You have /5 articles left.

Sign up for a free account or log in.

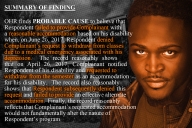

Broward College in Fort Lauderdale, Fla.

ISTOCK.COM/JillianCain

Many community colleges already have disbursed aid from the federal CARES Act relief package to their students.

Leaders of two-year colleges said they are grateful for the support, but also that it's not enough money, and that federal guidance on how to distribute the funds -- or lack thereof -- made it difficult to move quickly.

Community college students have been hard hit by the coronavirus pandemic. Many work at least part-time while attending school, often in industries that have been shut down by COVID-19. Community college leaders had to balance getting funds out to as many students as possible, while also ensuring the amount students received would make a difference.

The formula used in the CARES Act to send funds to colleges relied heavily on the number of full-time Pell Grant recipients institutions serve. About one-third of community college students are eligible for Pell Grants, but many also attend part-time, which reduced how much aid the colleges received.

"We're thankful for the dollars that were provided," said Monty Sullivan, president of the Louisiana Community & Technical College system. "But without a doubt, the amount of need that is out there far outstrips the aid."

The U.S. Department of Education released guidance in April saying that emergency student aid from the CARES Act could only go to students eligible for funding under Title IV. Later, the department said it would not enforce those guidelines, stirring more confusion.

In a survey from the National Association of Student Financial Aid Administrators, more than 80 percent of respondents said the multiple rounds of guidance from the department were confusing and delayed aid disbursement. A majority also said there wasn't enough instruction, which many institutions expressed concern over as the department prepared to release CARES Act funds without first providing guidance on how it could be used.

The way the funding formula worked, along with the confusing guidance from the Education Department, frustrated some community college leaders.

"The lack of clarity between the CARES Act and the Department of Education’s restrictive eligibility requirements excluding vulnerable members of our communities made it difficult to quickly establish processes and get money out in a timely manner," said Ashanti Hands, vice president of student services at San Diego Mesa College. "Trying to get students to the point of even being able to determine their eligibility sometimes meant completing a FAFSA, which, with all of the documentation needed for this process, put up barriers for many and seemed impossible with the short turnaround allowed."

College staff members spent "considerable time" addressing barriers that students faced in applying for funds.

They also had to determine how to equitably distribute funds that weren't enough to cover all of their students' needs, Hands said. The college had conducted a COVID-19 needs survey when the pandemic began. Responses showed that 58 percent of students had lost income; about one-quarter were unable to pay their rent, mortgage or utilities; 16 percent didn't have enough food; and 10 percent were in unstable living situations.

A team looked at equity-based distribution formulas and decided to provide $500 to all students who met basic eligibility requirements set forth in the CARES Act.

In Louisiana, the system established a common set of guidelines for its 12 colleges to follow when distributing funds, Sullivan said. Colleges identified who would be qualified and then divided the funds they received by the number of eligible students. The awards varied by a few hundred dollars across the colleges.

The two-year colleges moved quickly and distributed the money within a week of the last guidance issued by the department, Sullivan said. But creating the qualifications process was a "bit of a moving target."

Many students also were ineligible, even though they greatly needed the funds, he said. The average age of students in the system is 27. About 42,000 of the system's students are enrolled in adult basic education programs. They don't have a high school diploma and are often underemployed, and many of their jobs were hit hard by the pandemic, Sullivan said.

"The CARES Act completely ignored that group," he said. "It serves as an opportunity to remind people, this is who is in America. We have 64 million working adults with a high school diploma or less. They were not helped."

Another 40,000 students in the system who were enrolled in noncredit workforce training programs also were ineligible for funds.

If the department had issued guidance on the front end, Sullivan said, students could have adjusted their expectations. Instead, many institutions and students were confused as to why some were ineligible for the relief.

The Role of Community Colleges

Some leaders felt there were upsides to the lack of guidance, though.

"For everybody, we had to kind of figure it out on our own," said Scott Ralls, president of Wake Technical Community College in North Carolina. "While I do think figuring it out on our own was difficult, it also let us decide what was most important for our populations."

In Wake Tech's case, that meant ensuring each award was large enough to make a significant impact, Ralls said. The average grant eligible students received was over $1,000.

The college also set up its own grant funds for students who weren't eligible for the CARES Act aid. Emerald Owens, a 31-year-old student who works two jobs, was taking two courses in the spring semester. Because one was online, she didn't qualify for CARES Act funding.

But Owens was furloughed from her jobs and didn't receive unemployment money for more than a month, so she was struggling. She received a gift card for groceries, which the college sent to many students, and was told to apply to a special fund, which gave her two grants totaling more than $1,000.

The aid will help her pay her rent and afford the insulin she needs. It also helped her pay her larger cellphone bills, as she used her mobile hotspot to access the internet and take exams, ensuring she can continue pursuing her degree in mental health human services.

"Without any money coming in, it was extremely stressful. I've come this far and I didn’t want to lose out," she said. "I know it’s just money to them, but when you see what it’s actually doing for students -- without that, I don’t think I'd be able to pass my classes."

Other colleges are using their own funds to make up for holes in the CARES Act, as well. Broward College in Florida, for example, took its $150,000 budget for spring graduation to create a student support fund.

The system created to disburse those budget funds helped the college when it came time to distribute CARES Act funding. But the multiple revisions of the department's guidance for the funds delayed the disbursement, said Marielena DeSanctis, provost and senior vice president of academic affairs and student services at Broward.

While some community college leaders said the logistics of distributing the aid were likely difficult at all institutions, it's clear that two-year colleges faced significant challenges.

"I do think that when you read some of the guidance and some of the ways in which the legislation was written, it felt like there was probably an underappreciation of how community colleges operate and the role of community colleges to a certain extent," Ralls said, citing examples of what students could use the funds for, like the expense of flying back home (which relatively few community college students would need to do). "Community colleges are, I believe, America’s higher ed workforce. Some of the things that happened at community colleges to disrupt students are things people wouldn’t think of."

For example, Ralls said, the college had to close its food pantry, which was a blow to many students.

"I do think there are some ways that those aspects of the support community colleges provide was underappreciated," he said.