You have /5 articles left.

Sign up for a free account or log in.

A St. John's College classroom.

Courtesy of St. John's College

St. John’s College leaders took a counterintuitive but calculated risk three years ago when they decided to slash the cost of tuition and turn to donors to help replace the lost revenue. Some observers considered the move reckless; others dismissed it as a public relations stunt. But today, St. John’s is one step closer to meeting the $300 million fundraising goal it set in 2018.

The college announced earlier this month that it had banked another $50 million from donors and secured a $50 million matching grant from the Winiarski Family Foundation. Since launching the five-year fundraising campaign in 2018, the private liberal arts college has raised $245.3 million.

“We’re just way ahead of schedule,” said Mark Roosevelt, president of St. John's College in Santa Fe and collegewide president for the institution, which also operates a campus in Annapolis, Md.

The fundraising campaign is an essential piece of the college’s tuition reset plan. When the college’s administrators announced in 2018 that tuition was being slashed by $17,000, lowering the price to attend from $52,000 to $35,000, they said they would make up for lost tuition revenue by raising $300 million over the course of five years.

The tuition reset got the attention of students and parents who were intrigued by the new transparent sticker price. It also drew skepticism and optimism from higher education experts who wondered if the college’s new revenue model would be sustainable.

So far, the gamble has paid off. Enrollment, donations and applications from prospective students have all risen since 2018.

The fundraising campaign will continue for another two years, during which the college will need to raise another $55 million. Roosevelt said he’s confident the college will hit the $300 million mark.

“We feel that people really have stepped up,” he said. “For a college of our size, $300 million is a very, very large goal. It’s clear to me now that we will meet that goal.”

Though St. John’s leaders consider the tuition reset a success, experts doubt that many other private institutions will follow suit right away. The pandemic left many colleges with depressed enrollments and uncertain finances. Quite a few institutions are waiting for more proof that a tuition reset actually works, said Justin Draeger, president and CEO of the National Association of Student Financial Aid Administrators.

“I had a lot of conversations with colleges about it over the last several years, but very few have jumped in with both feet and actually pulled the trigger,” he said.

A Boon for Enrollment

St. John’s admissions officers waded through 1,472 applications this spring -- more than the college has ever received, said Ben Baum, vice president for enrollment. The competitive college accepted 893 students, and so far, 297 new students have committed to attend the two campuses in the fall.

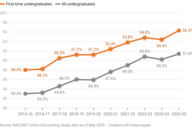

The increased applications at St. John’s are a hopeful sign that the college may be recovering quickly from the economic blows of the pandemic. Like many colleges and universities across the country, enrollment tumbled at St. John’s during the pandemic. Undergraduate head count fell to 677 during the 2020-21 academic year, from 828 students the year prior. Enrollment declined across the board nationally by 2.5 percent and 3.5 percent during the fall 2020 and spring 2021 semesters, respectively. Enrollment experts are uncertain when and if enrollment levels will return to pre-pandemic levels.

“The good news is that [students] are coming back,” Roosevelt said. “In fact, both campuses will have one of the largest freshman classes ever next year.”

Between 2018 and 2021, the college’s applicant pool increased by 9 percent. The college’s yield -- the percentage of admitted students who choose to attend the institution -- also increased by 3 percent in that same time frame.

“Ignoring the pandemic year, what I find remarkable about these yield numbers is how they held steady and then, this year, increased,” Baum said. “Usually, as an applicant pool grows, yield will drop.”

The tuition reset has likely driven the uptick in applications, Baum said. He’s had many more conversations with prospective students and their families about the cost of college in recent years.

“For middle-class students from middle-class families -- for whom $50,000 was an absurdly large amount of money to consider spending on college tuition -- $35,000 puts college more in range,” Baum said.

One reason college leaders often hesitate to reset tuition is fear that the public could interpret the reset to mean that the education is less valuable, Draeger said.

“As warped as I find it, there is a reputational risk that a school runs if they lower their tuition too much, because in the minds of the students and families that attend there -- they are wanting to attend a high-priced, selective institution that then gives them a lot of scholarships,” he said.

Angel B. Pérez, CEO of the National Association for College Admission Counseling, said he’s seen this scenario play out for some colleges and universities that have attempted tuition resets.

“One of the things that I think some schools in the past have discovered is that when they went out with a big announcement, sometimes it wasn’t received in the way that they intended,” he said. “So sometimes, what they didn’t realize is by cutting your tuition, you might be sending a message of ‘something could potentially be wrong with our financial picture.’”

St. John’s has received almost entirely positive feedback, Baum said.

“Many people warned us against doing a tuition reset, because of the possibility that people would have a negative reaction to a lowering of price,” Baum said. “In our experience, though, people haven’t responded that way.”

When St. John’s first announced its tuition reset plan, Roosevelt heard from dozens of college and university leaders who were considering a similar move at their institutions. The pandemic has slowed those requests somewhat, but he still speaks regularly to other presidents and higher ed leaders about tuition reductions.

“I’m cautiously optimistic that maybe we’re at the very beginning of a trend,” Draeger said. “But the cautious side of me says that we’re going to be entering into a period without federal stimulus, with significant enrollment pressures, and that may require schools to continue to be exploring sophisticated financial models.”

Despite the difficulties of the pandemic, St. John’s has no plans to raise tuition anytime soon.

“If you asked me if we had to do it over again, would we do it again? We definitely would,” Roosevelt said.