You have /5 articles left.

Sign up for a free account or log in.

AI is helping some university financial aid offices streamline their processes and information amid an increasingly confusing time with FAFSA and student loan repayments.

Mark McNasby is used to harried university officials reaching out for help resolving stressful situations, but last month, he began to receive similar requests from one particular group: financial aid officers.

The Free Application for Federal Student Aid was once again delayed, and McNasby’s artificial intelligence company, Ivy.ai, launched a FAFSA-specific product that monitored the FAFSA site in real time to help universities navigate the growing confusion from parents and students alike.

“It was a mini floodgate of ‘How does this affect my process, my students; what can I do to keep things up to date in real time and give students the best access to information?’” said McNasby, founder and CEO of Ivy.ai.

Artificial intelligence catapulted into the general public’s consciousness following OpenAI’s launch of ChatGPT in November 2022. Institutions have begun to use AI to streamline processes in admissions, food delivery and student engagement.

Financial aid offices are beginning to join that mix, seeing AI as a potential tool to navigate the choppy FAFSA waters and provide 24-7 answers to frequently asked questions from concerned and confused parents and students alike.

“Financial aid administrators are accustomed to something always being in limbo,” said Karyn Wright-Moore of Higher Education Assistance Group, a financial aid consulting firm. “I don’t think they’ve stretched to the point we’re going to implement AI to solve the FAFSA issue, but I do think FAFSA simplification caused a younger generation of aid administrators to think about how technology can solve some of these problems and identify some of the deeply hidden, complex compliance issues.”

Use Cases

Tammera Shinar was doing a typical cursory scroll through LinkedIn when she came across a post about how the artificial intelligence company Ocelot had developed a new product to better deal with the headache of the delayed FAFSA.

“They posted a demo saying to check it out and I quickly emailed them, saying, ‘How do we get our hands on this?’” she said.

Shinar, who oversaw financial aid services at Butte College at the time, wanted to ensure that employees had the same consistent information so they could give students accurate answers.

“Most colleges don’t have the luxury of closing financial aid for full trainings,” said Shinar, now Butte’s dean of student enrollment services. “My concern was all my folks getting the same information: Are they on the same level of understanding? Do they know how to search regulations?”

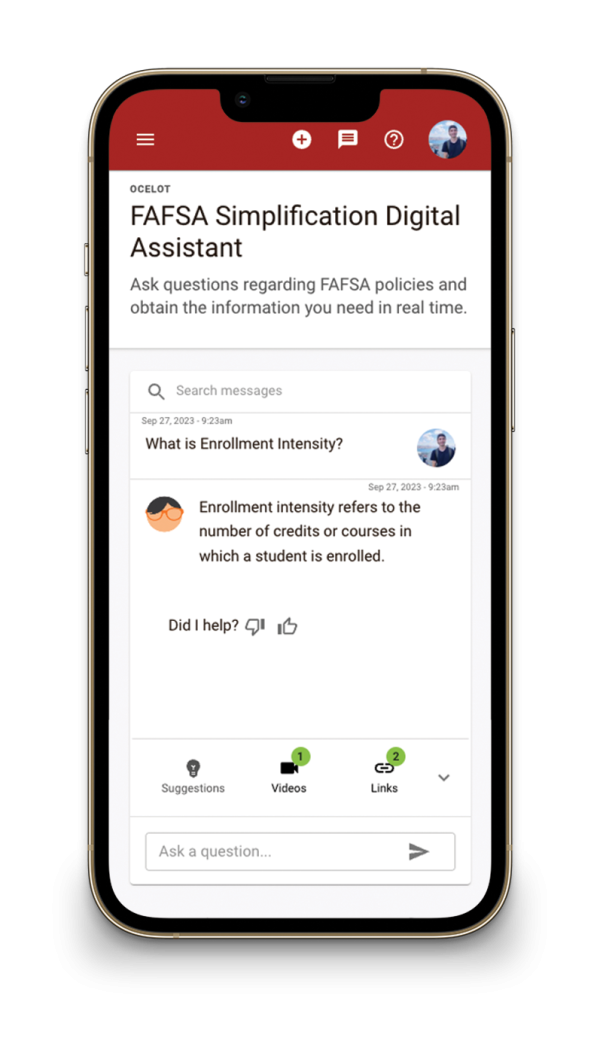

A look at Ocelot's bot to help answer student's questions on financial aid topics.

Ocelot

Talin Andonians, CEO at Ocelot, said there’s “absolutely” been more demand the last few years, starting with the COVID-19 pandemic.

“The resource constraints and staffing challenges and amount of turnover have been a big factor for a greater need for technology,” she said. “And now when we talk about FAFSA simplification, it’s the biggest change in 40 years; it has a lot of universities and colleges scrambling.”

Ocelot, similar to Ivy.ai, offers chat bots and live texting services to answer student and parent questions. Its FAFSA simplification digital assistant launched at the end of October and now has a dozen customers.

“Universities are figuring out what their AI strategy is, whether it’s in the classroom or how students are being supported,” Andonians said. “It’s definitely a phase I feel universities are working through.”

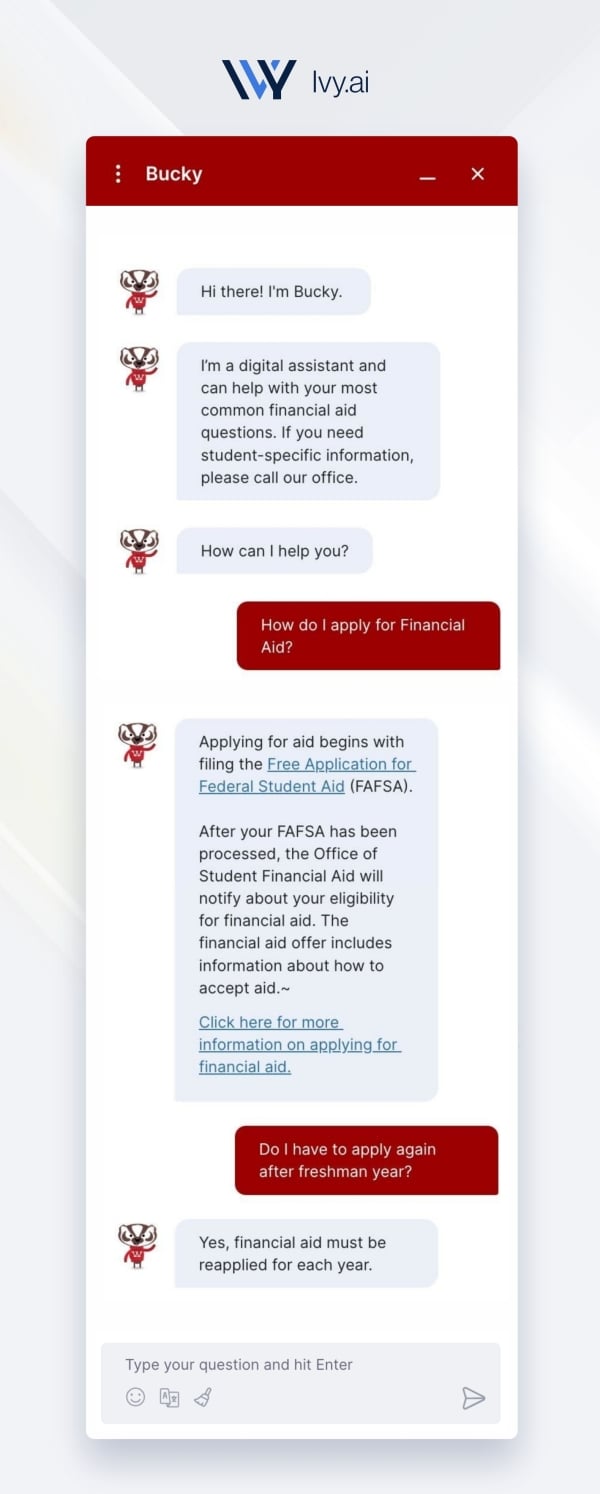

Karla Weber Wandel, communications manager for the University of Wisconsin at Madison’s financial aid office, started working with Ivy.ai’s chat bot in 2018. The technology scrolls the UW Madison financial aid page daily to provide up-to-date information to chat-bot users.

A look at "Bucky," the AI bot to help answer student's financial aid questions.

University of Wisconsin Madison/Ivy.ai

“It wasn’t to address one financial aid issue arising; more so it’s just helping folks get access to information on the site when the hot topics were popping up,” Weber Wandel said. The chat bot is especially helpful, she added, with the FAFSA change on “the forefront of everyone’s minds.”

“In financial aid, not everything is cut-and-dried, so we want to spend our energy where students can use the most help,” she said. “We’re not answering, ‘What is a subsidized loan?’ 20 times a day. We can focus on a more detailed avenue versus parts of the question that, to us, is kind of common knowledge but can be confusing [to students].”

Considerations

Higher Education Assistance Group’s Wright-Moore is “cautiously optimistic” about the use of AI in financial aid offices, although she said many offices are not “quite there” yet when it comes to widespread implementation of the technology.

“I think aid administrators hear it in the news, see it come across their desks, but don’t understand the risk or benefits,” said Wright-Moore, HEAG’s vice president of compliance and quality assurance. “In some ways they’re using a bit of AI right now and with aid administrators; it’s a wait-and-see concept. Ultimately, we all have to make the right decision on behalf of the institution and students we serve.”

Before they embark on that implementation, she said, colleges should take stock of the data that would be used by the AI technology. Step one, she said, is conducting a data study to ensure consistency across the institution—for example, a student’s “last day of attendance” could mean one date to one department and a different date in another department, depending on how they view the data. Step two is viewing how that data flow within an institution. Those steps are critical, she said, before reaching out to a third party such as Ocelot or Ivy.ai.

“The other, most frightening thing to institutions is cybersecurity risk,” Wright-Moore said. “So many colleges are victims of cyberattacks. You can begin internally with data cleansing and data analysis … before venturing outside of your institution make sure what you have … is as safe as possible.”

Karen McCarthy, vice president of public policy and federal relations at the National Association of Student Financial Aid Administrators, said the need for 24-7 answers has increased in recent years—but providing the answers through a bot needs to take consideration.

“Being able to respond to student inquiries quickly has been an evergreen issue because there’s always things changing,” she said. “If the question is, ‘What’s the deadline for me to do X?’ that’s easily addressed, but especially in the financial aid space, once you get into areas of ‘My family situation is a bit different now,’ or ‘How can I appeal?’ there are all kinds of follow-ups.”

Butte College leverages the technology to answer the more common inquiries—leaving administrators open to answer the more personalized, nuanced questions.

“There’s this imaginary theory that when you bring in this technology, you don’t need the people,” Shinar said. “But the work of the people just shifts. Looking at the technology to improve processes, tighten up compliance—there’s less human error.”

It remains to be seen which colleges will be the leaders in this space: McCarthy said smaller, more nimble institutions could be among the first, while Wright-Moore said larger institutions more flush with money and resources could move more aggressively.

“A lot of it will depend on the trajectory institutions take over all and whether they’re slow to move on this,” McCarthy said. “We’ve seen a little chatter; it starts with aid administrators talking about how they, as individuals, use it, and it’s ‘See, this saved me a lot of time.’ Then they’re thinking, ‘How can I leverage this, in terms of office and process?’”

Butte’s Shinar, who served as president of the California Community Colleges Student Financial Aid Administrators Association, said working with third-party vendors is fine, but users should know it’s not a silver bullet of a solution.

“It’s a game changer for the student experience, but you have to be dedicated to making the technology work for your college and system,” she said. “It takes an investment, and it’s about how invested you are in making sure the tool works for you.”