You have /5 articles left.

Sign up for a free account or log in.

The increasing popularity of income-driven repayment plans for federal loans, as well as loan forgiveness programs, might soon lead to the federal government losing money on its huge student loan portfolio, according to a newly released audit from the U.S. Department of Education's Office of Inspector General.

The audit builds on findings from a 2016 Government Accountability Office report, which revealed that the department had drastically underestimated the cost of income-driven repayment.

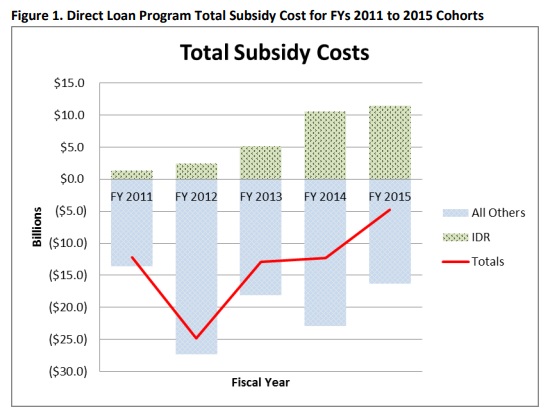

Between the 2011 and 2015 fiscal years, for example, the balance of this form of loan increased from $7.1 billion to $51.5 billion, the inspector general's audit found, an increase of 625 percent. Under income-based repayment, the federal government will loan more money than borrowers will repay, which isn't the case for other types of loans. As a result, the government subsidy for income-driven repayment plans increased to $11.5 billion in 2015 from $1.4 billion in 2011, according to the audit. And at this pace, the feds may soon lend more money overall than is being repaid by borrowers.

The department's Federal Student Aid office told the inspector general that "as more borrowers select IDR plans that allow for student loan forgiveness, the cost of this form of nonpayment could be a major issue for the federal government. In addition, FSA stated that the timing and potential magnitude of loan forgiveness programs create uncertain repayment terms that could pose significant challenges in managing its student loan portfolio."