Filter & Sort

Missed Deadline Stalls DeVos Agenda

Education Department says it won't meet November deadline to overhaul borrower-defense and gainful-employment rules, raising the stakes for legal challenges to the Obama-era regulations.

Tackling Poverty to Increase Graduations

A growing number of colleges are trying to help poor students meet their basic needs and remove barriers that keep them from graduating.

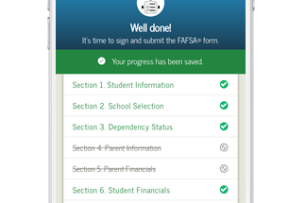

New Tool for FAFSA Completion

Advocates hope new myStudentAid mobile app will mean more applicants finish the FAFSA.

New Life for ACICS

Trump administration recommends restoring the controversial accreditor of many for-profits, citing a federal court ruling. Meanwhile, ACICS faces questions about its approval of a Danish business school's degree programs.

Navient's Role in Loan Servicing Overhaul

Trump administration's list of primary finalists to operate an overhauled student loan servicing system excludes Navient, a large and controversial servicer, which instead is participating in the program as a subcontractor in a team.

The FAFSA Challenge

Even as policy experts work to make it easier to apply for federal aid, they need to avoid rhetoric that may scare students off, writes Justin Draeger.

Barriers to Loan Forgiveness

While just a handful of borrowers have received Public Service Loan Forgiveness so far, the real payouts -- and renewed debates about the program's cost -- still loom.

Free-College Realities

Proposals for tuition-free college programs shift to meet the needs of the state while also exhibiting qualities of more successful existing initiatives.

Pagination

Pagination

- 278

- /

- 436