You have /5 articles left.

Sign up for a free account or log in.

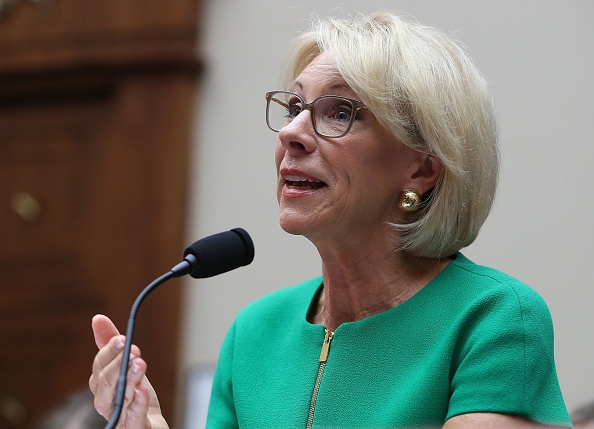

Education Secretary Betsy DeVos

Getty Images

A federal judge on Tuesday rejected a challenge from a for-profit college group to an Obama administration rule governing loan forgiveness for defrauded borrowers, clearing the way for the rule to take effect.

The ruling on the regulation, known as borrower defense, is seen as a major win for students by consumer groups. The rule would ban colleges from enforcing arbitration provisions of enrollment agreements. And it could make it easier for many student borrowers to receive loan forgiveness. But those benefits will also depend on how the Education Department, which has sought for the past two years to roll back the regulations, carries out provisions of the rule.

Tens of thousands of borrowers -- most of them former for-profit college students -- are waiting for rulings from the department on loan-forgiveness claims under the rule, which also encompasses actions of institutions far beyond student loan forgiveness.

“Countless borrowers around the country have been counting on this rule to go into effect,” said Julie Murray, a lawyer at Public Citizen who helped argue a lawsuit brought against the department by several consumer groups and state attorneys general. “Today is a huge victory for them.”

Education Secretary Betsy DeVos announced she would block the rule last year and undertake a rewrite accounting for the concerns of institutions. However, a federal district court judge, Randolph Moss, found last month that the 2017 rule delay was unlawful. And the Education Department said later that it wouldn’t seek to further justify the delay. The ruling on the for-profit association’s challenge clears the way for provisions of the rule to take effect although the judge did not issue further directions for the department.

A spokeswoman for the Education Department said DeVos respected the court’s ruling but didn’t offer details on plans to carry out the 2016 regulation.

“The secretary continues to believe the rule promulgated by the previous administration is bad policy, and the department will continue the work of finalizing a rule that protects both borrowers and taxpayers,” said Liz Hill, the spokeswoman for the Education Department. “The department will soon be providing further information regarding the next steps for implementation of the 2016 borrower-defense regulation.”

In addition to the arbitration bans and the financial responsibility provisions, the rule provides for automatic discharge of student loans for borrowers whose colleges closed three years ago and who never re-enrolled elsewhere. And it provides for group discharge when widespread fraud is found at an institution. But getting that loan relief will require action from the department.

Data released by Senate Democrats last month showed that more than 100,000 borrower-defense claims were pending at the department as of June 30, prompting those lawmakers to claim the department is ignoring struggling borrowers.

Rolling back the borrower-defense rule, along with gainful-employment regulations, had been a top priority for the Trump administration as well as the for-profit college sector. The Education Department released draft borrower-defense regulations in July that would be more restrictive than the Obama rule. But administration officials said earlier this month that they will miss a Nov. 1 deadline to issue a final rule for 2019.

That missed deadline means the earliest a DeVos borrower-defense rule could take effect is July 2020 -- more than a year and a half after the Obama rule takes effect.

But what happens with those provisions of the rule now depends on the actions of a department that’s admittedly hostile to the regulations.

“I worry a lot that they will intentionally slow walk or just refuse to do certain things,” said Ben Miller, senior director of postsecondary education at the Center for American Progress.

Miller noted that before proposing to rescind gainful-employment regulations in August, the Trump administration had spent more than a year repeatedly delaying provisions of that rule. He said it’s incumbent upon the Education Department to get out the necessary guidance to colleges on borrower-defense provisions like the arbitration ban as quickly as possible.

“The department is obligated to follow the rules on the books,” he said.

While Moss ruled against the California Association of Postsecondary Schools, the for-profit group that sought to block the regulations, he did not assess the substance of the group's objections and said, "This is not the first (and presumably not the last) chapter in a dispute about the fate of regulations."

Steve Gunderson, president of Career Education Colleges and Universities, said in a statement that the ruling was disappointing and would create further confusion for students and institutions.

He argued that there was precedent of the Obama and Bush administrations choosing not to enforce rules they did not agree with and said DeVos should use the same discretion.

"But for now, my hope is the Trump Education Department will provide as much guidance as possible to schools on how to operate amidst the current regulatory confusion caused by the decision to implement the Obama era regulation while they are in the final steps of creating a new, and much more balanced regulation providing due process to both students and schools," he said.