You have /5 articles left.

Sign up for a free account or log in.

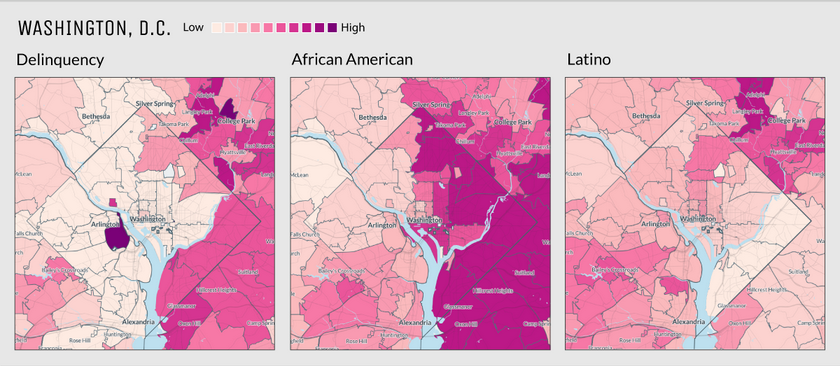

The Washington Center for Equitable Growth released Wednesday the second in a series of maps examining the interplay between geography and student debt. By breaking down student loan delinquency rates by zip code, the map shows minority communities are disproportionately affected by delinquency, even after controlling for income, on both the national and city level.

To construct maps like the one above, the center aggregated autumn 2015 credit reporting data from Experian and income data from the American Community Survey.

Disparate delinquency rates persist even in zip codes with similar median incomes but higher proportions of African-American or Latino residents, and, the researchers note, middle-class minority populations appear to be hit hardest of all.

In a column analyzing the center’s results, research economist Marshall Steinbaum and research analyst Kavya Vaghul suggest the poorest minority populations simply don’t have access to the necessary credit and rarely attend college, whereas middle-class black and Latino populations that do both still drop out of college at a higher rate and face racial inequality in the labor market.

“These data,” write Steinbaum and Vaghul, “tell us that at least with respect to longstanding group and individual income and wealth gaps between minorities and the overall population, debt-financed higher education is not the solution, and may even be contributing to the problem. The fact that, among minorities, the middle class is most strongly affected implies the problem is structural racism, not poverty. Any solution to the student debt crisis has to recognize that.”