You have /5 articles left.

Sign up for a free account or log in.

Donor-advised funds were a major source of fundraising for colleges and universities, according to an annual report released Tuesday.

AndreyPopov/iStock/Getty Images

Charitable giving to colleges and universities was essentially flat in the 2020 fiscal year despite the pandemic. For the first time in a decade, total giving to higher education institutions fell slightly, from $49.6 billion to $49.5 billion, according to the Council for Advancement and Support of Education’s latest annual giving survey.

Record-breaking totals last year were inflated by a $1.8 billion gift from Michael Bloomberg’s charities and foundations to Johns Hopkins University. If that gift were removed from the fiscal 2019 results, giving in fiscal 2020 would have increased by 3.6 percent, the survey found.

The Voluntary Support of Education Survey, released today, analyzes fundraising data from 873 colleges and universities for the 2020 fiscal year, which began July 1, 2019, and ended June 30, 2020. Surveyed institutions represent about a quarter of U.S. colleges and universities, but together they raised 78 percent of the estimated total voluntary support for U.S. higher education institutions in fiscal 2020. CASE estimates total support from nonrespondents using past data and nonrespondents' institutional characteristics.

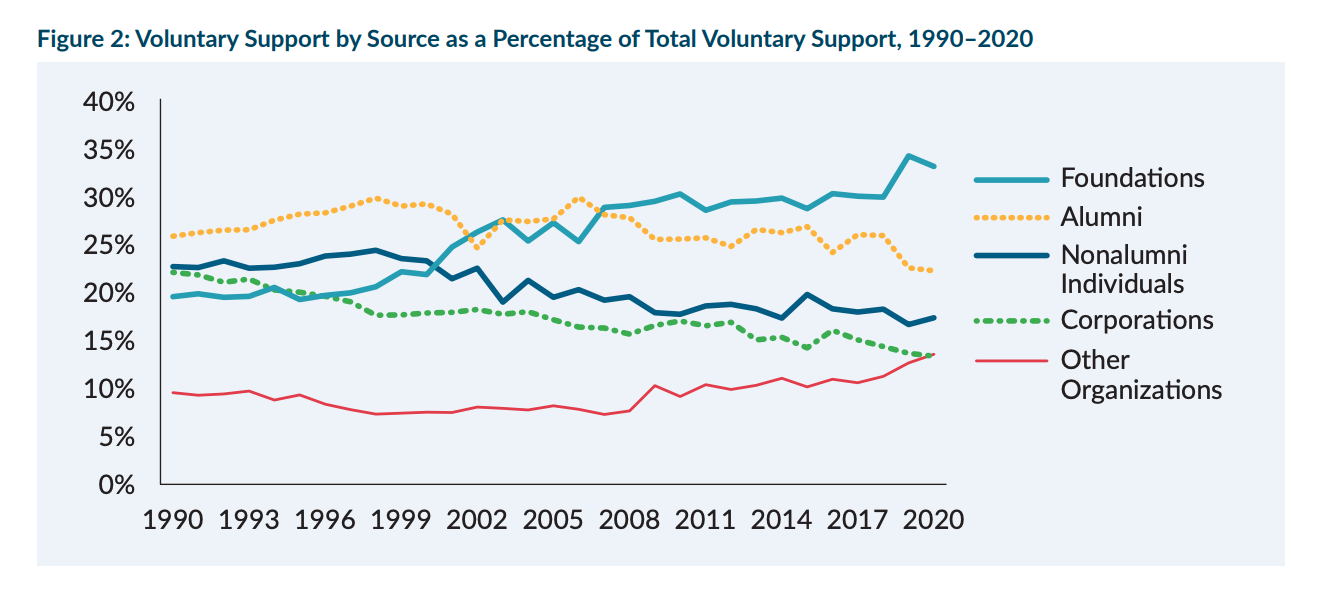

Giving from nonalumni individuals, which includes parents, increased by 4 percent, according to the survey. Aggregate giving from alumni, corporations and foundations fell in fiscal 2020. Combined, foundations and alumni make up 55 percent of total voluntary support for colleges and universities.

Contributions from other organizations increased by 7 percent in fiscal 2020 and edged past corporate giving for the first time. The rise in giving from other organizations can be attributed to payouts from donor-advised funds, according to Ann Kaplan, senior director of the Voluntary Support for Education Survey. A donor-advised fund is a 501(c)(3) organization, funded by an individual, that is managed by a separate, sponsoring organization. Individuals who put money into a donor-advised fund receive a tax deduction and no longer legally control the money. The fund must be spent on charitable giving, and donors can make recommendations for how it should be spent.

The 2017 Tax Cuts and Jobs Act increased the standard deduction taxpayers can claim on their federal tax returns and left colleges wondering how donor behavior could change as a result. One side effect of the Republican-backed tax overhaul is an uptick in donor-advised funds.

“When the Tax Cuts and Jobs Act was first passed in 2017, it was passed toward the end of that year and people kind of scrambled,” Kaplan said. “Some individuals opened donor-advised funds to store some money for future use and get the deduction while they could still get it.”

Now, those funds are paying out. A subset of 400 institutions reported support from donor-advised funds, and those funds make up 73 percent of giving from organizations not defined as corporations or foundations within that sample.

Donor-advised funds have been growing rapidly, said Una Osili, associate dean for research and international programs at Indiana University-Purdue University Indianapolis’s Lilly Family School of Philanthropy.

“The No. 1 recipient of a lot of the grants are education institutions,” Osili said. “Higher education is an important destination of those donor-advised fund grants.”

Kaplan bets that giving from other organizations will continue to grow and recommends that institutions be prepared to receive money from donor-advised funds.

“Any institution that’s raising money should have a system for dealing with donor-advised funds,” Kaplan said. “Don’t forget to thank the person that made it happen, even though they’re not officially the donor.”

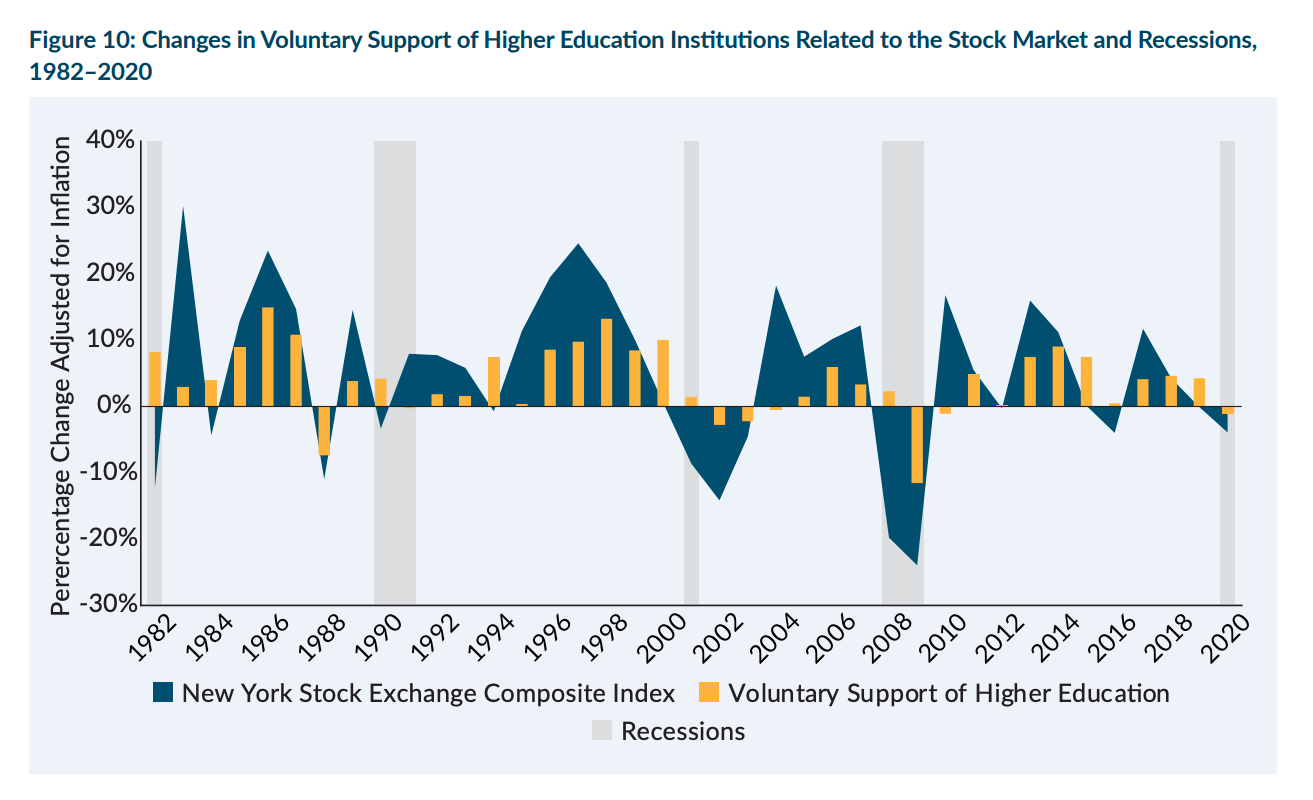

Gifts for current operations increased by 7 percent in fiscal 2020, while donations for capital purposes -- which include gifts for endowments, property, buildings and equipment -- declined by 10 percent. That decline could be due to stock market uncertainty at the beginning of the pandemic.

“There was a lot of uncertainty about what was going to happen,” Kaplan said. “The majority of capital-purpose gifts are made using securities, and it’s not like you wouldn't make the gift, but you would wait until you’re sure that the stock market is stabilized.”

During the Great Recession, donors and organizations moved away from giving to capital campaigns and infrastructure projects, Osili said. A similar shift in priorities could be behind the decline in giving for capital purposes.

Student financial aid remained the largest purpose for which donors restrict gifts to endowments, the survey found. Gifts for current operations were often restricted for research.

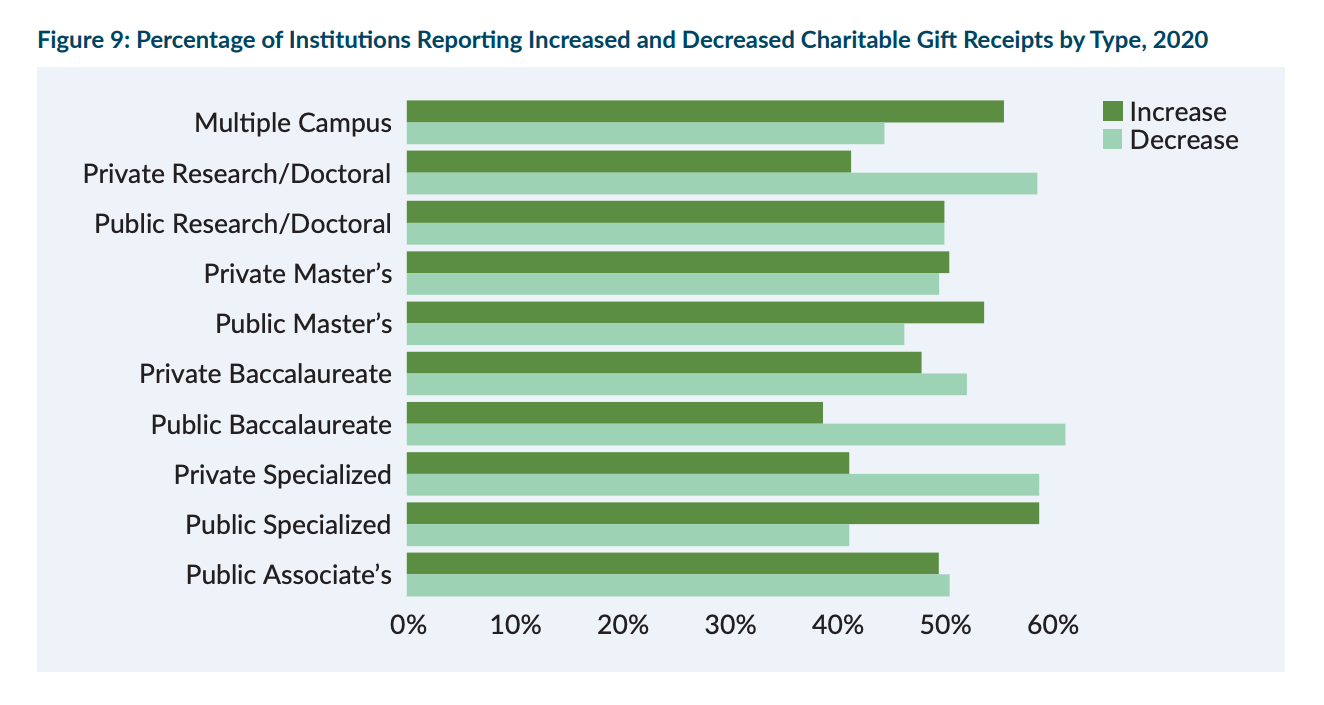

Public institutions fared slightly better than private institutions in fiscal 2020, though results within each type were mixed, according to the survey. Six in 10 public specialized institutions, a category that includes medical schools, reported giving increases. About two-thirds of private baccalaureate institutions and private research and doctoral institutions saw giving declines. Private master’s institutions, public associate's institutions and public research and doctoral institutions were split, with about half reporting declines in giving and another half reporting gift increases.

Institutions reported seven gifts of $100 million or more, totaling $1.01 billion, or 2 percent, of the fiscal 2020 total. In fiscal 2019, eight megadonors contributed $2.2 billion.

The year’s two largest giving seasons, the end of the calendar year and the end of the fiscal year, came in dramatically different economic landscapes. Voluntary support in the summer of 2019 -- which was the beginning of fiscal 2020 -- through the November-December giving push was so good, Kaplan would have ballparked a 7 percent or 8 percent bump for the full year had she been asked to guess how the year was shaping up before the pandemic hit.

“The atmosphere was so good in the first half of the fiscal year,” Kaplan said. Between July 1, 2019, and Dec. 31, 2019, all four major stock market indexes had increased by at least 6 percent.

The second half of fiscal 2020 was plagued with market uncertainty and an economic slowdown. The pandemic impacted economic subsectors differently, Osili said. Examining the pandemic’s impact on giving to colleges and universities is difficult because higher education sits at a crossroads of several subsectors.

The pandemic may have caused donors to shift giving to health and human service causes. The Black Lives Matter movement, which garnered new visibility at the very end of fiscal 2020, may have also driven donations to colleges and universities, the survey said.

“Some institutions are involved in research around the COVID-19 vaccine. Some are working on providing educational opportunities in distressed neighborhoods,” Osili said. “I think this is when higher education can show its relevance to communities.”