You have /5 articles left.

Sign up for a free account or log in.

Advocates want President Biden to be bolder in his plans for student loan forgiveness.

Brendan Smialowski/AFP via Getty Images

More than 43 million student loan borrowers rang in 2023 full of hope that their debt balances would drop by either $10,000 or $20,000 under President Joe Biden’s forgiveness plan. But that promised relief never materialized after the Supreme Court struck down Biden’s plan in June, leaving borrowers in limbo until student loan payments resumed in the fall following a three-year pandemic pause.

As the calendar gets ready to flip to 2024, borrowers along with student loan and consumer protection advocates are growing frustrated with the Biden administration, which is now eyeing other ways to provide relief. However, those other options are far more narrow than the initial, broad-based forgiveness plan.

The latest proposals include wiping out the balances for those who have been in repayment for more than 20 years and forgiving $20,000 for borrowers who owe more than they initially borrowed and who meet other eligibility requirements. Advocates say the administration’s plan doesn’t go far enough to help struggling borrowers.

To carry out those proposals, the Education Department is working its way through a lengthy rule-making process to issue new regulations that would provide relief under the Higher Education Act of 1965—an approach officials are hoping will pass muster if court challenges come. That process means convening a committee of negotiators to weigh in on its regulatory text. The committee first met in October, but it appeared to wrap up its work last week with little agreement about a path forward. If the negotiators reach consensus, the administration has to use its proposal; if not, the department can move forward with its plans.

Negotiators and outside advocates did not want the agency to limit how much relief would be given. A cap, they argued, would constrain the department’s ability to better support borrowers.

Over all, the three months of talks, which left advocates irked, revealed the difficulties involved with providing relief and picking winners and losers. But the pressure on Biden, who has made debt relief a priority, to find a way forward won’t soon abate, especially with the presidential election next year.

“We need some assurance that they are still in this fight,” said Satra D. Taylor, director of higher education and workforce policy and advocacy for Young Invincibles, an advocacy group focused on amplifying the voices of young adults. “The fight is not over. I’m hopeful that the Department of Education is ready for 2024.”

‘Go Down Fighting’

For Dalié Jiménez, a law professor at the University of California, Irvine, and director of its Student Loan Law Initiative, 2023 has been a good year in the world of student loans—in some ways.

Despite being blocked from implementing the broad-based cancellation plan, the Education Department worked to implement a series of reforms to the student loan system, repayment plans and relief programs such as Public Service Loan Forgiveness. So far, the administration has canceled nearly $132 billion in loans for more than 3.6 million Americans.

“They’ve erased more debt than has ever been erased,” Jiménez said. “We have a lot more to do.”

She had high hopes for the administration’s backup plan for relief, announced shortly after the Supreme Court struck down its first approach in June. But she has been disappointed so far. The proposals cover people who owe more than they initially borrowed, who’ve been in repayment for 20 to 25 years already, who are eligible for relief under more targeted forgiveness or repayment options, and who attended programs or institutions that failed to deliver sufficient financial value.

Jiménez and others want the department to include borrowers experiencing financial hardship who wouldn’t benefit from the other parts of the proposal. Department officials have said they also want to add a hardship provision, but they have yet to make a specific proposal.

The department hasn’t released data outlining how many borrowers would be affected by its latest plan, though Jiménez and other experts said it would mean narrow relief. A hardship plan could include more people, she said. Based on her team’s research, she recommended that the committee cancel all student debt for borrowers with household incomes below $71,000—that group that experiences greater hardship when looking at six measures, including credit score and adverse legal proceedings such as bankruptcy.

“I wish they were bolder,” she said of the administration. “There is going to be a lawsuit regardless … Go down fighting.”

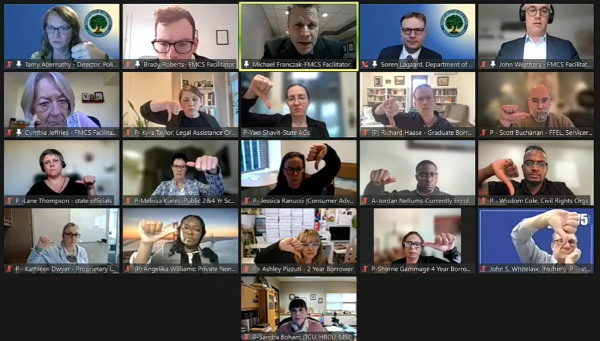

In its December meeting, the advisory committee voted down the Education Department’s proposal that would waive up to $20,000 in loans for borrowers whose current balance exceeds what they initially borrowed. Several committee members took issue with the cap and didn’t want to limit the department’s ability to provide relief.

Katherine Knott/Inside Higher Ed

The committee ultimately failed to reach consensus on many of the key proposals at last week’s meeting. On the provisions where no consensus was reached, the department is free to propose whatever it likes.

New regulations pertaining to student debt relief are expected in May. Members of the public can then comment on the rule. The department will have to review and respond to those comments before issuing the final regulations. At that point, the plan could be challenged in court, extending the timeline until borrowers could see relief.

While liberals aren’t happy, conservatives have continued to hammer the administration over its revised debt-relief effort, questioning the department’s legal authority to carry out the plan. Last week’s round of talks kicked off with one negotiator—Missouri solicitor general Josh Divine—withdrawing from the process entirely after the committee voted down his proposal to add a representative of individuals who never took out student loans.

Despite general support for student loan forgiveness and agreement on the categories of borrowers that would benefit, most of the negotiating committee ultimately disagreed with the department on how exactly to provide debt relief. Several committee members took issue with the department’s refusal to release a specific proposal on hardship, and the final meeting ended on a sour note as negotiators pushed for an additional session specifically to discuss the issue. The department did leave the door open to a possible fourth session but wouldn’t commit to one.

How to Make a Policy

As part of negotiated rule making, the Education Department must:

Put out a public notice about intent to form a committee and hold a public hearingHold a public hearingPublish notice inviting nominations for negotiatorsPick the negotiatorsHold negotiated rule-making sessions- Write the proposed regulations

- Publish those regulations for public comment, which lasts at least 30 days (expected in May 2024)

- Read and respond to the comments; revise the regulations as needed

- Publish the final rule. Rules need to be published by Nov. 1 in order to take effect July 1 of the following year, but the department can implement rules early.

“We don’t know if any of our concerns would be taken care of through a catchall hardship provision,” John Whitelaw, advocacy director at the Community Legal Aid Society in Delaware, who represents individuals with disabilities on the committee, said at the meeting.

The department sought to nail down during the negotiations how exactly to establish who qualifies for hardship relief but didn’t end up making a specific regulatory proposal. Department officials said they were worried about the legality of a hardship category and wanted more information from the committee on the potential legal justifications.

“We are not walking away from [hardship],” said Tamy Abernathy, director of the policy coordination group at the Education Department.

Taylor, with Young Invincibles, said hardship would be the easiest way to target the groups of borrowers who are often overlooked. That includes those who are incarcerated, in default or hold Parent PLUS loans. The department’s decision to not provide an actual proposal on hardship “seemed like a slap in the face,” she said.

A representative from Young Invincibles did serve as a negotiator representing currently enrolled students.

“We’re asking departments to act in good faith,” Taylor said. “We’re really trying to create those rules, but it just seemed like the Department of Education had their own agenda or own idea of how they wanted to proceed and really did not want any input.”

Taylor understands the administration’s hesitation about legal challenges following the Supreme Court decision, but she said that doesn’t mean the department shouldn’t try.

“They have members of the general counsel, so they can inform the language, but to just not try or give up, that’s not advocacy,” she said.

‘Feeling Uncertain’

Preston Cooper, a senior fellow at the Foundation for Research on Equal Opportunity, a market-friendly think tank, said the different proposals could lead to “substantial” amounts of relief for borrowers, even if the plan looks narrower on paper. He added that the more targeted approach could be a recognition that the broad-based strategy isn’t politically or legally viable.

Cooper thinks that fewer borrowers would see their entire balances wiped out under the latest proposals. Biden’s initial plan would’ve zeroed out the balances for about 20 million Americans. Stopping short of wiping out the balances for a large swath of borrowers and targeting the relief at individual groups could help the plan withstand legal scrutiny, he said.

“Some of the plaintiffs and servicers might decide that this isn’t necessarily worth their time” to challenge, he said, “and who knows, you might get judges to agree that because it’s smaller and more targeted, maybe they think it might be legal, after all. I don’t necessarily think that’s going to be the way it goes, but that might be what their theory is.”

Looking back at the year more broadly, Cooper sees 2023 as the start of additional skepticism both from federal courts and Congress about the scope of the Education Department’s authority.

“This could be the beginning of a movement to claw back some of that power from the Department of Education and to recognize that if we think that debt relief was warranted, that’s something that has to be approved by Congress,” he said. “The Department of Education really should not have the power to go it alone.”

Sarah Sattelmeyer, project director of education, opportunity and mobility at New America, a left-leaning think tank that’s been following the negotiations, said that without the hardship proposal, it’s hard to assess what the new plan means for borrowers.

“Any form of cancellation will be important for borrowers it effects,” she said.

Sattelmeyer is looking for more clarity on the agency’s plans in the new year and will be following how borrowers fare as they get back to repaying their loans. The payment restart had a rocky beginning in October, but borrowers are shielded from the worst consequences of defaulting on their loans for the next year. The Education Department released data Friday showing that 60 percent of the 22 million borrowers who had payments due in October made those payments.

She’s also tracking whether the understaffed department has the resources it needs to accomplish the reforms it put into place this year.

“A lot of progress was made in terms of creating new and reforming existing programs to really help borrowers,” she said. “We’re leaving the year feeling uncertain.”