You have /5 articles left.

Sign up for a free account or log in.

The rhetoric of college admissions is all about possibility. Prospective students are encouraged to enroll and told of the availability of aid -- federal, state and institutional -- to help.

But is that rhetoric overstated? A new analysis by the Center for Law and Social Policy suggests that it is a stretch to say that most students receive enough money to afford college.

"When Financial Aid Falls Short" finds that the gap between the cost of attending college (including living expenses) and all student resources that do not need to be repaid grew by 23 percent between 2012 and 2016. And for many students, the report says, the gap is quite large.

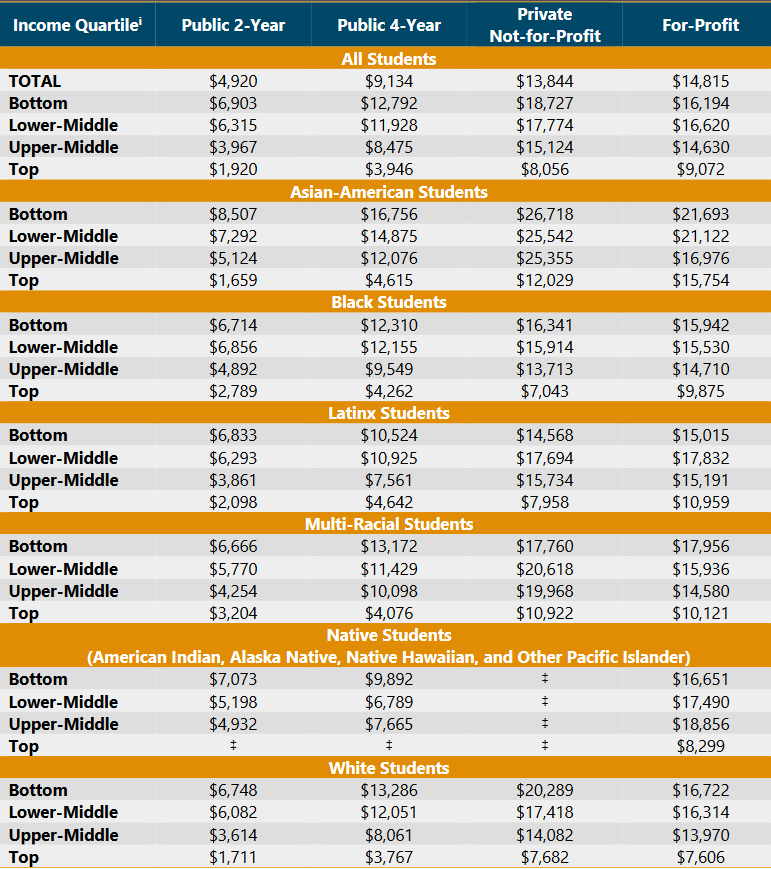

At community colleges, 71 percent of students have some unmet need, averaging $4,920. And unmet need is greater among those attending four-year institutions, minority students and those who are disadvantaged.

Adding to the concern, the report says, these figures probably underestimate the true extent of unmet need. Colleges "notoriously underestimate students’ cost of living," the report says.

While some might think that unmet need is simply an annoyance, the CLASP report notes research that finds major impacts of unmet need on students.

"The effect of this may be increased material hardship like food or housing insecurity that forces students to make such difficult choices as sleeping in their car or choosing between buying food and paying tuition. Difficulties making ends meet may also cause students to reduce the number of courses they take or drop or stop out altogether," the study says.

"This common cost-cutting strategy is why policies that require full-time enrollment (particularly full-time enrollment without significant, additional aid) can be harmful to students with unmet need. Students with unmet need may also take on costly student loan debt that can endanger their financial future. Student loan debt is riskiest for students of color who default on student loans at disproportionately high rates, even if they completed their program of study."

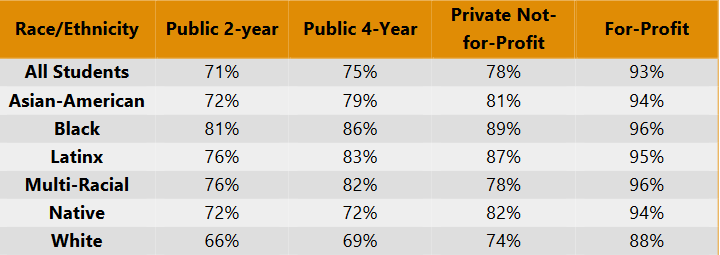

The share of students with unmet need varies by racial and ethnic group, and by type of institution attended. Across racial and ethnic groups, those attending for-profit colleges are most likely to have unmet need.

Another table adds in family wealth levels:

Among the recommendations in the report:

- Federal and state governments should provide more need-based aid.

- States should provide more general support for public higher education.

- The Free Application for Federal Student Aid and college aid calculation tools should be revised to be more realistic about students' expenses, especially those beyond tuition and fees.

- States and colleges should do more to connect students with benefits for which they qualify but may not know how to obtain.