You have /5 articles left.

Sign up for a free account or log in.

When Inside Higher Ed surveyed college presidents last spring, the campus leaders expressed overwhelming (and to some observers confounding) confidence in their institutions’ financial state.

Nearly eight in 10 agreed with the statement “I am confident my institution will be financially stable over the next 10 years.” And almost six in 10 (58 percent) said they expected their institution to be in better shape next year than it was at the time, with more than two-thirds of those presidents saying they expected enrollment to rise over the next year.

Inside Higher Ed’s 2023 Survey of College and University Business Officers, released today in conjunction with this weekend's annual meeting of the National Association of College and University Business Officers, finds higher education business leaders to be less optimistic than their bosses—and arguably more in tune with the financial realities facing their institutions.

It’s not that they think the sky is falling: a full two-thirds of CBOs (65 percent) say they are confident in the 10-year outlook of their colleges, for instance. But 19 percent of those surveyed say they lack confidence in the financial stability of their institutions over a decade, including about a third (32 percent) of business officers at public master’s and baccalaureate colleges. Just 10 percent of campus chief executives answered that way in April.

And more than a third of all CBOs (36 percent)—and almost half of financial leaders at public colleges and universities (47 percent)—expect their financial condition to worsen over the next year, compared to just 22 percent of presidents who said that.

It’s not surprising that business officers would be less upbeat than presidents, said Larry Ladd, a senior consultant at AGB Consulting and longtime director of the higher education practice at Grant Thornton, a tax firm. “In any college cabinet, the CFO is the least optimistic—or should be,” Ladd said. Presidents are more likely to engage in what he called “magical thinking,” because while “they may know they have problems, they also have plans to deal with them, and they have to believe they will work.”

More on the Survey

Inside Higher Ed’s 2023 Survey of College and University Business Officers was conducted in conjunction with Hanover Research. The survey included 217 chief financial officers from public, private nonprofit and for-profit institutions, for a margin of error of 6 percent. A copy of the free report can be downloaded here.

On Sunday, July 16, Inside Higher Ed will conduct a session on the survey at the National Association of College and University Business Officers annual meeting in Orlando, Fla.

On Wednesday, Aug. 2, at 2 p.m. Eastern, Inside Higher Ed will present a free webcast to discuss the results of the survey. Please register here.

The Inside Higher Ed Survey of College and University Business Officers was made possible by support from EY Parthenon, HelioCampus and Syntellis.

Other findings of the business officers’ survey include:

- Fewer than one in seven chief business officers (13 percent) say senior leaders at their institution have had serious internal discussions in the last year about merging with another college or university. But about twice that many (25 percent) say they think their institution should consider merging with another institution in the next five years. And three in five CBOs believe their institution should consider sharing administrative programs with another college or university in the next five years.

- About six in 10 business officers (62 percent) said they expected to finish the 2022–23 academic year with a positive operating margin. That dropped to 51 percent when excluding federal economic recovery funds.

- More than a third (35 percent) of business officers say their institution has reviewed its academic portfolio in the previous year, and of those, half said they had reduced the overall number of programs they offer and a third said they had invested in the quality of weaker programs. Two-thirds of CBOs agree (68 percent, 31 percent strongly) that their institution has more academic programs, majors or departments than it should.

- About a quarter (22 percent) of business officers, and 41 percent of CBOs at private nonprofit institutions, said their college or university took funds from its endowment over and above its normal spending levels in the past 12 months.

Assessing the Financial Outlook

Inside Higher Ed’s surveys are an annual temperature-taking of sorts—think of it more like the health survey patients fill out when they go to the doctor than the physicians’ actual assessments themselves. The set of questions that asks business officers to rate their institutions’ financial stability over five and 10 years says more about the officials’ state of mind than it does about their institutions’ actions and outcomes.

Viewed that way, the 2023 survey’s data suggest that most business officers continue to be reasonably upbeat despite plenty of chronic aches and pains and some more serious illnesses that are spreading through the community. “I’m feeling pretty good, Doc, all things considered,” the majority seems to be saying.

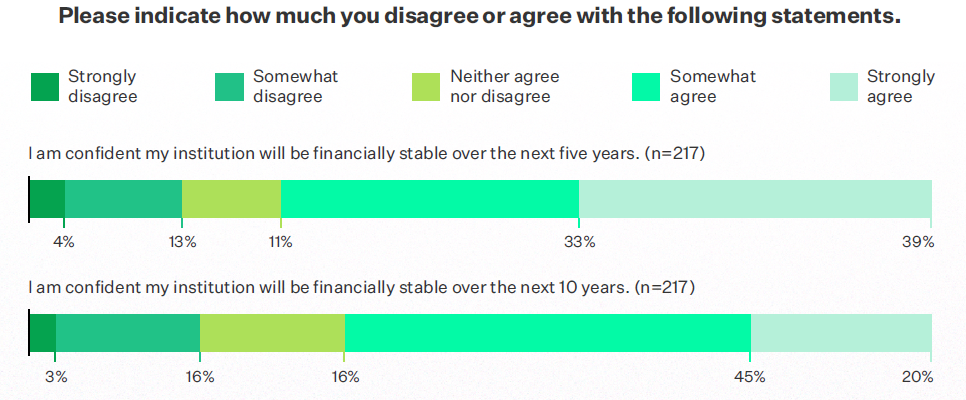

Two-thirds of CBOs over all agree (20 percent strongly) that they are confident in their institution’s financial stability over 10 years. (Seventy-two percent say they are confident over five years.)

The confidence is unevenly held, though. Business officers at private nonprofit institutions are 10 percentage points likelier than their public institution counterparts (69 to 59 percent, respectively) to express confidence over a decade, led by those from four-year undergraduate institutions—yes, those “small private colleges” that most analysts of higher education view as one of the industry’s most vulnerable sectors, along with regional public universities.

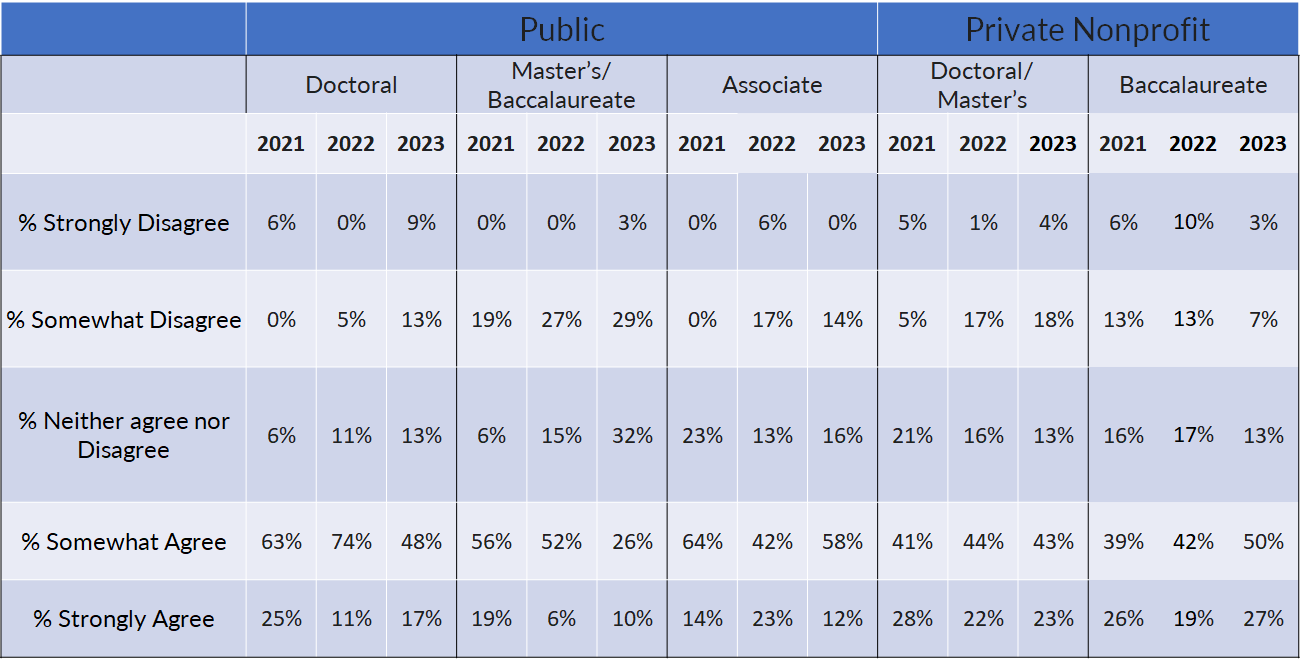

CBOs from those public master’s and baccalaureate institutions expressed by far the least confidence, with just 36 percent saying they are confident in their institution’s financial stability over a decade, and just 10 percent agreeing strongly. That 36 percent has fallen sharply since 2021, when 75 percent of CBOs at regional public institutions expressed confidence over a decade.

Business officers' responses to the statement: "I am confident in the financial stability of my institution over 10 years."

Just over half of business officers agree (51 percent, 33 percent strongly) that their institution is in better shape now than it was in 2019, before the COVID-19 pandemic and the ensuing recession. Thirty-five percent of CBOs disagree. In Inside Higher Ed’s 2022 survey of business officers, 65 percent said their institution was in better shape than in 2019, while only 24 percent said it was in worse financial shape.

Those who agree attribute that improved position mostly to “increased revenue from … sources such as charitable giving, government support, or auxiliary enterprises” (64 percent) and “increased unrestricted net assets” (61 percent), both of which are likely tied to the significant infusion of federal recovery funds that filled budget gaps many institutions faced because of decreased enrollment, increased pandemic-related expenses and diminished housing and dining revenue when students were dispersed.

The third of business officers who think their institution is in worse shape now than it was in 2019 cite a painful mix of decreased net tuition revenue (89 percent) and increased purchasing costs (86 percent) and salary and benefits expenses related to inflation.

Looking ahead, business officers are divided on whether their institution will be better or worse off a year from now. Forty-two percent expect it to be better off, while 36 percent anticipate being in worse shape. Private college officials are more optimistic than their public university peers; about half of private college CBOs (48 percent) expect to be better off in 2024 than they are now, compared to just 33 percent of public college business leaders.

Those who envision an upturn are banking on higher enrollment (62 percent) and increasing net tuition revenue (56 percent)—and planning on cutting their budgets “in response to economic conditions” (37 percent). The CBOs who anticipate a worsening outlook a year from now most cite inflationary increases in labor costs (76 percent) and nonlabor operating costs (55 percent), while about half expect their enrollment and net tuition to decline.

Mary Jo Maydew, who served as Mount Holyoke College’s chief financial officer through 2011 and just returned for a one-year interim stint last year, said she is not surprised that more institutions are feeling financial pain than they did last year.

“While COVID was really hard on institutions, it wasn’t financially devastating because of the government’s financial support,” she said. Last year “was a good year for a lot of places in part because of the federal payments. Also people were very, very cautious about budgeting tuition revenue because they had gotten smacked in the previous year, and then some of them had more students than they expected. That all helped the bottom line.”

Another sign of the impact of the recovery dollars can be found in CBOs’ answers to a question about the state of their budgets in 2022–23. Nearly two-thirds (62 percent) said they were likely to achieve a positive operating margin in the just-finished fiscal year (with a high of 70 percent of public doctoral university business officers and a low of 48 percent of those at public master’s and baccalaureate institutions). When asked to assess the likelihood of operating in the black without counting federal recovery funds, the proportion dropped to 51 percent over all.

The evaporation of the federal recovery funds will be exacerbated by the continuing impact of inflation, which Ladd of AGB Consulting calls a “corrosive element” for colleges. “They can’t raise their prices as fast as inflation—the market won’t allow it—but their costs are going up significantly,” he said.

The wild card may be what happens to college enrollment and whether it rebounds more from the lows of the pandemic more than it has so far. The plurality of the business officers who expect 2024 to be better are counting on enrollment rising at their institutions, while a majority of the third of CBOs who anticipate a difficult next year expect enrollment to decline.

Ladd suspects some of those banking on enrollment growth may be disappointed. “Maybe a third of them are engaging in some form of magical thinking,” he said. “Of the close to 200 clients I’ve had, when they’re in distress, someone—usually the president—will say, ‘We’ll grow our way out of this problem.’ You hardly ever see that happen.”

Maydew said the fact that one in five business officers acknowledged a lack of stability over a decade is evidence of “underlying weakness in some of the sectors”—particularly because she suspected that those who chose to complete the survey may be unrepresentative, tilted toward the positive.

“If I’m a business officer looking at a default on my debt three years out unless things radically improve, I don’t have a lot of motivation to fill this out,” Maydew said. “I actually don’t want to talk about it.”

Mergers and Consolidation

Campus closures and mergers have been much in the air, with small private institutions such as Cabrini University, Medaille University, Cardinal Stritch University, Presentation College, Holy Names University, Iowa Wesleyan University and Finlandia University closing and Salus University and St. Augustine College, among others, being absorbed in mergers with larger partners.

Few business officers (13 percent) say that senior administrators at their institution have had “serious internal discussions” in the last year about merging with another college or university. Business officers at colleges in the Northeast (25 percent) were about twice as likely to say such discussions had occurred, and 21 percent of CBOs at private doctoral or master’s universities acknowledged such conversations.

Fewer still (7 percent) said it was likely that their institution would “merge into or be acquired by another college” in the next five years. (It was 12 percent in the Northeast, and 15 percent among CBOs who were not optimistic about their college’s 10-year financial stability.)

But a full quarter of business leaders said their institution should consider merging with another college or university, with 40 percent of CBOs at colleges in the Northeast, 35 percent of those at private doctoral/master’s universities and 41 percent of business officers who said their college had taken a supplemental draw on its endowment this year saying yes.

While most CBOs see a full-blown merger as unlikely, many more foresee the possibility—and the desirability—of other forms of cross-institutional collaboration.

Just 19 percent of business officers say senior leaders at their college or university have had serious discussions in the last year about combining academic programs or sharing administrative functions with another institution.

About a third (36 percent) say their institution is either very or somewhat likely to combine academic programs with another institution within five years, and 48 percent say it is likely to share administrative functions with another institution over that time.

And even larger numbers—49 percent and 61 percent, respectively—believe their institutions should combine academic programs or share administrative functions.

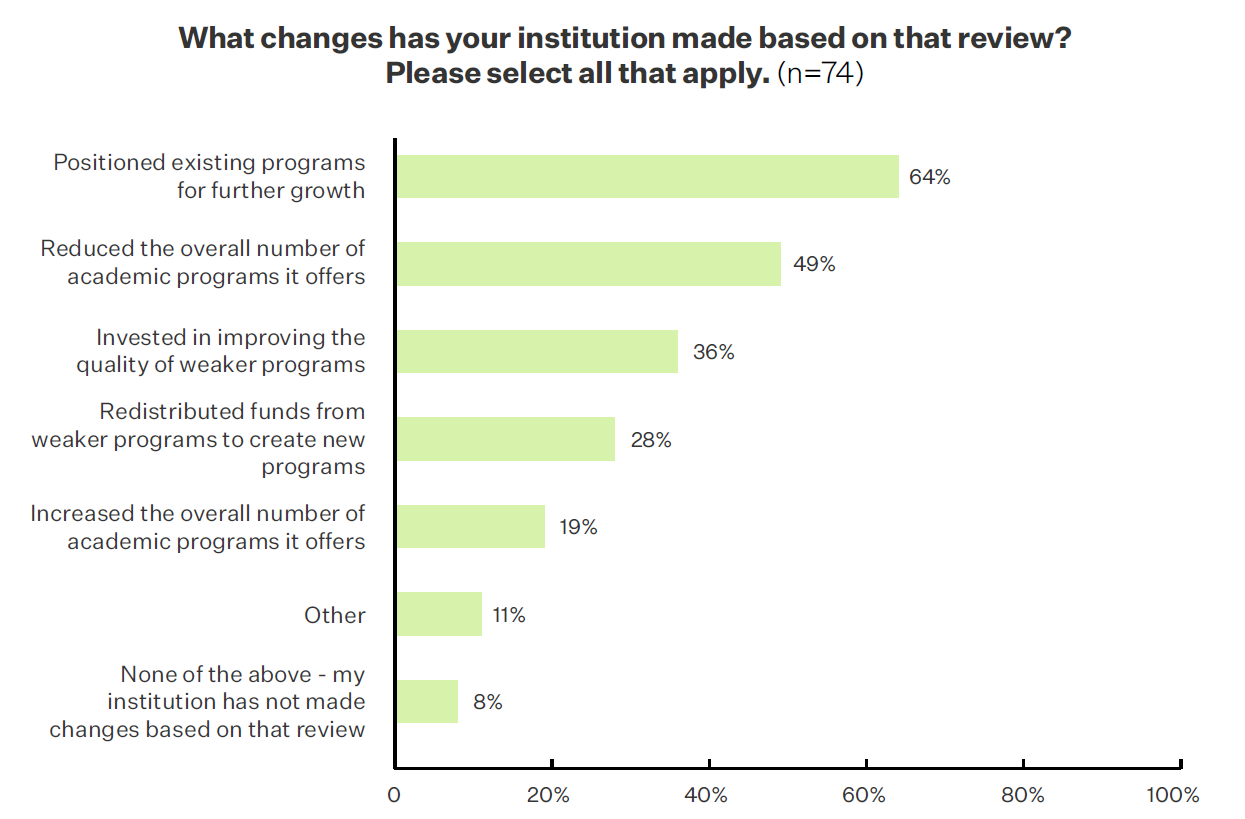

Business officers are also clearly focused on another kind of consolidation—of their own academic programs. About a third of CBOs (35 percent) said their institution had conducted a thorough review of its academic programs in the last year, with that proportion higher at public master’s and baccalaureate colleges (42 percent) and private doctoral and master’s universities (40 percent).

Of those, about half said their institution had reduced the overall number of academic programs it offers, as seen below.

And a full two-thirds of business officers agree (68 percent, 31 percent strongly) that “given the current number of enrolled students, my institution has more academic programs, majors or departments than it should.”

Maydew, the longtime Mount Holyoke CFO, said she was heartened that “business officers get that there’s a structural cost problem” at many institutions, and that “there are ways to mitigate that by sharing academic programs and services and reducing programs. But I’m less sure it’ll happen, because it’s very difficult, even within an existing consortium” like the Five Colleges Consortium, of which Mount Holyoke has long been a part.

Difficult for many reasons, including that decisions to cut academic programs often result in painful layoffs of faculty and staff members and other controversial outcomes.

Managing Change

West Virginia University and its iconic president, E. Gordon Gee, have made waves in higher education with their plan to become a leaner, stronger institution amid continuing enrollment and financial challenges. The business officers’ survey joins other recent Inside Higher Ed studies in trying to gauge how institutional leaders are thinking about their positioning post-pandemic.

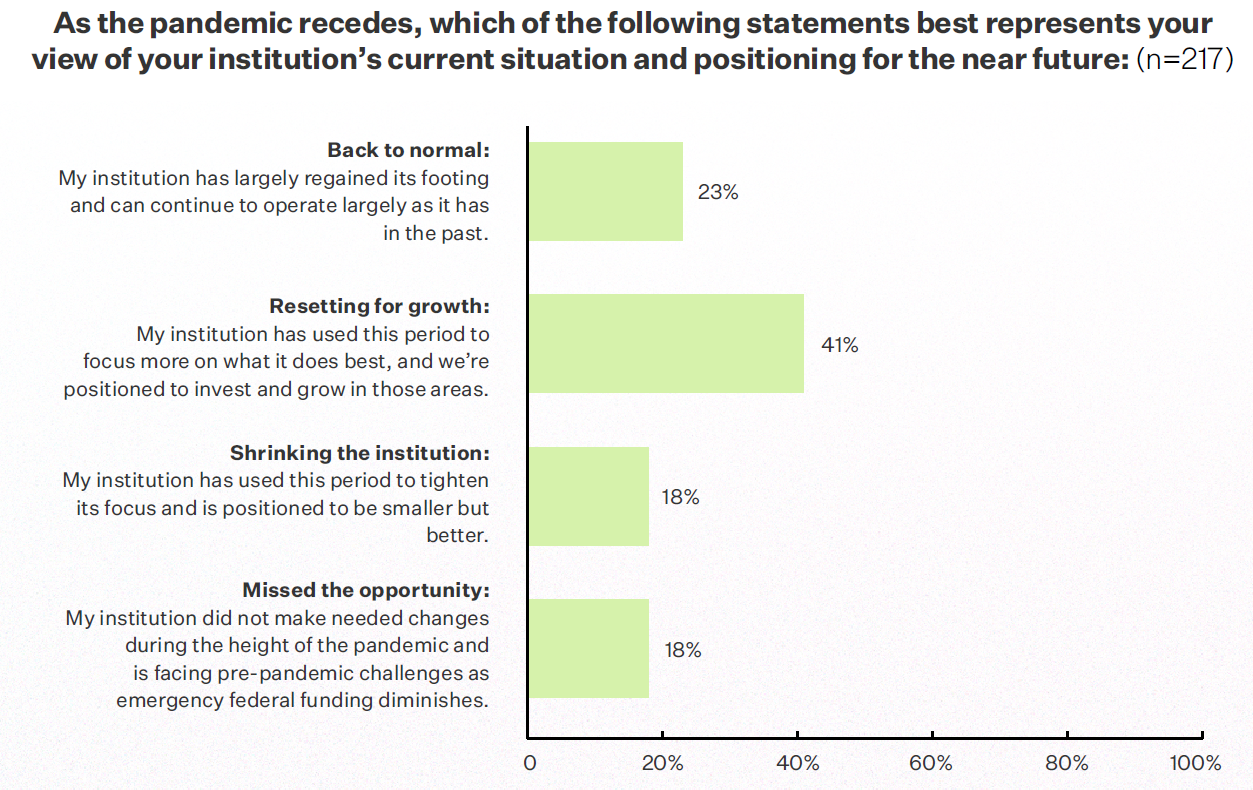

The most on-point question asked CBOs to choose among several views of their college or university’s stance going forward. Given four choices, a plurality (41 percent) said their institution was “resetting for growth,” focusing more on what it does best and investing in those areas (presumably in part by shifting money away from less successful areas). The other three options—back to normal, shrinking the institution (à la West Virginia), and “missed the opportunity”—garnered between 18 percent and 23 percent of respondents.

Responses to other questions show business officers to be quite a bit less sure than their presidential colleagues that the adaptation many institutions embraced in reaction to the disruption of the COVID-19 pandemic will have lasting impact. Fifty-one percent of presidents in April strongly agreed with the statement “My institution will keep some of the COVID-19–related changes even after the pandemic ends,” for instance; just 31 percent of business officers answered that way.

Forty-five percent of presidents strongly agreed that their institution was “pushed to think out of the box … in a way that will benefit the institution in the long run,” compared to just 33 percent of CBOs.

And when asked if their institutions had the “right mind-set” and the “right tools and processes” to respond quickly to needed changes, business officers were far less likely to agree (53 and 50 percent, respectively) than were presidents (65 and 60 percent, respectively).

Other Findings

The survey explored a range of other issues about the state of higher education finances and operations. They included:

Endowments. About a third of business officers at private nonprofit colleges and universities (32 percent) said their institution had in the past year taken funds from its endowment over and above the levels called for under its normal spending policy, either through a loan or a special distribution. That number was even higher, 41 percent, at private baccalaureate colleges.

About half of CBOs (51 percent) said the value of that drawdown was between $1 million and $5 million, while about a quarter (27 percent) said it was more than $5 million.

Employee turnover. Nearly half of business officers (47 percent) said the turnover of employees at their institution in 2022–23 was about the same as in the 2021–22, while about a third (32 percent) said it was higher. More CBOs at private baccalaureate colleges and public master’s and baccalaureate universities (45 percent each) reported that the turnover rate was higher.

CBOs overwhelmingly cited competitive offers from other employers as the primary cause of turnover at their institution, at 92 percent. Burnout was a distant second (55 percent), followed by lack of opportunity for growth (48 percent). No more than 20 percent identified negative experiences with workplace culture (20 percent) or negative views of leadership (16 percent) as reasons for the turnover.

Few business officers said they were very (6 percent) or extremely (12 percent) worried about the rate of turnover at their institution, with 35 percent saying they were either slightly worried or not worried at all.

Ladd of AGB Consulting suggested they should be, especially at a time of rising costs. “When you have to replace an employee in an inflationary environment, you end up paying that person a lot more than existing, equivalent positions,” he said. “Either you let that inequity stand with its morale consequences, or you have to raise other salaries commensurately, which is unlikely.”

Availability of data. Business officers sent mixed signals about their satisfaction with the information available to them to make smart decisions. Just a third of CBOs (36 percent) agreed that “a lack of adequate data and analytic capacity is a significant obstacle to a sustainable financial future for my institution,” down sharply from the 53 percent who agreed in Inside Higher Ed’s 2022 survey.

But no more than two-thirds of CBOs agreed (and no more than 21 percent strongly agreed) that their institution has the data and other information it needs to make informed decisions about a range of key institutional matters, such as the performance of academic and administrative technology (67 percent), the efficacy of specific academic programs (61 percent) or the performance of administrative units (53 percent).