You have /5 articles left.

Sign up for a free account or log in.

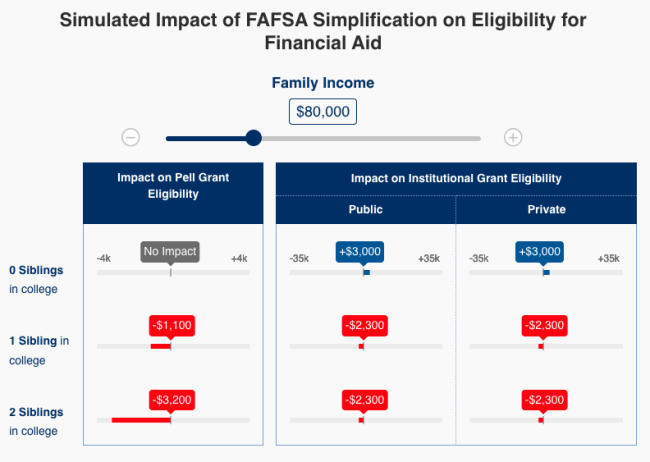

A new interactive tool from researchers with Brookings shows the new federal financial aid formula will affect students’ eligibility for Pell Grants and institutional aid.

Brookings Institution

The upcoming overhaul to the Free Application for Federal Student Aid and the underlying formula that determines how aid is dispersed will mean thousands more students will be eligible for the Pell Grant and higher-value Pell Grants than under the current formula, a new Brookings report finds.

All the changes in the 2020 FAFSA Simplification Act could mean that Pell Grant eligibility increases by about $2.6 billion from the current formula. However, students with siblings in college likely will lose billions in institutional aid, according to the report, which analyzed how FAFSA simplification will affect students’ eligibility for financial aid.

“Students don’t know this at all, and I think it’s important to convey to them that their prices are likely to change,” said Phil Levine, a professor of economics at Wellesley College and lead author of the report.

Levine, a nonresident fellow with Brookings’ Center on Children and Family Studies, worked with Jill Desjean, a senior policy analyst with the National Association of Student Financial Aid Administrators, to calculate the impact of the simplification policy changes. NASFAA released a modeling tool last year to help institutions gauge how the new federal formula would affect them.

The Education Department is set to release a new version of the FAFSA this December as part of a broader overhaul of the federal financial aid system that includes changing how eligibility for the Pell Grant is determined, among other policy shifts.

Desjean said the Brookings report is a “first stab at trying to get the word out that things are changing for next year,” but it’s still hard to predict exactly how students and families will be affected.

However, students who receive the maximum Pell Grant award won’t see any changes in their aid eligibility, she said.

“Don’t worry, nothing’s going to change to hurt you,” she said.

Levine said that much of the discussion about FAFSA simplification has been focused on the technical changes and process rather than how it will change what students have to pay for college.

“I was actually surprised when I first started focusing on the details of FAFSA simplification, how much of a potential impact it would have on how much students would have to pay to go to college,” he said, adding that he supports the idea of making the application easier to use. “When I looked at the details of the changes that were actually being made, I realized, this is a big deal. This is not just about making the form easier. It’s about changing prices.”

Levine said he wanted to help users better understand what FAFSA simplification means for them. The report includes an interactive tool based on NASFAA’s tool and an analysis of national data that families can use to determine how their aid eligibility will change under the new system.

“There are clear winners and losers that will result from FAFSA simplification,” the report states.

Some of the winners include Pell Grant recipients. The amount of aid that students would be eligible for would increase by $1.6 billion. Levine estimates that about 174,000 students will become eligible for the grant.

The data analysis is based on dependent students enrolled full-time at four-year institutions, which does not include all those who would benefit.

“Eligibility for institutional grant aid will also increase substantially,” the report states. “The 2 million continuously eligible students would be eligible for up to $3.4 billion more institutional aid and another 159,000 students will become eligible for $242 million in aid. The potential total benefit for this group is $3.7 billion.”

The primary losers, per the report, are students who have siblings in college. In the current federal formula, families with more than one child in college see a discount in what they are expected to pay out of pocket. For families with two children in college, the expected contribution is cut in half for each child. That discount is going away in the new formula, which will have a “sizeable impact” on eligibility, per the report.

“For the almost 900,000 students with one sibling in college who will maintain their eligibility, they stand to lose almost $3,000 each in institutional grant aid, totaling $2.5 billion,” the report says. “Another 157,000 will lose all eligibility that could have provided up to $7,900 in aid each, totaling $1.2 billion.”

Levine said the aid eligibility changes mean that institutions will have to make key decisions about how they’ll award aid, such as whether to make up for the aid that students with siblings are set to lose, and how to manage the trade-offs that come with the new federal aid system.

“Students with siblings in college will generate all the cost savings,” the report states. “They stand to lose thousands of dollars in financial aid. For those students who are already on campus, they will be shocked by the large increase in their net price, should these changes be implemented.”