Filter & Sort

Opinion

Extend the Exemption for the Endowment Tax

The pending legislation has fiscal implications for many small colleges and might well be the final nail in the coffin for those struggling to survive, writes David Gerard.

Reversal on Graduate Lending

As Republicans in Congress look to change course on graduate lending policies, some higher education groups warn about limiting access and tougher paths to service-oriented careers.

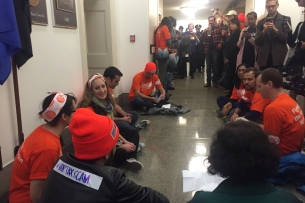

Arrests, Anger, Anxiety as Grad Students Visit Paul Ryan's Office

Key area of concern is House plan to tax tuition waivers, which some have said would make it impossible for them to afford to stay in their programs.

GOP Seeks to Shift Accountability for Colleges

While for-profits get the relief they’ve long clamored for, the GOP’s proposed overhaul of the Higher Education Act would add performance-funding standards for most colleges.

Senate Passes Tax Bill With Major Implications for Higher Ed

Legislation would tax largest private college endowments, create new cost burdens for business unrelated to educational mission and could put new strains on state budgets that fund public universities.

GOP Begins Rewrite of Federal Aid Law

House education committee leaks its ambitious first draft of a reauthorization of the Higher Education Act, with broad changes aimed at both deregulation and more accountability in how federal student aid is distributed and used.

Nationwide Protest Against Tax on Grad Students

At Penn and elsewhere, students organize “grade-ins” to show what they do and how House Republicans’ tax legislation could make it harder for them to make ends meet.

How the Tax Bills Would Hit Higher Ed

On eve of vote on Senate tax reform plan, we compare it to the House version, which would hurt students and families more. Both would hit colleges and universities hard by imposing new taxes and constraining state budgets.

Pagination

Pagination

- 294

- /

- 433