You have /5 articles left.

Sign up for a free account or log in.

Council for Aid to Education

Individual donors reopened their checkbooks in 2017 as a strong stock market fueled rising personal giving that in turn powered an increase in contributions to higher education institutions.

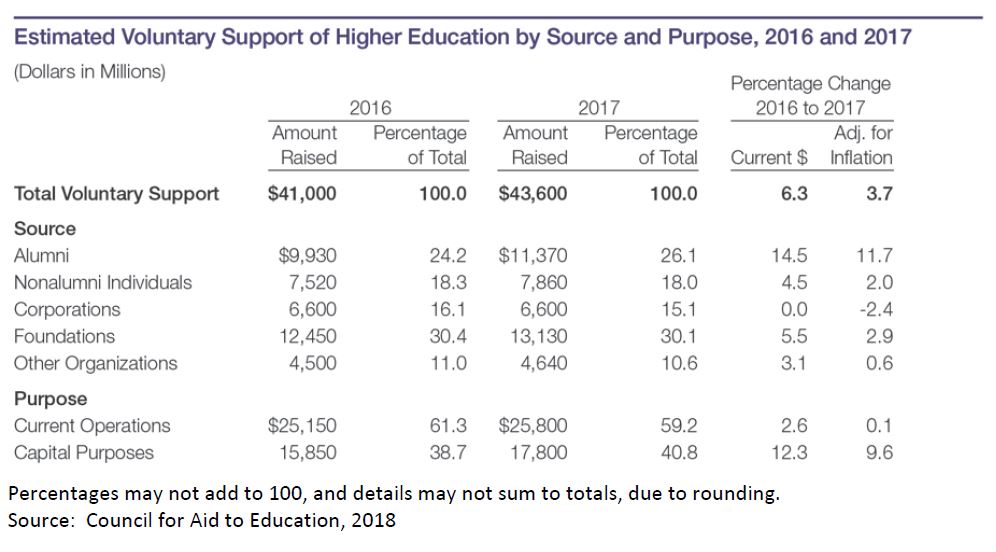

Colleges and universities raised a total of $43.6 billion in the fiscal year ending June 30, 2017, according to results from the latest version of the annual Voluntary Support of Education survey from the Council for Aid to Education, which is being released today. The fund-raising total is up 6.3 percent from 2016 -- 3.7 percent after adjusting for inflation.

It is the highest fund-raising total recorded in the survey’s six-decade history. The 6.3 percent year-over-year increase nearly quadrupled the rate of growth between 2015 and 2016, which was 1.7 percent in last year’s survey.

Personal giving by alumni proved to be responsible for much of the growth in 2017. Alumni giving increased by 14.5 percent, to $11.37 billion. Nonalumni giving rose by 4.5 percent, to $7.86 billion.

That’s a turnaround from last year, when both alumni and nonalumni giving dropped significantly. But the swings balance out over time, according to Ann E. Kaplan, who directs the annual survey and is vice president at the Council for Aid to Education.

“If you average the two years, it doesn’t look as dramatic,” she said. “Because there really was a decline last year in personal giving.”

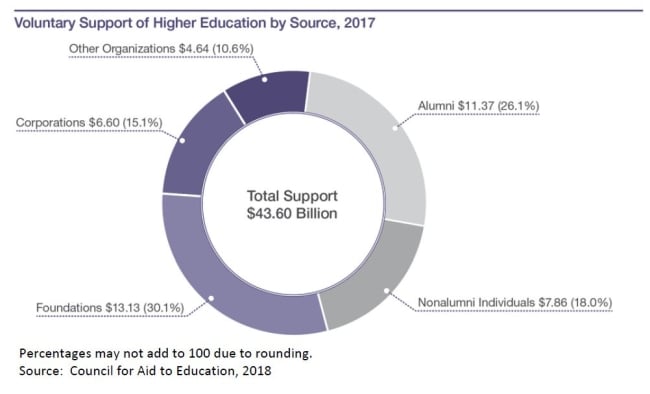

Last year, total donations to colleges and universities rose because of an increase in giving by organizations. This year, organizations’ giving flattened out somewhat. Giving by corporations was unchanged at $6.6 billion. Giving by foundations increased by 5.5 percent to $13.13 billion, and giving by other organizations rose by 3.1 percent to $4.64 billion. The category for other organizations includes donor-advised funds, a giving mechanism wealthy donors have increasingly utilized in recent years.

The varying rates of growth led to shifts in the percentage of the total fund-raising pie that each source of donations held. Some sources of fund-raising declined as a share of the total amount even though they increased on a dollar basis.

Alumni giving represented 26.1 percent of total voluntary support of higher education in 2017, up from 24.2 percent the previous year. Nonalumni individual giving was 18 percent, down from 18.3 percent.

Foundations gave 30.1 percent of all voluntary support, down slightly from 30.4 percent the year before. Corporations gave 15.1 percent, down from 16.1 percent. Other organizations gave 10.6 percent, down from 11 percent.

The significant growth in personal giving can be attributed in large part to stock market performance. Personal giving in a particular year tends to be closely tied to market returns in that same year. On the other hand, giving by corporations, foundations and other organizations is connected with the previous year’s market performance. That’s because organizations are likely to make commitments in one year to give in the next.

In other words, a weaker stock market in 2016 depressed personal giving in 2016 but hit organizations’ giving in 2017. The stronger market in 2017 led to higher personal giving the same year, but it’s too early to tell how it will affect giving by organizations in 2018.

Over all, the picture shows contributions to colleges and universities rising along with the economy.

“The economy is expanding,” Kaplan said. “It’s a steady but not dramatic recovery.”

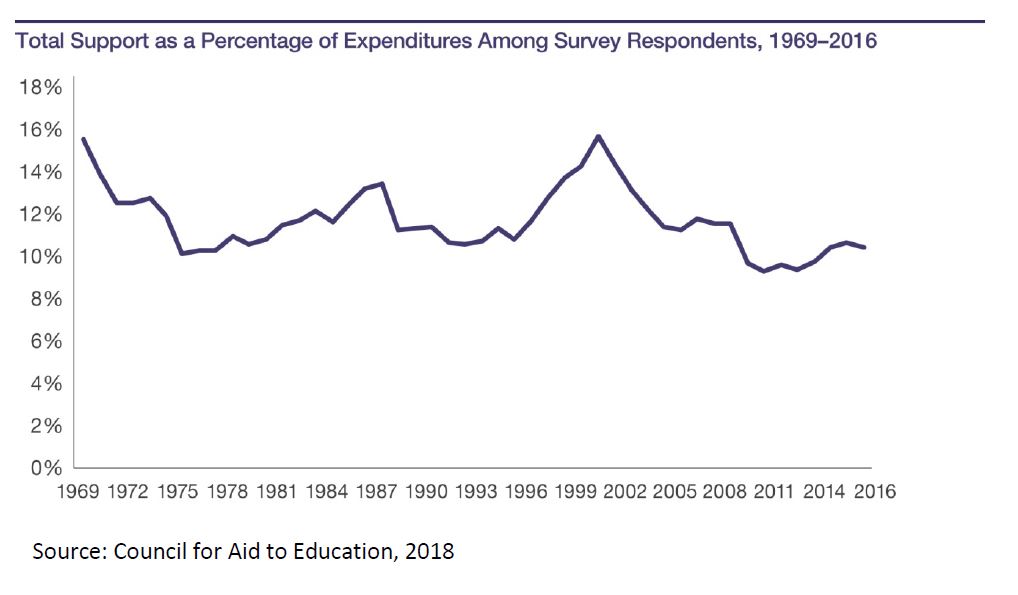

Even with an expansion of philanthropic dollars, colleges and universities aren’t able to use donations to fund the bulk of their budgets.

Philanthropic support has hovered around 10 percent of total college and university expenditures in recent years -- a significant chunk of money, but nowhere near the majority of their funding. The percentage is down from 2000, when charitable support represented a peak 15.7 percent of institutions’ expenditures.

Well over half of all contributions to higher ed, 59.2 percent, were directed toward current operations. The remaining 40.8 percent went to capital purposes. The previous year, 61.3 percent of contributions went to operations and 38.7 percent went for capital purposes.

Alumni contributions increased more for capital projects than they did for operations, according to a subset of surveyed institutions that answered questions on alumni support. Alumni support for capital purposes -- like buildings and endowments -- rose by 16.7 percent. Alumni support for current operations rose by 8.7 percent.

Colleges and universities received more gifts in the form of securities in 2017 than they did in 2016, according to another subset of survey respondents. The value of gifts made as securities increased by 26.6 percent. The number of such gifts rose by 16.9 percent.

CAE received responses from a total of 933 institutions.

Higher ed fund-raising continued to be dominated by the biggest players. In 2017, the 20 institutions raising the most money attracted 28.1 percent of all gifts given -- $12.23 billion. The year before, the top-20 fund-raisers brought in $11.2 billion, or about 27 percent of a total of $41 billion raised by all institutions.

The one-year increase is not necessarily a break from previous trends, though. In recent years, the top-20 fund-raisers have drawn approximately 27 percent to 29 percent of all money raised, according to Kaplan.

| 1. | Harvard University | $1.28 billion |

| 2. | Stanford University | $1.13 billion |

| 3. | Cornell University | $743.5 million |

| 4. | Massachusetts Institute of Technology | $672.94 million |

| 5. | University of Southern California | $668.33 million |

| 6. | Johns Hopkins University | $636.91 million |

| 7. | University of Pennsylvania | $626.49 million |

| 8. | Columbia University | $603.08 million |

| 9. | Yale University | $595.89 million |

| 10. | Duke University | $581.05 million |

| 11. | New York University | $567.12 million |

| 12. | University of Washington | $553.89 million |

| 13. | University of California, Los Angeles | $550.93 million |

| 14. | University of Chicago | $483.47 million |

| 15. | University of Michigan | $456.13 million |

| 16. | University of Notre Dame | $451.43 million |

| 17. | University of California, San Francisco | $422.17 million |

| 18. | University of California, Berkeley | $404.59 million |

| 19. | Ohio State University | $401.85 million |

| 20. | Indiana University | $398.26 million |

The Outlook Ahead

The survey of fund-raising in the 2017 fiscal year comes at an unsettled time for philanthropy of all types. The newly enacted federal tax reform package contains several provisions that are expected to change donor behavior.

Colleges and universities are likely to be affected by several provisions. They include an increase in the standard deduction, a cap on mortgage interest deductions and a cut in deductions for state and local taxes -- all of which could cause fewer households to itemize their tax returns and would in turn eliminate their incentive to give in order to secure a charitable tax deduction. They also include the elimination of a tax provision allowing donors to deduct 80 percent of the value of contributions counted toward preferred seating at athletic events. Also, donor-advised funds will be able to be used to pay personal pledges starting in 2018.

Some of those provisions could have already caused individuals to shift donations in order to utilize the most favorable set of tax laws. For instance, donors might have prepaid pledges in December 2017. That could show up in next year’s study.

The changes to donor-advised funds could shift the breakdown of contributions from such funds and from individuals. But the effects are not yet clear. They might not be entirely clear in next year’s study, either -- it will cover six months before the tax reform package became law and six months after it is in effect.

Comprehensive results from the 2017 Voluntary Support for Education survey will be published this spring.