You have /5 articles left.

Sign up for a free account or log in.

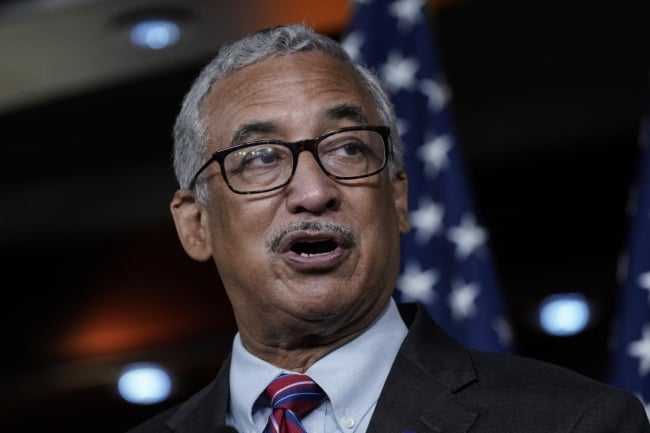

Representative Bobby Scott

Drew Angerer/Getty Images

A years-long push to lessen the incentive for for-profit institutions to recruit veterans as students took a major step toward becoming law with the House’s passage of a $1.9 trillion coronavirus relief package Saturday morning.

Included in the package, which would also send another $40 billion in aid to the nation’s colleges and universities during the pandemic, was a provision tightening the controversial "90-10" rule.

The for-profit industry, however, is expected to try to kill the change when the Senate takes up the relief package this week, warning that the change pushed by Democrats would inadvertently lead to for-profits accepting fewer veterans and members of the military. The proposal did survive one hurdle Monday night when the Senate's parliamentarian ruled that it could stay in the bill, according to groups on both sides of the debate. For-profit industry lobbyists had hoped the parliamentarian would rule that the measure goes beyond what is allowable in the funding bill, as she did in killing the Democratic proposal to raise the federal minimum wage.

Currently, for-profit colleges and universities are required to get at least 10 percent of their revenue from sources other than the federal government. That limits the share of income the institutions can get from students’ federal aid to no more than 90 percent. Those not meeting the rule are barred from being able to receive any of the money the federal government gives out each year through student aid.

The rule was enacted under the theory that for-profits of any quality should be able to get at least 10 percent of their revenue from students willing to pay to attend, or from employers subsidizing the cost of their workers getting training at the institutions.

Letters to the Editor

A reader has submitted

a response to this article.

You can view the letter here,

and find all of our Letters to

the Editor here.

Representative Bobby Scott of Virginia, the Democratic chairman of the House education committee, told reporters on Friday that the rule requires that for-profit institutions “show some semblance of attraction to people.”

However, critics of the for-profits, which have at times been found to defraud prospective students about the kind of education they’d get, have long complained the 90-10 rule has a loophole -- the money service members and veterans use for their education through the GI Bill at for-profits is not counted as federal dollars.

Instead, the GI Bill dollars count toward helping for-profits meet the 10 percent minimum requirement. To advocacy groups like Veterans Education Success, that incentivizes for-profit institutions to aggressively try to get service members and veterans to enroll, and many of them have been defrauded.

Under a provision in the House’s relief package -- pushed by Congressman Mark Takano, a Democrat from California who chairs the House veterans' affairs committee -- GI Bill dollars would begin to be counted as federal money.

However, Career Education Colleges and Universities, the lobbying association for the for-profit industry, is hoping to kill the change in the Senate. The group argues the change would actually hurt veterans and service members seeking an education.

As a result, for-profit colleges would have no choice but to turn away those hoping to use the GI Bill, said Nicholas Kent, senior vice president of policy and research for the for-profit industry association.

“The proposed modifications to the 90-10 rule will undoubtedly deny tens of thousands of veterans and service members the opportunity to use their earned GI Bill and [Department of Defense] education benefits at the private career school of their choice,” Kent said.

A study earlier this month by a group called the Veterans Education Project estimated that the change would mean 87 for-profit institutions, or 5 percent of for-profits participating in the federal student aid program, would fall out of compliance with the rule.

Students turned away by for-profit institutions could end up at a nonprofit of worse quality, argued the study, co-authored by Jason Delisle, a visiting fellow at the American Enterprise Institute, and Cody Christensen, a former research associate at the conservative Washington think tank.

“If a for-profit institution demonstrates strong student outcomes, but 90-10 discourages it from enrolling more students with federal aid, the rule is clearly counterproductive,” said the study, whose findings are strongly contested by critics of the for-profit industry. But similarly, a 2016 Education Department report found that if military benefits were counted differently, the number of for-profit institutions out of compliance with the rule would jump from 17 to nearly 200.

Stephen Patterson, a spokesman for Veterans Education Project, declined to say whether it receives any funding from the for-profit industry. A spokeswoman for Career Education Colleges and Universities also declined to say whether the industry group has given the veterans' project any money.

The veterans' group, on its website, lists relationships with a number of small non-profit institutions and the United Negro College Fund. The group’s board of advisers also includes federal officials, including former Department of Veterans Affairs deputy secretary James Byrne and Curt Coy, former deputy under secretary for economic opportunity at the Veterans Benefits Administration.

However, Scott, the Democratic chairman of the House education committee, said he doubts that veterans will be turned away and insisted the change is needed.

“Veterans are targets for abuse and fraud,” he said.

Beth Stein, senior adviser at the Institute for College Access and Success, also questioned whether for-profit institutions really would turn away business. “That’s not what would happen,” she said.

For-profits under the 90-10 rule only face sanctions after not being in compliance of the requirement for two consecutive years. So institutions, she said, would have two years to adapt to the change. They could market themselves to attract more students who do not rely on federal benefits in order to meet the 10 percent minimum, she said. For-profit colleges and universities could also enter into more partnerships in which employers pay to send workers to the institutions.

Kent and Delisle also argue that the 90-10 rule is not a fair judge of colleges’ quality.

“The 90-10 rule is a decades-old revenue test, which is unevenly applied to proprietary institutions and has nothing to do with educational quality,” Kent said. “The current rule does not punish an institution for weak student outcomes, rather, it punishes them for simply enrolling too many students from low-income backgrounds.”

“With more postsecondary education data available than ever before, policy makers should abandon proposed changes to this antiquated policy and focus instead on developing a meaningful accountability framework that holds all higher education institutions responsible for how well they serve their students,” he said.

Delisle’s study agreed. “The 90-10 rule is out of step with the movement toward more modern accountability policies in higher education, policies that are based on advanced data systems and student outcomes,” it said. “The 90-10 rule is an antiquated and blunt input rule that is concerned entirely with revenues, not what students themselves earn from their education, whether they pay their loans or whether they graduate.”

Stein, though, said other regulations, including the Obama administration’s gainful-employment rule, do look at factors like whether graduates end up with jobs with salaries high enough for them to pay off their debt. That rule was repealed by the Trump administration but is expected to be restored in some form by the Biden administration. Career Education Colleges and Universities has opposed the rule, as well, because it primarily applies to for-profit institutions.

The provision, meanwhile, has strong support among Democrats, who control the Senate. “This loophole invites for-profit schools to funnel federal dollars to their bottom lines and exploit our veteran and service member student borrowers in the process,” said Senator Dick Durbin, from Illinois, the Senate’s second highest-ranking Democrat.

Durbin, separately from the coronavirus relief bill, last week introduced a bill that would further tighten the requirement on for-profit institutions, requiring at least 15 percent of their revenue come from sources other than the federal government.

Senator Ben Cardin, a Maryland Democrat and a longtime critic of counting veterans' benefits as federal funding, also backed changing how GI Bill dollars are counted.

“It is long overdue that we make this change and better protect veterans and the educational benefits they earn as a result of their service,” he said. However, other Democrats, like Joe Manchin, a moderate senator from West Virginia and a key vote in the Senate, declined comment.