You have /5 articles left.

Sign up for a free account or log in.

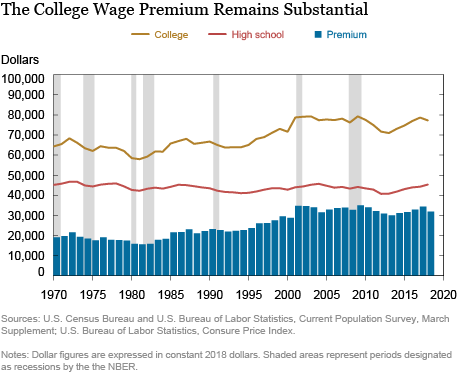

Amid constant discussion of whether college is "worth it" or whether new models will displace the bachelor's degree, new research shows that there is a clear economic edge for those who earn bachelor's degrees over those with a high school diploma. And the research shows that the rate of return on the investment of paying for college is high enough to make the decision to go to college a wise one for most students.

The new research notes the constant questioning of the economic value of earning a bachelor's degree, particularly with many students taking on debt to pay for college. The research, by the Federal Reserve Bank of New York, acknowledges some fluctuations in the wage premium for bachelor's degree holders and their economic return on paying for college. But it says that there is no doubt about the economic value of earning a bachelor's degree.

The study examines average wages and adjusts for inflation and other labor market changes over time. In recent years, the average college graduate with only a bachelor's degree earned $78,000, compared to $45,000 for those with only a high school diploma. "This means a typical college graduate earns a premium of well over $30,000, or nearly 75 percent," the study says. "This 'college wage premium' has fluctuated over time … The college wage premium generally increased during the 1980s and 1990s, rising from less than $20,000 to around $30,000, before settling into a relatively narrow range of $30,000 to $35,000 after 2000."

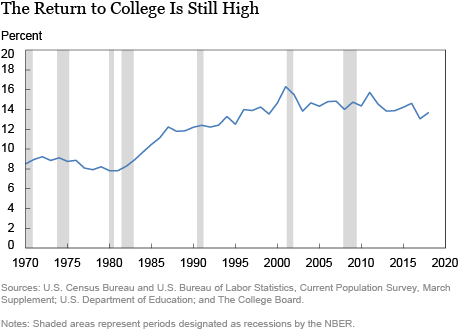

When it comes to the rate of return on funds spent on college, the study is similarly certain of the value of paying for college.

"As with any investment, the costs and benefits of college accrue over different time intervals, making it a bit tricky for students and their parents to judge the economic value of a degree," the report says. "Indeed, for the typical college student, the costs of college result in a negative cash flow while in school (assumed to be four years for a bachelor’s degree), followed by a positive cash flow (the college wage premium) received over one’s entire career. In order to weigh the up-front costs against the lifetime benefits, we calculate the internal rate of return -- a measure investors commonly use to gauge the profitability of different kinds of investments."

The report continues, "We estimate that the return to college hovered between 8 and 9 percent until the early 1980s, then climbed to almost 16 percent following the technology-fueled economic expansion of the 1990s, where it remained, more or less, through the Great Recession. Over the past several years, this return appears to have declined slightly, drifting down by roughly two percentage points to just under 14 percent."

The cost of college is going up, the report notes, but that doesn't mean the return is not worth it.

"At nearly 14 percent, the return to college easily exceeds various investment benchmarks, such as the long-term return on stocks (7 percent) or bonds (3 percent)," the report says. "Thus, while the rising cost of college has eroded the return to a bachelor’s degree to some extent, our analysis suggests that college remains a good investment, at least for most people."