You have /5 articles left.

Sign up for a free account or log in.

istock.com/Alex_Doubovitsky

Tuition discount rates reached an all-time high in 2018-19 as net tuition revenue growth slowed and enrollment declined at nearly half of colleges, according to a new report by the National Association of College and University Business Officers.

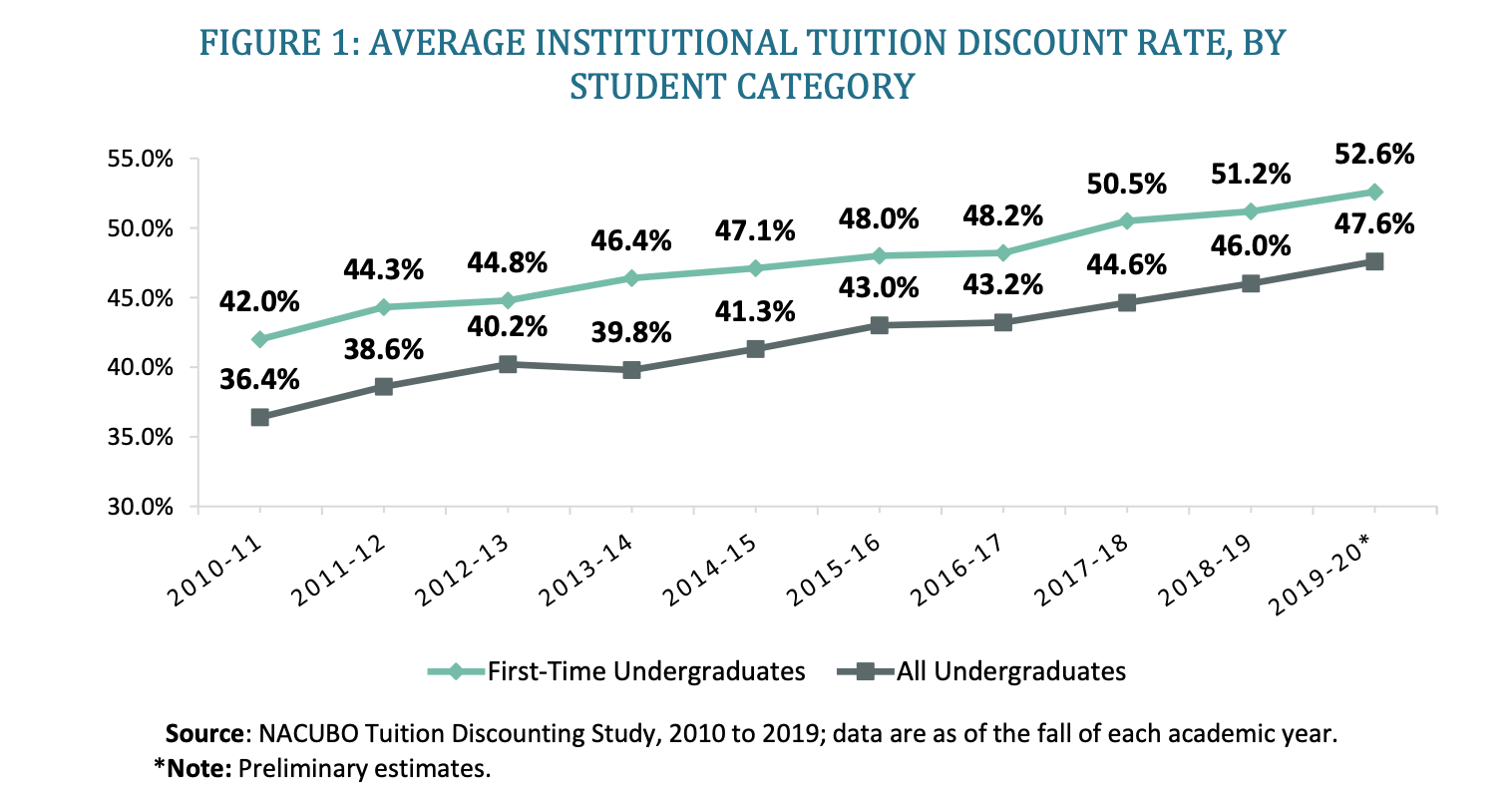

According to the annual NACUBO study, the average tuition discount rate for first-time undergraduate students at private nonprofit colleges in 2018-19 was 51.2 percent, three percentage points up from 2016-17 and one percentage point short of last year’s prediction. The rate for all undergraduates in 2018-19 was 46 percent, up nearly two percentage points from the year prior.

The report defines the tuition discount rate as “total institutional grant aid awarded to first-time, full-time, degree- or certificate-seeking first-year undergraduates as a percentage of the gross tuition and fee revenue the institution would collect if all students paid the sticker price.” Results are based on a survey of 366 private nonprofit institutions and Integrated Postsecondary Education Data System data.

Tuition discount rates have been trending upward for a decade. To calculate financial aid awards, colleges often work with outside consultants to perform financial aid optimization, said Alex Bloom, associate director of research at consulting firm EAB. The process determines how much institutional grant aid will be awarded to different groups of students and “calibrates” that aid with net tuition revenue numbers. The goal, Bloom said, is to increase enrollment, which will therefore offset the cost of the aid.

But the NACUBO report shows this isn’t working for all colleges.

“In the last few surveys, we’ve seen that the share of institutions reporting declines in enrollment, despite the increasing discount rates, has been around 45 to 50 percent,” said Ken Redd, senior director of research and policy analysis at NACUBO.

Between fall 2016 and fall 2019, 54 percent of institutions experienced no change or declines in enrollment, the report shows. The top three reasons institutions cite for flat or declining enrollment are increased competition from other colleges, price sensitivity of students and the changing demographics of prospective students.

“It’s unlikely that everyone was just wrong about how much aid to give,” Bloom said about the NACUBO results. “It’s more likely the case that essentially the demand was weakening enough that institutions have to discount more to get the same number of students to enroll.”

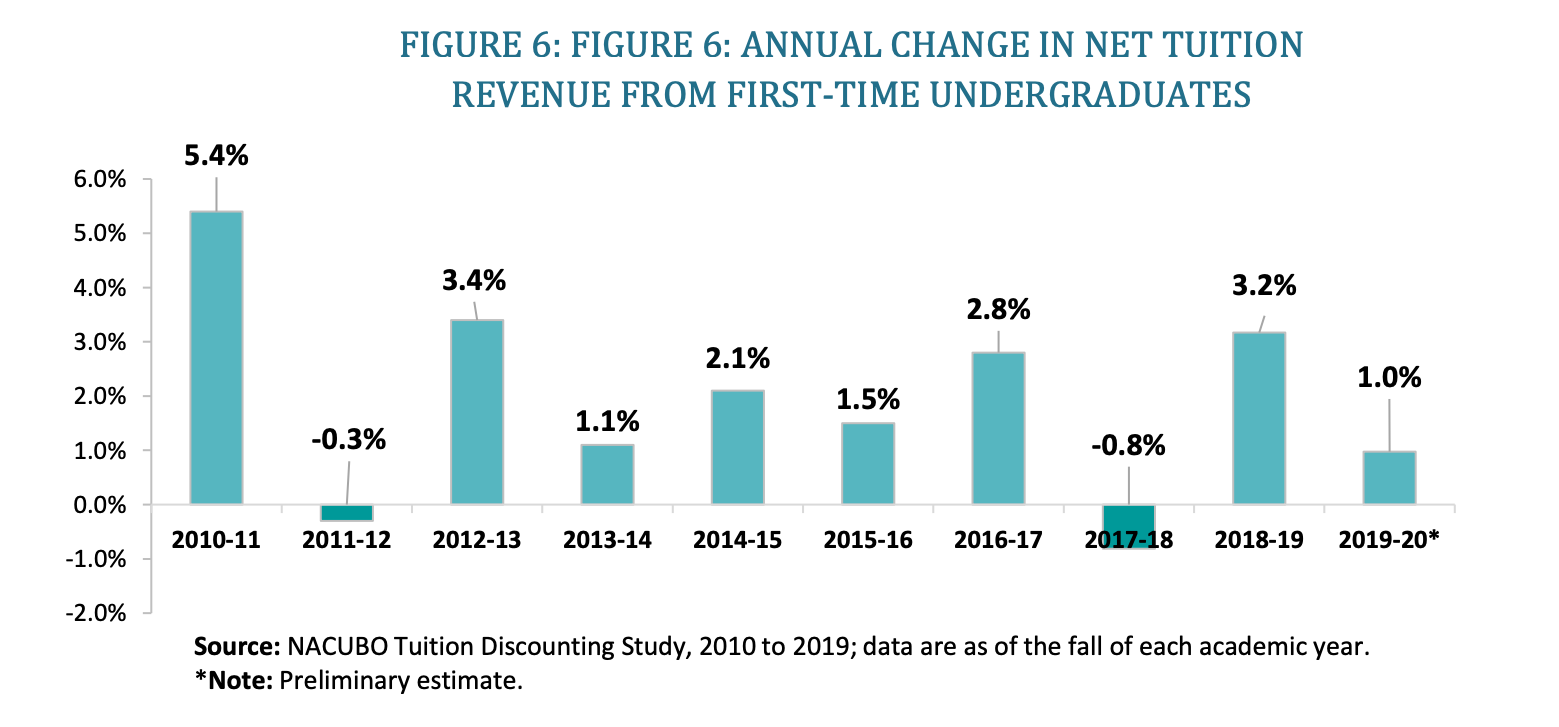

Net tuition revenue per undergraduate increased in 2018-19, but at less than half the rate it had the year prior, the report shows. It’s difficult to parse out a trend of net tuition revenue over the past several years. In 2018-19, institutions saw a three-percentage-point boost in net tuition revenue. A year earlier in 2017-18, net tuition revenue decreased by nearly a full point.

The slimmer margins are not a good sign for private colleges, especially those that are already extremely tuition dependent, said Lucie Lapovsky, principal at Lapovsky Consulting and former president of Mercy College.

“I believe as a result you’re going to see more schools go out of business,” Lapovsky said. “Edmit just did something where, because of COVID, they upped their [prediction of] private colleges going out of business from about 240 to about 340. We have both Standard & Poor's and Moody's putting a negative outlook on the sector.”

The coronavirus pandemic has placed even more financial strain on colleges, which is accelerating some colleges' downfall, Lapovsky points out. The NACUBO report data were collected before the pandemic forced campuses to close, and Redd thinks the crisis will only reinforce existing trends.

“It is a likely harbinger of the future where schools will be having to distribute even more aid to students who are going to have even more financial need than we realized when we started collecting the data.”

But the steady upward march of tuition discount rates is not necessarily a death sentence for private colleges. Some colleges are turning to non-tuition-based revenue streams. Kaitlyn Maloney, senior director at EAB, pointed out that many colleges also rely on summer facilities rentals and revenue from summer camps and conferences. These revenue streams are, of course, currently impacted by the pandemic and resulting campus shutdowns, but they could be helpful to colleges in the future.

“We are seeing a lot of institutions launch emergency donor campaigns to raise funds -- though many of those are admirably intended to bolster the institutions’ support for students in need,” Maloney wrote in an email. “In the absence of strong alternative revenue sources, many institutions are relying on emergency reserves and accessing lines of credit to fund operations while they figure out their plans for the fall. The most creative alternative revenue source I’ve seen is university-branded face masks -- I’m sure these will be ubiquitous in virtual bookstores soon.”