hoped might be a thing of the past.

Endowment use. About four-fifths of business officers in the survey said their institution was at least partially dependent on its endowment to fund campus operations, and of those, about one in 10 said they had taken funds from their endowments over and above the normal spending policies in the last 12 months.

About 12 percent said they expected to have to make a similar drawdown or loan in the next 12 months, with another 3 percent saying they might.

Most business officers, 84 percent, said they expected to keep their annual payout rate flat in the coming year.

Business continuity. If the pandemic taught college business officers anything, it may be whether -- and how effectively -- they can keep doing what they do in an emergency. Nearly four in five business officers said their institution had "sufficient procedures in place" to ensure they could continue to operate in a crisis. But only 30 percent agreed strongly.

Given that a pandemic isn't the only crisis that can force colleges to shut their physical campuses -- one need only look to the West's forest fires right now -- that number may rise.