You have /5 articles left.

Sign up for a free account or log in.

A majority of surveyed students faced financial challenges in the past year, and many say they are without emergency funds.

Tero Vesalainen/iStock/Getty Images

Financial distress is prevalent among undergraduates nationally, with almost three in four students experiencing financial difficulties in the past year, according to the fall 2022 Student Financial Wellness Survey.

The survey, detailed in a May report from Trellis Research, examined financial challenges among undergraduate students at two- and four-year institutions and their impact on student success.

Surveyed students reported high levels of financial and basic needs insecurity and mental health challenges, which impacted academic performance and ability to focus on coursework. They were not always aware of supports available from their institutions.

Despite the financial challenges present within higher education, 70 percent of respondents believed the cost of college was a good investment for their financial future.

SFWS by the Numbers

The fall 2022 Student Financial Wellness Survey from Trellis Research includes data from 89 institutions: 61 two-year colleges, 18 public four-year institutions and 10 private four-year institutions. The survey was open to 388,653 students and 36,446 students responded, a response rate of 9.4 percent.

Respondents tended to be older, attend college full-time and identify as female.

Student success outcomes: Stress related to finances and mental health challenges can upset a student’s college career, pushing them to stop out.

Approximately 48 percent of students who had experienced financial challenges while enrolled agreed they had difficulty concentrating on academics because of their finances. Among respondents, nontraditional students, first-generation students and students with jobs were more likely to have difficulty focusing on academics due to financial concerns, compared to their peers.

Students who indicated a major depressive disorder or generalized anxiety disorder were also more likely to have difficulty concentrating on academics.

Financial distress: While enrolled in college, 73 percent of students had experienced financial difficulty.

A lack of available finances was common among surveyed students, with 57 percent of students indicating they would have difficulty finding $500 in cash or credit for an emergency in the next month and 15 percent of those saying they would be completely unable to find $500 in an emergency.

Black (69 percent) and Hispanic (61 percent) respondents were more likely to say they would have trouble finding $500 in emergency funds, compared to their peers.

(In a 2022 Student Voice survey of 2,000 students, conducted by Inside Higher Ed and College Pulse, two-thirds of students said they would be worried about needing to drop out of college if a financial setback such as a large car-repair bill arose, with more than half of these students reporting they would be “very worried.” A full 67 percent of those who nearly had to drop out of college due to COVID said they would be very worried.)

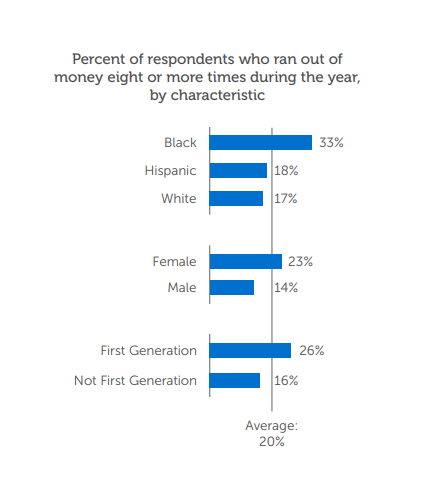

One in five students responding to the Trellis survey reported they had run out of money eight times or more in the past year, with a higher frequency among Black (33 percent), female (23 percent) and first-generation (26 percent) students.

Despite present financial challenges, students reported they would use institutional resources around financial wellness, if offered. Around 60 percent of students said they would use financial support services, like coaching, if offered.

Basic needs insecurity challenges and solutions: Financial insecurity can bleed into students’ basic needs, resulting in a lack of food or adequate housing to support them.

The survey found three in five students had experienced one type of basic needs insecurity in the past year and 10 percent of students experienced all three forms of basic needs insecurity: food insecurity, housing insecurity and homelessness.

Food insecurity is “the limited or uncertain availability of nutritionally adequate and safe foods, or limited or uncertain ability to acquire acceptable foods in socially acceptable ways,” according to the Economic Research Service of the U.S. Department of Agriculture. Among respondents, 46 percent had experienced food insecurity within a month of taking the survey.

To combat food insecurity, free food pantries are becoming more common on college campuses, but connecting students to resources remains a challenge.

Of the survey’s participating colleges and universities, 80 percent had at least one food pantry or closet available to students, but only 19 percent of food-insecure students reported visiting a pantry of any type. More than 45 percent of surveyed students who were food insecure indicated their campus did not have a food pantry or they did not know if their institution had a pantry.

Housing insecurity, which the U.S. Department of Housing and Urban Development defines as “difficulty finding affordable, safe or quality housing, having unreliable housing or inconsistent housing and overall loss of housing,” can include a lack of funds to pay for utilities, overcrowded conditions or frequent moving. Homelessness is “lacking fixed, regular and adequate housing,” according to the Office of Federal Student Aid.

In the past year, 44 percent of students were housing insecure, 5 percent explicitly identified as homeless and 15 percent had experienced homelessness at some point since starting college.

Students at two-year institutions were more likely to be housing insecure, with 47 percent responding that they had faced housing insecurity, compared to 40 percent of students at four-year institutions experiencing housing insecurity.

Seeking stories from campus leaders, faculty members and staff for our Student Success focus. Share here.