You have /5 articles left.

Sign up for a free account or log in.

For institutions with a national reputation, application growth was highly variable after a reset.

Photo illustration by Justin Morrison/Inside Higher Ed | Getty Images

Dozens of colleges and universities have dropped their sticker prices for tuition over the past decade, even as research has shown that tuition resets have a nominal influence on long-term enrollment increases. But a report released this week shows that regional colleges were more likely than nationally known institutions to see increases in applications after a reset.

“Students are more focused now on return on investment than they used to be,” said Devon McGee, a principal at Kennedy & Company, the higher education consulting firm that produced the report. Compared to bigger-name colleges, “A lot of these regional institutions are great liberal arts–type institutions, but they are less associated—fairly or unfairly—with preparing students for a job.”

Researchers used Integrated Postsecondary Education Data System data to identify 70 institutions that decreased their published in- and out-of-state tuition prices by 5 percent or more between 2012 and 2019. They then separated them “by brand reach and brand awareness,” putting each college into one of two categories: nationally known universities with doctoral and professional programs ranked between 15 and 17 on the Carnegie Classification scale and regional universities ranked between 18 and 20 on the scale.

“We tried to isolate the impact of the reset itself,” McGee said. “It’s good to know that applications have increased,” but if, for example, “a college’s applications are going up 10 percent [after a reset], they’d be happy until they found out everyone else’s applications increased by 10 percent as well.”

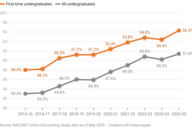

All of the institutions researchers analyzed had application increases after a reset, according to the report. But increases alone don’t indicate how much of that growth can be attributed to a tuition reset or other factors. That’s especially true because the 2010s were a period of application growth for most institutions.

“During the 2010s we actually saw expanding numbers of high school graduates and college-going rates—a greater pool of students to pull from,” McGee said. Another factor in application growth the report accounted for is student outreach by colleges that purchased lists of contact information for students in the region.

“It increases significantly the number of applications they generate,” McGee said, “but it will have offsetting effects on the yield because they’re buying those and not necessarily creating an organic demand.”

Other factors that can contribute to application growth outside of a reset include the rise of relaxed requirements for entrance exams, colleges becoming test optional and students applying to a higher average number of schools.

After creating a regional baseline to account for those variables, the research firm found that regional institutions were more likely to have an influx of applications after a reset when compared to nationally known institutions.

Application growth at the 21 nationally known colleges the report analyzed was highly variable after a reset: some institutions experienced increases higher than the baseline while some saw a decrease. And in the years following a reset, there was a “weak positive correlation” between a reset and an increase in the number of applications, “suggesting that the strategy is not highly impactful or consistently beneficial for them.”

On the other hand, the 49 lesser known institutions the report analyzed showed a “demonstrably positive upward applications trend” in the five-year period after reset.

It’s evidence, McGee said, that some “students are now starting to understand that the sticker price they see is not necessarily indicative of the quality” of the college.

The report didn’t investigate how the application influx translated to increased enrollment, however.

“There’s a little bit too much noise from our perspective to evaluate the effects on enrollment versus applications,” McGee said. “Of course the goal of tuition reset is to increase enrollment. However, the steps in between receiving an application and yielding a student are highly variable in terms of sophistication, quality, technology and manpower at these institutions.”

Branding Power

This divide between how resets influenced application growth at nationally known colleges compared to regional ones comes down in part to branding. At the bigger-name institutions, “the sticker price accounts for less of a student’s decision to apply,” McGee said. “It’s brand reach, it’s sports, student life, opportunities for a bigger campus feel.”

The regional institutions “rely much more on their price point as a way of generating applications,” McGee said. “The price point is a marketing tool. If the price point is very high, students are less willing to say that a high price means a high-quality education … If students aren’t actually going to pay the sticker price, there’s little incentive to show a much higher price, because all it’s going to do is scare students away.”

And according to the report—which analyzed colleges that did resets ranging from 5 percent to 75 percent—a larger reset doesn’t necessarily equate to bigger application growth.

“That was somewhat surprising,” McGee said. He hypothesized that’s because “institutions that are priced that high don’t have to drop their prices by 50 percent. They just have to drop it below their peer set to look more affordable.”

But that doesn’t mean all the regional institutions had application gains after a reset: 20 of those colleges saw fewer applications in the year after the reset.

“To be effective, a tuition reset strategy must be combined with a thoughtful and well-timed marketing strategy to publicize the new sticker price,” the report said. “Additionally, strategic alterations to the scholarship discounting structures must be in place to understand and mitigate tuition revenue risk.”

Implementation Is Key

Lucie Lapovsky, an economist and higher education consultant, said marketing is key to making a tuition reset work as a tool for increasing applications and enrollment.

“One of the questions you have to ask is how did they implement a reset?” she said. For instance, announcing a reset at the beginning of the school year (one year before the reset goes into effect) is more effective than announcing it in January.

“Most of the class would have been recruited by then,” Lapovsky said, “so it would be unreasonable to expect a significant impact on applications.”

Lapovsky said she has also worked with colleges that do a reset but don’t advertise it, which is another missed opportunity.

“Most schools that do a reset think about who they are and why students would want to come. There’s increased clarity of brand which they also market with a lower price,” she said. “The schools who do it well don’t just say, ‘Come to us, we’ve lowered our price.’”

According to Lapovsky’s own research, among a slate of institutions that reset tuition between 2013 to 2018, 82 percent experienced an increase in applications.

One discrepancy Lapovsky noticed in Kennedy & Company’s report was that some of the colleges (mostly the nationally known ones) on the list haven’t actually done an official reset. Tuition data reported to IPEDS may appear like a reset for some institutions, “when really it was just a redefinition of the way the data was done.” (McGee confirmed that the report was based solely on IPEDS data.)

Nonetheless, Lapovsky said, the premise of report is valuable because it supports other research that says smaller, lesser known colleges are more likely to benefit from resets.

“Schools with low acceptance rates and high yield—like Harvard, Yale, Amherst and Swarthmore—will be able to fill themselves up at their full price for years to come many times over,” Lapovsky said. “It’s the schools that are really struggling to get the students where I think there’s probably a lot more price sensitivity.”

Daniel Corral, an assistant professor of higher education at the University of Toronto, said this new report on how resets influence application growth is another step toward filling in the ongoing research about the subject.

“Applications are just one piece of the puzzle,” he said. “The most important piece is enrollment and making sure those applications convert to butts in seats.”

Jim Hundrieser, vice president for consulting and business development at the National Association of College and University Business Officers, said the report’s conclusions offer “a worthwhile idea” for regional colleges—many of them struggling with enrollment—to explore.

“If there’s anything that would activate interest in prospective students that could be reaffirmed through the admissions process,” Hundrieser said, “I certainly think that’s something worthy of strong consideration.”