You have /5 articles left.

Sign up for a free account or log in.

The University of Illinois at Chicago was the first institution to extend its commitment deadline after the latest FAFSA delay. A small but growing number of colleges are following suit.

Photo by Martin Hernandez Rosas/University of Illinois at Chicago

A week after the Education Department announced that colleges and universities would not receive student financial aid information until mid-March, institutions are beginning to adjust their own timelines accordingly.

The vast majority of colleges use May 1—traditionally known as National College Decision Day—as the deadline for accepted students to commit. But since financial aid offers aren’t likely to go out until April, thanks to the latest and most disruptive delay in a rollout of the new Free Application for Federal Student Aid riddled with such hiccups, a growing number of institutions has pushed their commitment deadlines to June or suspended them indefinitely. They hope to give students—and their own beleaguered financial aid and admissions offices—some time and flexibility.

Only a handful of colleges have announced extensions so far, but the list kept growing throughout last week and into the weekend. A few hours after the delay was announced Tuesday, the University of Illinois at Chicago became the first institution to push its commitment deadline to June 1; Oregon State University followed close behind on Wednesday.

Several private institutions also pushed their deadlines to June 1, including Monmouth College in Illinois, Kalamazoo College in Michigan and Lewis & Clark College in Oregon. Widener University in Pennsylvania suspended its May 1 commitment deadline but has yet to replace it with a new date.

Some institutions are extending application deadlines as well. The University of New Hampshire, for one, switched to rolling admissions last week; executive director of public relations Tania deLuzuriaga wrote in an email that officials wouldn’t establish a new deadline “until the FAFSA information is more solidified.”

Other colleges are loosening their deadlines for making formal financial aid offers to accepted students. Officials fear that sending offers out before they receive students’ FAFSA information could result in serious inaccuracies—a possibility exacerbated by the new form’s significantly altered student aid calculations.

The last time admission calendars were thrown into waters this murky was in 2020, when the COVID-19 pandemic forced colleges to give students much-needed flexibility.

Oregon State was among the first to change its commitment deadline then, too. Jon Boeckenstedt, OSU’s vice president of enrollment management, said the FAFSA delay feels a lot like the pandemic in its disruptive effects and the anxieties it raises for prospective students. That’s why the university decided fairly quickly that an extension was the best path forward.

“We had two options: we could either stick to our May 1 deadline and deal with thousands of individual requests for flexibility, or we could get out ahead of this and live with the ramifications,” he said.

Those ramifications are already compounding. Admitted-student days and FAFSA nights are being retooled, and planning decisions determined by estimated class size and tuition revenue will likely be made much later than in previous years. Some private colleges could see the delay as an opportunity and send beefed-up institutional financial aid offers earlier in an attempt to lure applicants away from universities operating on a stalled timeline.

But the primary concern of the institutions that have pushed back deadlines is easing the process for students—especially those from underserved communities who rely on FAFSA information to make crucial decisions.

“If ED pulls through and submits the FAFSA info early, by mid-February, say, then we might regret this decision from a planning perspective,” Boeckenstedt said. “But we’re doing this from the standpoint of what’s best for our students, not what’s best for OSU. And we’ll never really regret doing what’s best for students.”

Most institutions are taking a wait-and-see approach. Large public university systems have yet to make their announcements, though they have not written off the possibility. Boeckenstedt predicted that if systems such as the University of California or the University of Arizona pushed back their deadlines, a critical mass would likely follow suit.

Rachel Zaentz, senior media relations officer for the UC system president’s office, wrote in an email to Inside Higher Ed that while the system has “not made any final decision regarding an extension of the May 1 commitment deadline,” officials were aware of the “significant implications” of the FAFSA delay on institutional planning and student decision-making. (This paragraph has been updated to correct the spelling of Rachel Zaentz's name.)

Megan Gilbertson, a spokesperson for the Arizona Board of Regents, said the University of Arizona was “taking into consideration the call to move application and financial aid deadlines because of the FAFSA complications.” The board will consider the question at its Feb. 22 meeting, she added.

Disparate Effects

A coalition of higher education advocacy organizations and professional associations called on colleges last Wednesday to present a united front and collectively suspend the May 1 commitment deadline. But that may not happen, because the FAFSA delay won’t affect all colleges equally.

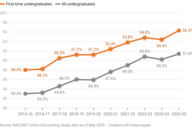

The institutions that have extended their deadlines so far tend to serve more lower-income students; a few are primarily minority-serving institutions. Kiely Fletcher, vice provost for enrollment management at the University of Illinois at Chicago, said the consequences of a delayed financial aid offer are much higher for those students. Last fall’s incoming class at UIC was 40 percent first generation and 56 percent eligible for the Pell Grant, federal aid for low-income families.

“One thing I’ve heard throughout this whole rollout, through all the delays, has been, ‘We’re all in the same boat,’” she said. “But not all institutions will experience the effects of the delay the same way … For our students, the anxiety is much higher.”

Fletcher said UIC hosted its first admitted-students day last Saturday, before the most recent delay announcement, and even then the FAFSA was No. 1 on people’s minds.

“We got to the Q&A portion, and literally the first hand raised was a parent who asked, ‘Will you extend your deadlines?’” she said.

Institutions that are able to offset the impact of the FAFSA delay by putting up institutional funds as collateral—or by using the College Scholarship Service Profile to estimate student aid packages without federal data—are less inclined to push back deadlines prematurely. So are those whose applicants are less reliant on federal and state financial aid.

Furman University, a private liberal arts college in Greenville, S.C., has no plans to formally extend its decision deadline. But Emily Schuck, Furman’s vice president for enrollment management, said the institution will offer “exceptional flexibility” for individual students who need more time before committing. That strategy is feasible at Furman because of the relatively low share of students who qualify for significant federal aid: currently just 13.5 percent of the student body is Pell eligible.

Furman was also prepared for this moment. Last summer, when ED first pushed the FAFSA launch deadline to Dec. 31, the university signed up for the CSS Profile for the first time. Schuck said they’d hoped to need it only for early-decision and early-action applicants but are now grateful they can use it to send students financial aid estimates independent of FAFSA data.

“We’re lucky to be able to use the Profile. Most colleges are really scrambling right now,” she said. “But this is a problem for higher ed as an entire industry, and we’re trying to solve it together. Even with the Profile, the delay will bring other challenges, like predicting revenue and planning orientation and other services.”

Schuck is also worried that wealthier students will be able to game the system in ways their lower-income peers can’t, by making deposits at multiple institutions, for instance, or securing priority options for things like housing and even class registration.

“While this puts stress on institutions, it’s going to be much harder for students,” she said. “It’s up to us to clear this muddy path for them.”

‘We Need to Move to COVID Measures’

The Department of Education has weathered withering criticism from lawmakers throughout the new FAFSA rollout; last Thursday the Government Accountability Office opened a probe into the process at the behest of several Republican senators. After last week’s delay, enrollment and financial aid officials are starting to demand accountability, too.

Boeckenstedt said he’s most worried about two things: whether the department meets its loose mid-March timeline—which he said it has “given us no reason to be confident about”—and how quickly colleges can process the data into accurate financial aid packages, which may depend on institutional resources and software capabilities.

“It’s not about when the [Institutional Student Information Records] start coming in; it’s about when we get a critical mass,” he said. “Knowing that the tentative date to start sending batches—not all the information, just batches—is mid-March doesn’t do much to reassure.”

He said the federal government could ease colleges’ frantic contingency planning by committing to a hard March 15 deadline on submitting all ISIR data to colleges.

Fletcher said she hopes ED goes beyond that and shows some understanding of the difficult spot the delays have put colleges in—and that it acts with urgency.

In December, lawmakers called on the ED to loosen family income verification requirements this application cycle to help parents navigate the new, much-delayed FAFSA. Fletcher said that in light of the latest delay, the department should waive verification altogether, as it did in 2020.

“What we really need to do is move to COVID measures,” she said. “UIC families have to go through verification more than most, because low-income people are more likely to have nontraditional income streams … I don’t want to paint the department as the bad guys, but at this point they need to move quickly to alleviate these stressors for families, just like we did.”