You have /5 articles left.

Sign up for a free account or log in.

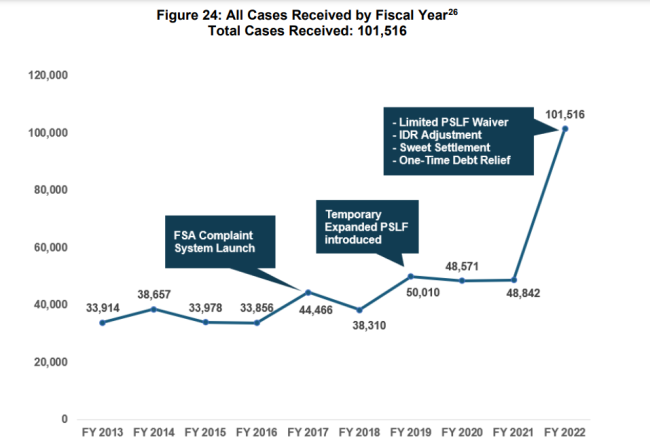

The ombudsman’s office, under new leadership, worked to improve visibility of the online complaint tool and saw an increase in complaints.

Federal Student Aid Fiscal Year 2022 Annual Report

The federal student aid system needs “robust interventions” in order to break the cycle of inequity in higher education finance, the ombudsman for the agency that runs the system concluded in its annual report.

“At each stage of the student aid lifecycle, the higher education finance model disproportionately fails families of color,” the ombudsman’s report says. “Collectively, these failures perpetuate disparities in student and borrower outcomes and may ultimately widen the racial wealth gap. If policymakers wish to restore the promise of higher education and the pathway to the middle class for all, they should examine the student loan safety net through an equity lens and consider expanding existing programs to ensure more equitable outcomes for student loan borrowers.”

The ombudsman’s annual report is a change in tone from previous iterations, experts said, but one that reflects the administration’s recent focus on shoring up the student loan safety net by overhauling debt-relief programs and offering student loan forgiveness for eligible borrowers.

The ombudsman’s office fielded nearly 90,000 complaints in fiscal 2022—more than double the previous year.

Bonnie Latreille, the FSA ombudsman and co-founder of the Student Borrower Protection Center, took over the ombudsman’s office in July 2021. The ombudsman’s office is charged with responding to consumer complaints and identifying areas of improvements in the student loan system. The office worked to improve visibility of the online complaint tool and held listening sessions with borrowers to hear more about the student loan system.

The ombudsman’s report was part of Federal Student Aid’s annual report, which includes a range of information about the agency and provides a window into how it’s doing. The Federal Student Aid office touted the rollout of the student loan forgiveness application, efforts to hold colleges and universities accountable for misconduct, and progress toward fixing “longstanding flaws in loan forgiveness programs.”

The office didn’t meet nine of 38 its performance metrics, including ones on employee morale, customer satisfaction and cybersecurity.

“There’s plenty for us to be worried about from this report,” said Justin Draeger, president of the National Association of Student Financial Aid Administrators. “We’re heading into the highest stakes ever for students and borrowers.”

Student loan payments, which have been paused since March 2020, could resume this year after the Supreme Court rules on whether the Biden administration’s plan to forgive up to $20,000 in federal student loans for eligible Americans is legal.

Additionally, several new regulations for debt-relief programs will go into effect July 1. The department also is planning to adjust borrowers’ accounts to more accurately track their repayment progress. In October, the department is supposed to launch a new version of the Free Application for Federal Student Aid, though some experts are concerned the agency won’t meet that goal.

“There are more challenges ahead,” Draeger said. “If you were stressed already, this report didn’t help.”

Draeger said that FSA’s annual report shows the need for reform at the agency, which is one of the few performance-based organizations in the federal government. The performance-based organizations were created in part to give agencies private-sector flexibility. The agency is managed by a chief operating officer but doesn’t have a Board of Directors like other performance-based organizations.

“This report points to the fact that FSA governance needs to be revisited by Congress,” he said.

Complaints and Policy Recommendations

Mike Pierce, executive director of the Student Borrower Protection Center, said the ombudsman’s report did a good job of highlighting the pain points in student loan policy and putting a face on the issues.

“The previous [ombudsman] reports have been technical and dry and didn’t do a good job of lifting up borrowers’ voices,” he said. “The department is finally centering student loan borrowers in management of student aid.”

Latreille’s report recommended stricter requirements for college-sponsored accounts, changes the bankruptcy rules for student loans and a broader overhaul of Parent PLUS loans.

Those are areas “in which students, borrowers, and families of color may be disproportionately burdened by their student loan debt during the financial aid lifecycle,” the report says.

Advocates have said for years that Parent PLUS loans disproportionately burden low-income families of color. The loans are costly and not subject to many of the new, more generous debt-relief programs, including the proposed income-driven repayment program. Up until late last year, Parent PLUS loans weren’t included in the department’s planned account adjustment.

“While Parent PLUS loans may have been originally intended as a way for high-asset, low-liquidity families to pay for school, research shows that the reality of who is taking out these loans is quite different,” the ombudsman wrote. “In fact, the high costs of Parent PLUS loans are disproportionately borne by families of color, who have less wealth to pull from to pay for school and therefore rely on Parent PLUS loans to bridge the gap between the cost of attendance and other federal aid offerings.”

The ombudsman’s report says the recommendations were informed by the complaints.

About 57 percent of the complaints were about issues with repayment or loans—about 30 percent were about the Public Service Loan Forgiveness and the limited waiver that temporarily changed the terms of the program. Borrowers who are currently incarcerated also reported logistical challenges accessing debt relief programs and getting information from their student loan servicer. The ombudsman recommended that the department consider automation and other strategies to better serve incarcerated borrowers.

Pierce said it’s “extraordinary” that complaints doubled in a year that student loan payments were paused, which he said shows that borrowers are struggling to access the new debt-relief measures and that there’s a lot of work to do toward improving student loan programs.

“Borrowers eligible couldn’t make heads or tails [of] the waiver,” he said. “Lots of folks missed out.”

Borrowers also complained about issues with customer support and institutions. Twenty-three percent of the complaints were about applying for student aid.

“And that’s with an application that’s stable and well tested,” Draeger said.

Draeger and others have publicly expressed concerns about the department’s timeline for FAFSA simplification and the pace of progress thus far.

He said the ombudsman’s call to view the student loan system through an equity lens is a valuable one. But, he said, the focus on the back end of the system was a missed opportunity. He would’ve liked to see more front-end issues that cover borrowers currently taking out loans addressed, such underwriting criteria for Parent PLUS loans or caps on how much someone can borrow.

“Only focusing on the back end leaves aside the high amounts of debt that we put on people of color disproportionately,” he said.