You have /5 articles left.

Sign up for a free account or log in.

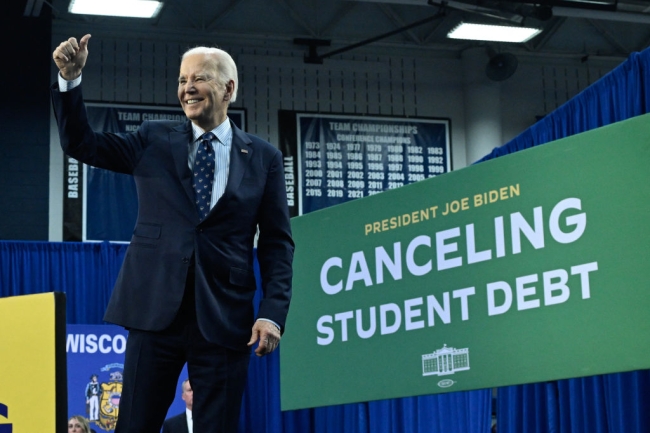

President Biden detailed his administration’s latest efforts to provide student loan borrowers relief in a speech Monday in Madison, Wisconsin.

Photo by ANDREW CABALLERO-REYNOLDS/AFP via Getty Images

Before President Biden stepped up to the podium at Madison Area Technical College in Wisconsin, his message was clearly forecasted on a number of screens around the stage: “Canceling Student Debt.”

“I will never stop to deliver student debt relief to hardworking Americans, and it’s only in the interest of America that we do it,” Biden said.

Monday’s announcement offered few new details about the administration’s plan to provide debt relief, which has been in the works since last summer. Under the plan, borrowers who fall into one or more of five categories would see either partial or full cancellation. The groups include people who owe more than they initially borrowed as a result of accrued interest and those who have been repaying loans for more than 20 years.

Fixing the country’s student debt crisis is part of his broader economic agenda, Biden said, noting that the ballooning debt is a drag on local economies. In addition to the debt-relief plan, Biden also highlighted efforts to expand career and technical education, make community college free and invest in American manufacturing.

While Biden spoke in Wisconsin, Vice President Harris touted the plan in Philadelphia and Second Gentleman Douglas Emhoff was dispatched to Arizona. Meanwhile, Education Secretary Miguel Cardona participated in a roundtable discussion with student loan borrowers in New York City.

The promotional tour is the latest signal that the Biden administration sees debt relief as key to mobilizing young voters and winning a second term in the White House. In a recent survey, nearly 70 percent of Generation Z respondents said the government should take some action to cancel student loans. Still, like so many issues, debt relief has become polarizing. Biden’s previous effort to provide broad-based student loan forgiveness infuriated Republican lawmakers, who said his administration was exceeding its constitutional authority.

Satra D. Taylor, director of higher education and workforce policy and advocacy for Young Invincibles, an advocacy group focused on amplifying the voices of young adults, said action on debt relief is very important for the president’s re-election campaign.

“We’re pushing the administration to fulfill their promise and ensure that young adults understand that more relief is coming,” she said.

Biden’s team suffered a blow in June 2023, when the Supreme Court struck down his broad-based plan, which would’ve forgiven up to $20,000 for eligible Americans. In response to the court’s decision, Biden pledged to find other ways to provide relief. They include the plan outlined Monday, which was refined over a series of public meetings.

“Tens of millions of peoples’ debt was literally about to get canceled but some of my Republican friends, elected officials, and special interests sued us and the Supreme Court blocked us,” Biden said Monday in Madison.

‘A Lot of Noise’

Beth Akers, a senior fellow at the American Enterprise Institute, a conservative think tank, said the outline of the proposal is largely in line with what the administration has previously announced but offers a few more details.

“I don’t think anything is new or particularly good policy,” she said, adding the plan is more politically motivated. “This makes a lot of noise and connects to people.”

Akers said that borrowers who need relief will get it under the plan, though she doesn’t think the groups are targeted enough to benefit only the “truly needy.”

Under the plan, borrowers who owe more than they initially borrowed will get up to $20,000 of interest forgiven. Low-income borrowers, as well as those enrolled in an income-driven repayment plan, could get all their interest canceled. Single borrowers who earn $120,000 or less and married borrowers who earn $240,000 or less will be eligible for full interest cancellation.

Borrowers who attended programs or institutions that were kicked out of the federal financial aid program or that closed and failed to deliver sufficient financial value would see their full balances wiped out. Additionally, borrowers eligible for forgiveness under more targeted programs, such as Public Service Loan Forgiveness, will also see some relief. The fifth category of eligible borrowers are those experiencing financial hardship as a result of their loans.

Overall, 23 million borrowers would see their accrued interest eliminated; 4 million would have their balances wiped out and more than 10 million borrowers would get at least $5,000 in relief. Officials expect more than 30 million people to benefit from this plan when it’s combined with their other efforts to provide debt relief over the last three years. So far, the administration has forgiven $146 billion in student loans for 4 million Americans.

Black and Latino borrowers, as well as those who attended community college or are financially vulnerable, are expected to experience “significant relief” under this plan, according to a White House fact sheet.

“Not only are Black students more likely to take on student loans than their white peers, but they also end up holding nearly twice as much debt as their white peers four years after graduation,” it reads. “And Latino borrowers are also more likely to default on their student loans compared to white borrowers.”

Aissa Canchola Bañez, policy director of the Student Borrower Protection Center, said that Monday’s announcement offers borrowers reassurance that Biden is still working on his so-called Plan B to provide debt relief.

“Folks expected this fight to end with the Supreme Court,” she said. “It’s been a long slog since then. We’re seeing light at the end of tunnel for plan B.”

Legal Challenges

When borrowers could see the expected relief is unclear, though Biden promised the plan would be in place by the fall. Officials said they would take the next step to enact the proposal—publishing the regulatory changes on the Federal Register—in the coming weeks. Once the Office of Management and Budget finishes reviewing the plan, the Education Department can post the proposed regulations, which will be subject to public comment for at least 30 days. The department must review and respond to those comments before issuing the final rule—the last step before borrowers could see relief.

However, once the rule is finalized, it will be subject to legal challenges. The administration is basing its authority to implement this plan on the Higher Education Act of 1965, which is different from the broad-based debt-relief plan struck down by the Supreme Court. The legal authority for the initial plan relied on a federal law the administration cited during the COVID-19 pandemic to change the terms of student loans to ensure borrowers weren’t negatively impacted by the national emergency.

Officials and some legal experts have said the administration is on stronger legal footing with the Higher Education Act. However, debt relief is an untested use of the law, which allows the department to “compromise, waive, or release” its claims against borrowers.

Akers said that several states are likely already preparing legal challenges. And a challenge to this debt-relief plan could have more validity than the recent lawsuit filed to block the Biden administration’s new income-driven repayment plan known as Saving on a Valuable Education, she noted. In that lawsuit, 11 Republican Attorneys General argued that SAVE was just another version of the broad-based debt-relief plan that the Supreme Court struck down.

Akers said SAVE was tied to a policy change while “this plan is about canceling student debt.”

Republican lawmakers said this latest plan penalizes taxpayers who never went to college and ignores the Supreme Court’s ruling.

“This is an unfair ploy to buy votes before an election and does absolutely nothing to address the high cost of education that puts young people right back into debt,” said Louisiana Senator Bill Cassidy, the senior Republican on the Senate Health, Education, Labor and Pensions Committee.

Cassidy also used his statement Monday to criticize the Education Department’s much-beleaguered roll-out of the new Free Application for Federal Student Aid, which has faced numerous delays and technical glitches.

“It seems the reason students don’t know what schools they can afford this year is because Biden’s Department of Education is spending its time concocting student loan schemes instead of fixing the mistakes they’ve already made on FAFSA,” Cassidy said.

Meanwhile, debt-relief advocates and Congressional Democrats praised the plan, saying it’s part of a broader effort to fix the student loan system and lower the cost of college.

“Since the day President Biden took office, I have urged him to do everything in his power to cancel as much student loan debt as possible, especially for communities of color who are systematically held back from achieving the American dream,” Senate Majority Leader Chuck Schumer said in a statement. “While there’s always more work to be done to alleviate the burden of student loan debt, and we will not stop until crippling student loan debt is a thing of the past.”